Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a Demo

Amani Wells-Onyioha

COMMENTARY

An expense is something that impacts your wallet. An investment is something that impacts your life. So, which term best describes President Biden’s Student Loan Relief initiative? When you understand the positive impact it will have on everyday Americans — those with student loan debt and those without it — it is easy to see it as an investment that will have far-reaching benefits.

The initiative, which was announced by the White House in August 2022, promises up to $20,000 in debt cancellation for those who received Pell Grants to cover tuition-related expenses. Those who did not receive Pell Grants can have up to $10,000 in student loan debt canceled. In both cases, eligibility requires that you make less than $125,000 per year, or less than $250,000 per year for couples.

Those numbers represent the investment, but what is the impact? The U.S. Department of Education estimates that the initiative has the potential to affect 43 million Americans with outstanding student debt. For nearly half, it will cover the entire amount of their student debt.

In Georgia, where nearly 1.5 million people are eligible for loan forgiveness, the impact could be huge. The state’s $68 billion in student loan debt averages out to approximately $42,000 per borrower. That average makes Georgia the third highest state in the nation in terms of student debt. Most in Georgia who qualify for loan forgiveness would be eligible for the $20,000 maximum. Regardless of the amount of debt involved, removing it could empower some life-changing moves.

What would that look like? Consider these scenarios:

- Owning your own home is part of the American dream. Living that dream is difficult when you are carrying student debt. For a married couple, Biden’s initiative has the potential to forgive $40,000 in debt, giving that couple the space to take on a mortgage.

- Statistics show that 5 million people have student loans in default, which can result in a wide variety of negative consequences. Debt forgiveness can either do away with those loans, or reduce them to a level where making payments becomes possible. As a result, borrowers avoid being charged collection fees, having their wages garnished, and having their credit scores damaged, among other consequences.

- Anyone seeking a loan — whether for a car, a home, or another personal asset — will be assessed by their debt-to-income ratio. The average college grad carrying a high level of debt and earning a modest starting salary does not have a healthy debt-to-income ratio. As a result, they will have a hard time securing credit. When $20,000 in debt is forgiven, it can have a significant positive impact on their debt-to-income ratio.

What about the impact on those who are not carrying student debt? As mentioned, those with less debt have a better chance of securing a mortgage. Reports show that the red-hot housing market is slowing down. Those looking to sell homes should welcome the increased buying potential that comes with loan forgiveness.

For many, a college education was presented as the key to financial freedom. They were told that the more educated they became, the more financially free they would be. Unfortunately, that can’t always be counted on. What can be counted on, however, is that the more educated they become, the more debt they will have.

The average amount of student debt per person nationally currently stands at approximately $30,000. Those in the 25 to 34 age group, which is the age group with the most college debt, make a salary that is just short of $50,000 per year. After taxes and other bills, there is not much left to make student loan payments. Without some form of assistance, many will be on a hamster wheel for the rest of their lives, potentially never making a dent in their debt.

Moving forward, the Biden Administration has proposed that colleges and universities do a better job of justifying the amounts they are charging for higher education. When announcing the Student Loan Relief initiative, the White House said schools, “have an obligation to keep prices reasonable and ensure borrowers get value for their investments, not debt they cannot afford.”

I agree with the Biden Administration that loan forgiveness is not enough. In 2022, an extra $10,000 is equal to a few months’ worth of rent payments. Overall, this relief will only give people a little wiggle room. What they need is an opportunity for an education that does not rob them of their financial freedom.

The movement to offer tuition-free education at state universities, which was once the norm, is making a comeback. I would love to see more states serve their residents by making it a reality everywhere, guaranteeing the empowerment that comes with education without the despair that comes with overwhelming debt.

Amani Wells-Onyioha is a political expert, civil rights advocate, and thought leader. Working with Sole Strategies as their operations director, she is the engine behind progressive candidates seeking to uplift underrepresented communities. You can reach Wells-Onyioha at [email protected].

For a different view on this topic, read COMMENTARY: Student Loan Forgiveness Is a Policy Mistake

Read this story for free.

Create AccountRead this story for free

By submitting your information, you agree to the Terms of Service and acknowledge our Privacy Policy.

Spotted sea trout surged, shorebirds struggled, and the water’s safe for swimming

The Gist

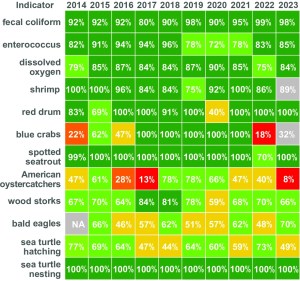

Spotted sea trout flourished, sea turtles and shorebirds struggled, and blue crabs crawled their way out of trouble in ever-warming coastal waters last year. Those are a few of the findings in the Coastal Resources Division’s annual Coastal Georgia Ecosystem Report Card, released today.

What’s Happening

Every year since 2014, the Department of Natural Resources collects data on 12 indicators of coastal ecosystem health that impact humans, fisheries and wildlife and issues a report card.

Based on data collected in 2023, Georgia’s coastal ecosystem this year earned a B, which equates to a “moderately good health score” of 78%, up from last year’s score of 74%.

Click here to see the full 2023 Coastal Ecosystem Report Card.

The ecosystem indicators and scoring methods for the report card were developed with the University of Maryland Center for Environmental Science, which has helped to create other ecosystem health assessments around the country.

This year, red drum remained plentiful and spotted sea trout numbers improved, as the sea trout count in the Wassaw and Ossabaw sound systems rebounded. The report said a 2016 regulation that increased the minimum catch size limit for sea trout is helping.

Shrimp numbers improved a bit, too, just in time for their recognition as the state’s official crustacean by the Georgia Legislature this year.

According to the Department of Natural Resources, the dockside amount of wild-caught “food shrimp” brought in by commercial fisheries increased to 2.6 million pounds from 2.1 million pounds in 2023 (though the overall dockside value of Georgia shrimp decreased to $9.4 million from $11.3 million, largely due to competition from foreign suppliers of lower-priced, imported frozen shrimp).

Blue crabs got a D in the report but improved from a score of 18% last year to 32%. Warm coastal waters and increased salinity in the water could explain why crab numbers were low in the survey, but the report also noted its sample size of crab was skewed because its trawling vessel was out of commission for part of 2023. The amount of blue crab caught by commercial fisheries increased to 3.4 million pounds in 2023 from 3.1 million pounds in 2022, with a dockside value of $7 million.

Overall, the dockside value of all commercial fisheries tracked by Natural Resources in Georgia in 2023 was $19.7 million, about $2 million less than in 2022.

The lowest scorers

As was the case last year, shorebirds in general and American oystercatchers in particular were the animals that scored the lowest. Wildlife biologist Tim Keyes said big storms that hit the coast washed out and degraded the beaches and marsh islands where oystercatchers nest. Shorebirds, including wood storks, were also preyed on by raccoons, opossum, coyotes and hogs that live in remote coastal areas.

Keyes said the Coastal Resources Division is working with the Army Corps of Engineers to build new 10-foot-high sand islands and sandbars using dredged-up sediment near Cumberland Island and along the Intracoastal Waterway to give the birds a boost and a better place to roost.

Loggerhead sea turtles, a threatened species, dropped to a C grade from a B, primarily due to increased predation. Sea turtle nesting sites were plentiful once again, with 3,431 loggerhead nests located, and a 52% emergence rate for hatchlings. But many of the eggs and baby turtles were gobbled by wild hogs, raccoons, coyotes before they could make their journey to the sea, according to the Wildlife Resources Division report.

The good news

The report contains good news for humans who like to cavort in coastal waters, as the water quality index received an A, at 89%. Overall indicators show the water is generally safe to swim in and to eat local shellfish, that oxygen levels support fish and other species, and bacteria is at acceptably low levels.

Read this related story:

Have questions or comments? Contact Jill Jordan Sieder on X @journalistajill or at [email protected]

And subscribe to State Affairs so you do not miss an update.

X @StateAffairsGA

Instagram @StateAffairsGA

Facebook @StateAffairsGA

LinkedIn @StateAffairs

Democratic incumbents vie for redrawn House district seat

ATLANTA — Democratic incumbents running in south DeKalb County’s newly drawn District 90 are in a political predicament: Longtime comrades, they now find themselves pitted against each other.

Reps. Saira Draper and Becky Evans met Wednesday on the debate stage at St. John’s Lutheran Church to make the case for why voters should choose them for the newly drawn district in the upcoming May primary.

Mike St. Louis, chair of the Druid Hills Civic Association and moderator of the hourlong debate, lamented the“gratuitous” pairing of two Democratic incumbents in the same district drawn by Republicans who controlled the special legislative session on redistricting last year. The process was an effort to comply with a judge’s order to add more majority-Black districts.

House District 90, which Draper represents, will still include the part of Atlanta that is in DeKalb County, as well as six new precincts in southwest DeKalb that were in District 89, where Evans serves. Each was elected in districts that were and remain majority-Black, solid-blue districts.

No Republican or independent candidates qualified for the 2024 election for the new District 90.

Draper and Evans began and ended Wednesday’s debate acknowledging their respect for each other, and their chagrin over their political predicament, while trying to draw distinctions on their legislative records and strengths.

“This was not something that either of us asked for. It’s not something that either of us wanted,” Draper said. “And to me, it really underscores the fact that we have to get the majority in Georgia.”

Draper, a civil rights attorney serving in the House since 2023, said what makes her “the best person for the job … really boils down to democracy and diversity.” She described herself as an elections and voting rights expert who helped to “flip Georgia blue for the first time in 30 years” during the 2020 presidential election and the 2022 midterms, when she said she “led the voting rights efforts” in Georgia for President Joe Biden and U.S. Sens. Raphael Warnock and Jon Ossoff, for whom she oversaw campaign staff and thousands of volunteers.

Draper said she’s now fighting to bring Democratic majorities back to the state House and Senate, which she estimated will likely take four to six years.

In the meantime, she said she has worked to push through what legislation she can in the Republican-controlled House and cited as a small victory House Bill 1207, a bill she crafted that requires advanced proofing of ballots by candidates and election supervisors. Draper sought out five Republicans as co-signers to gain majority support for the bill, which passed in both chambers and awaits Gov. Brian Kemp’s signature.

Noting that “diversity is a central tenet to the Democratic Party,” Draper said, “as a woman of color and as an immigrant, I bring perspectives to the table that are underrepresented at the Capitol.”

Draper immigrated to the U.S. when she was 6 years old from England, where her Spanish mother and Pakistani father met. “That makes me Spakistani,” she said, eliciting laughter from the audience. “But it also makes me the only member of the Georgia General Assembly who is a member of the Hispanic caucus and the Asian American Pacific [Islander] caucus.”

Evans, a community organizer and political operative who has served in the House since 2019, emphasized her six years of experience building relationships with fellow legislators and delivering on measures to support education, the environment, gun safety and housing.

“And I’m 100% pro-choice, 100% pro-LGBTQ and 100% pro-health care expansion,” Evans said, adding she is proud of her work developing legislation to promote literacy among school children over the past two years, including writing a bill last year to create the Georgia Council on Literacy and another bill to ensure that children are screened for dyslexia and other reading challenges and that teachers are trained in evidence-based reading and writing instruction.

When her bills didn’t pass from the House to the Senate by the Crossover Day deadline in 2023, Evans said she persuaded Republican lawmakers in the Senate to adopt her legislation, which then passed. She now serves on the 30-member literacy council, which she said is working “to make sure that all of our children will have the broadest possible futures and that they can all learn how to read.”

Evans also said she was “proud to deliver this session $7.4 million in [federal] gun violence prevention awareness funds that will go out to community groups” and to support the passage of a bipartisan Senate bill that will give “[sales] tax breaks [on gun safety devices] where people are using their guns responsibly.” She said she also advocated for adding new funding for school security grants to the education budget, which was approved.

The candidates took similar positions on many issues, both decrying the private school voucher bill they said would drain funds from public schools, and the need for the state to better fund impoverished school districts. They described their individual efforts to curtail gun violence and promote voting rights, as well as detailed their years of experience in ground-level get-out-the-vote efforts in DeKalb County and metro Atlanta. Draper and Evans also expressed measured support of the Atlanta Public Safety Training Center, which they said is needed to train police and first responders.

Among the 40 or so people in the audience, Lora Wuennenberg, 68, a Kirkwood resident and program manager at the humanitarian nonprofit CARE, said she emerged from the debate torn between the two candidates. Noting they have similar positions on the major issues she cares about, including public education, she said Draper, her current representative, impressed her as an “an activist who can mobilize people and is willing to stand up and stand out on some of the issues that may not be getting enough attention.”

“Becky seemed more of a practical, behind-the-scenes organizer, someone who understands the bureaucracy of government and has a lot of established contacts,” Wuennenberg said, noting Evans has worked across the aisle and “found entry points” to get legislation passed. “In the Republican-controlled House, maybe she can be more effective than Saira.”

Wuennenberg said over the next few weeks she’ll follow the candidates and look to see “how Saira thinks she can mobilize support for the bread-and-butter issues that have an impact on people’s lives” in the next legislative session.

Arica Schuett, 36, a Ph.D. candidate in political science at Emory who lives in Druid Hills, said she also needs to spend more time studying the candidates.

She said Draper’s focus “on mobilizing voters and removing barriers to election participation resonated” with her, while Evans’ “experience and her ability to to work with constituencies that include Republicans is important. So getting a better understanding of how each candidate would manage their position in a really Republican Legislature is what’s important to me.”

Schuett said she plans to dive deeper into their proposed legislation and voting records. “I kind of want to look a little bit more at what they’ve done, right?”

The primary election will take place May 21.

Have questions or comments? Contact Jill Jordan Sieder on X @journalistajill or at [email protected]

And subscribe to State Affairs so you do not miss an update.

X @StateAffairsGA

Instagram @StateAffairsGA

Facebook @StateAffairsGA

LinkedIn @StateAffairs

Barbershop talks and hip-hop summits: Georgia Black legislators’ group has big plans to build coalitions, boost voter rolls

The nation’s largest gathering of Black lawmakers is slated to meet in Atlanta this summer to discuss ways to boost voter participation nationwide ahead of the upcoming fall elections.

The Aug. 2-4 conference theme is “Testing 1, 2, 3.” The meeting will be the precursor to a series of events the Georgia Legislative Black Caucus plans to hold heading into the November presidential election.

“Because we’re the largest Black caucus in the nation, we’re reaching out to all of the caucuses from across the nation,” Rep. Carl Gilliard, D-Savannah, chairman of the 74-member Georgia caucus, told State Affairs. “This is the first time that I think we’re doing a total reach-out to all of the Black caucuses. We share a lot of similarities. Whether it’s voter suppression in Georgia, the same laws are going to be tried in Tennessee and the same laws are going to be tried in Florida. We share a lot of commonalities.”

Next week, for instance, the Georgia caucus is scheduled to issue a statement supporting efforts to pass a hate crimes bill in South Carolina. The bill passed in the House but stalled in the Senate, Gilliard noted.

Over 700 Black legislators represent about 60 million Americans, according to the National Black Caucus of State Legislators. In addition to the Georgia caucus, Black caucuses exist in nearly three dozen states.

Shortly after the August convention, the Georgia Legislative Black Caucus will embark on a 14-city tour throughout Georgia to focus on “getting out the vote.”

“We’re not going to tell them who to vote for,” Gilliard said of voters. “But what is happening right now is no one is talking to the people. And if the election were held today, we all would be in trouble because no one is talking or meeting the people where they’re at.”

The tour is a continuation of various actions the Georgia Legislative Black Caucus has taken this year to align with other organizations of people of color on common causes.

In March, the caucus joined forces with the Asian American Pacific Islander and Hispanic caucuses for a tri-caucus town hall. It was the first time the three groups have aligned. The Black caucus also has “reached out to partner with the Hindus of North America population and the diaspora,” Gilliard said.

“What we’re trying to do is form a coalition to get to as many diverse groups of people as we can,” he said.

Gilliard said the lack of individual and collective involvement in communities he’s seeing concerns him. It’s a far cry from four years ago.

In 2020, the deaths of Ahmaud Arbery, an unarmed Black man murdered while jogging in Glynn County, and Breonna Taylor, a Black woman killed by Louisville, Kentucky police serving a no-knock warrant for drug suspicion, led to more than 450 protests nationwide and on three continents.

That same year, former Georgia gubernatorial candidate Stacey Abrams led an effort to increase the voter rolls for the 2020 presidential election. Fair Fight and the New Georgia Projects, two groups Abrams founded, registered more than 800,000 new voters.

That level of community and political engagement has since subsided, Gilliard said.

“People don’t know what’s going on,” Gilliard said. “No one is really talking to the people. You’ve got a presidential election. I’m talking about on both [political] sides. There are rallies and different events being held, but nobody has gone to the barbershop. No one has gone to the community centers or the neighborhoods. We’re going to be empowering those communities by going and taking those townhall meetings right where they’re at, not in a big municipality but in community centers and neighborhoods.”

The caucus also plans to hold a hip-hop summit to reach young people, many of whom are skeptical of both political parties.

“They’re forming their own opinions,” Gilliard said. “They’re saying, ‘Forget about Trump. We need to hear something different.’ That’s just their perception. That’s why I’m really quietly championing the young candidates behind the scenes who are running right now because we need young leaders.

“We have to get as many people together, but we also have to get them ready to work.”

Have questions, comments or tips? Contact Tammy Joyner on X @lvjoyner or at [email protected].

And subscribe to State Affairs so you do not miss any news you need to know.

X @StateAffairsGA

Instagram@StateAffairsGA

Facebook @StateAffairsGA

LinkedIn @StateAffairs

Special prosecutor to decide if Lt. Gov. Jones should face criminal charges in 2020 election-meddling case

Lt. Gov. Burt Jones will face scrutiny over whether he should be criminally charged for alleged meddling in the 2020 presidential election in Georgia.

The Prosecuting Attorneys’ Council of Georgia said Thursday it has assigned Executive Director Pete Skandalakis as the special prosecutor to handle the case because Fulton County District Attorney Fani Willis is barred from investigating Jones. The council is a nonpartisan state advocacy agency for district attorneys.

In July 2022, Superior Court Judge Robert McBurney blocked Willis from investigating Jones because her actions were an “actual and untenable” conflict of interest. At the time, Willis had hosted a campaign fundraiser for Jones’ Democratic rival, Charlie Bailey, and donated to his campaign when both men were running for lieutenant governor. Willis is currently involved in an election interference case she brought against former President Donald Trump and 18 others.

McBurney’s ruling left it up to the council to decide whether Jones should be criminally charged.

“I’m happy to see this process move forward and look forward to the opportunity to get this charade behind me,” Jones said in a statement issued Thursday. “Fani Willis has made a mockery of this legal process, as she tends to do. I look forward to a quick resolution and moving forward with the business of the state of Georgia.”

The council cited state bar rules in its news release and said there would be no further comments.

Skandalakis’ appointment marks another step in the ongoing political odyssey for Jones and other lawmakers over charges that they served as “false” electors to help Trump overturn the 2020 presidential election in Georgia.

Jones is one of 16 alleged “false” electors in Georgia who gathered at the state capitol on Dec. 14, 2020, to cast ballots for Trump and then sent their false certification of his victory to the National Archives and the governor’s office.

Jones has denied any wrongdoing, saying he and other electors were acting on the advice of lawyers to preserve Trump’s chances in Georgia in case the former president won a court challenge that was pending at the time. Jones was a state senator during the 2020 election.

Trump’s campaign enlisted an alternate slate of electors in 2020 in a number of swing states where Trump was defeated, as part of an effort to circumvent the outcome of the voting, The New York Times reported Thursday.

Have questions? Contact Tammy Joyner on X @lvjoyner or at [email protected].

And subscribe to State Affairs so you do not miss any news you need to know.

X @StateAffairsGA

Facebook @StateAffairsGA

Instagram @StateAffairsGA

LinkedIn @StateAffairs