Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoWhat should Georgia do with its $12 billion surplus? Experts: Spend it on education, Medicaid, tax credits and refunds

Georgia is sitting on nearly $12 billion of surplus, the most cash on hand in state history. Here’s what some fiscal and government experts suggest doing with some of the windfall:

Danny Kanso, director of legislative strategy and senior fiscal analyst at Georgia Budget & Policy Institute

The state [should] plan around recurring spending in public education. We’re one of a handful of states that don’t account for poverty in our education formula. We know that poverty has a huge effect on how students learn and their ability to be successful. So we recommend the state increase and add funding that responds to the level of poverty in each district and school across the state. We can help to front load that through some surplus funds. Then, preserve it over the long term using recurring revenues.

Medicaid is an area where now we're one of 11 [states] that hasn’t expanded Medicaid. More than half a million Georgians need access to health care and don't have a path to getting access to health care otherwise. That's one of the most important things we could do immediately. Those surplus funds could be part of that equation and should give us confidence that we can pay for it long term.

Use the surplus funds in an intentional way to manage the budget and ensure that we’re well-resourced enough to sustain those investments, rather than focusing on one-time uses.

The most important thing the state could do to give economic relief to Georgians is to adopt an Earned Income Tax Credit. Thirty other states have it at varying levels. The federal government has it. Second to Social Security at the national level, the earned income tax credit has been one of the most successful anti-poverty programs in modern American history.

Dr. Jeffrey Dorfman, fiscal economist for the state of Georgia

One thing that's very important, and the governor really insists on this, is it has to be a one-time thing. We can't take these extra monies and spend them on an annual recurring thing because then when the money's gone, now you're burdening the taxpayers and you're gonna have to raise taxes to keep paying for that. That's why we're looking at water and sewer systems and rural broadband and a lot of things like that where we can pay upfront costs with the money we have now. If we can do infrastructure investments and lower our ongoing expense structure. This is our ultimate goal.

Tony West, deputy state director for Americans for Prosperity Georgia

Keeping the rainy day fund fully-funded is a smart idea. Anything leftover could be used for more transformative tax reform. As much progress as we’ve made over the last six years on the tax code, there’s more room for improvement. If done right, it will lead to even more revenues down the road. That would be at the top of my list. Return some money to taxpayers. Pay down bond debt. Consider doing a one-time project, not a recurring one.

Eric Johnson, project director overseeing construction of the Hyundai EV Plant in Bryan County and former Senate president pro tem

I’d make sure the teachers’ pension fund has enough money to pay future retirees. Then, I’d look at what’s needed in education and health care [areas that have taken big budgetary cuts in recent years]. Lastly, make sure there’s enough money for disaster relief.

In Case You Missed It

Georgia’s purse holds billions and is closed tight, but should it be?

Teachers, Bridges, Tax Refunds: What Georgia’s $5 Billion Surplus Can Buy

Georgia’s Record $5B Budget Surplus Sets Up High Stakes Legislative Session

How would you spend the money? Contact Tammy Joyner on Twitter @LVJOYNER.

And Subscribe to State Affairs today!

Twitter @STATEAFFAIRSGA

Facebook @STATEAFFAIRSUS

LinkedIn @STATEAFFAIRS

Read this story for free.

Create AccountRead this story for free

By submitting your information, you agree to the Terms of Service and acknowledge our Privacy Policy.

In hot water with your HOA? A new law buys you time to fix the problem

The Gist

Georgia homeowners living in communities governed by homeowners’ associations now get time to fix a covenant violation before the HOA can take legal action, thanks to legislation signed into law Monday.

Gov. Brian Kemp signed House Bill 220 at the Capitol, continuing his flurry of bill-signings across the state. To date, Kemp has signed about three dozen bills since sine die, which marked the end of the 2024 legislative session, his spokesman Garrison Douglas told State Affairs. Sine die ended in the early hours of March 29. The governor has until May 7 to sign, veto or take no action on a bill. If he takes no action, the bill automatically becomes law.

What’s Happening

HB 220 requires community-governed associations to notify in writing a home or condo owner of a covenant breach — such as painting their house a color not approved by the association, and give them time to fix it before going to court or taking some other legal action.

Rep. Rob Leverett, R-Elberton, sponsored the bill which included parts of an HOA bill promoted by Sen. Donzella James, D-Atlanta. James had been trying for two years to get some HOA-related legislation passed.

While the HOA portion of HB 220 does not go as far as James’ proposed single legislation, it’s a start, she and others say.

Why It Matters

An overwhelming majority of new subdivisions being built in Georgia now will have HOAs, experts told State Affairs. In fact, new homes that are part of a homeowner association are growing fastest in the southern and western part of the United States. An estimated 2.2 million, roughly 22%, Georgia residents live in a building or home overseen by anHOA or some other type of community association, according to the Community Association Institute.

Lawmakers such as James have heard complaints in which HOAs have terrorized homeowners and threatened to take their property, all while homeowners have had little to no legal options. In some cases, homeowners have lost their homes after falling behind on HOAs fees, even if they never missed a mortgage payment.

What’s Next?

While HB 220 is now law, Senate Resolution 37 has yet to be appointed. The resolution, sponsored by James, creates the Senate Property Owners’ Associations, Homeowners’ Associations, and Condominium Associations Study Committee. Committee members will be appointed by the President of the Senate, Lt. Gov. Burt Jones.

Lawmakers appointed to the committee will delve further into HOA issues before presenting recommendations to the Legislature when it convenes in January.

See related stories:

Have questions? Contact Tammy Joyner on X @lvjoyner or at [email protected].

And subscribe to State Affairs so you do not miss any election news you need to know.

X @StateAffairsGA

Facebook @StateAffairsGA

Instagram @StateAffairsGA

LinkedIn @StateAffairs

All you need to know heading into the May 21 primary

Gist

Georgia’s primary is less than a month away and there’s a lot to unpack.

The May 21 primary will be the first time some Georgians will be voting in new districts for state and congressional candidates. They’ll also be voting in local races for sheriff, judges, school board or county commission members. Primary winners who have challengers will go on to compete in the Nov. 5 general election. Georgia is an open primary state, meaning voters can choose the party ballot they wish to vote for.

This year, Georgians who want to vote absentee in the primary could face possible challenges due to mail delivery delays.

What’s Happening

North Georgia and metro Atlanta are seeing significant mail delivery delays. The holdup, according to media reports, appears to be at the United States Postal Services’ new Regional Processing and Distribution Center in Palmetto. The problem has led to dangerous situations in which people are not getting critical medication.

Georgia’s U.S. Sen. Jon Ossoff recently grilled USPS Postmaster General Louis DeJoy on the delays. Ossoff told DeJoy during an April 16 hearing that on-time delivery rates were abysmal. He said 66% of outbound first-class mail had been delivered on time while 36% of inbound mail had been delivered on time in the last three months.

DeJoy blamed the problem on the difficulty in condensing operations at the facility.

With the approaching primary, state lawmakers are concerned the ongoing mail delays could disrupt the election process.

Mike Hassinger, a spokesman for the Secretary of State’s office, told State Affairs that Georgia voters are ready.

“Georgia voters are already registered,” he said. “They know how they like to vote. More than half of them vote early. About 5% vote absentee by mail, just in general, and then the rest are voting on election day. So we’ve been able to set up systems that are familiar with Georgia voters so that the percentage who might be worried about their absentee by mail ballots are relatively small.”

Why It Matters

Georgia emerged as one of the country’s most important political battleground states during the 2020 election. The Peach State will once again play a key role in deciding who wins the 2024 presidential election in November.

In the May 21 primary, Georgia voters will whittle down their choices for who they send to Congress and to the state capitol next year.

Under a federal court-approved redistricting process last year, Georgia now has new congressional and state district electoral maps. Those maps created one majority Black seat in the U.S. House of Representatives, five new majority-Black districts in the state House and two in the state Senate.

The redistricting resulted in new seats, intriguing matchups and former politicians returning to the fray. You can see the newly drawn maps here.

What’s Next?

Here’s what you need to know to ensure a smooth voting process:

To vote early.

Early voting is April 29 to May 17. Find your polling place here.

To vote absentee.

Here’s what you can do to avoid problems if you vote absentee:

- Get your absentee ballot application done early. You can request an absentee ballot here.

- Track your application through Georgia BallotTrax. You must have a valid absentee request on file with your county board of elections in order to see your absentee ballot status in Georgia BallottTrax.

- If you’ve been having mail delays, place your completed absentee ballot in an official drop box during advanced voting instead of using the United States Postal Service. Check your county voter registration and election office for drop box locations. And yes, your absentee ballot counts. It is counted in the final tally not just close races.

- If you change your mind about voting absentee and decide to vote in person, take your absentee ballot to your local elections office where they will void it.

- If you need to contact your county election office, find that information here.

Have questions, comments or tips? Contact Tammy Joyner on X @lvjoyner or at [email protected].

And subscribe to State Affairs so you do not miss any news you need to know.

X @StateAffairsGA

Instagram@StateAffairsGA

Facebook @StateAffairsGA

LinkedIn @StateAffairs

Weekend Read: Motivated by deep commitment to change, senator from Cataula promotes 369 bills

Shortly after the 2024 legislative session ended in the wee hours of March 29, state Sen. Randy Robertson began working on legislation he plans to introduce during next year’s legislative session, which starts in January 2025.

“I easily spend eight or nine months researching, working through, sitting down with attorneys making sure what I’m doing is constitutional,” the third-term Republican from Cataula told State Affairs. “[I’m] reaching out to subject matter experts to make sure that we are addressing a problem and we are addressing a problem with the right solutions and we’re not creating an additional problem.”

Raised by a single mom, the retired law enforcement officer was surprised to learn that his name was attached to 369 bills, the most introduced in the Senate during the 2024 legislative session.

Robertson said his upbringing and career in law enforcement has helped him focus on the types of bills and decisions he makes whether in the Senate chamber or on the nine committees on which he serves.

His middle name might be “over achiever.”

Robertson is vice-chair of the Senate Public Safety committee and also serves on the appropriations, children and families, ethics and government oversight committees. Last fall, Robertson took on the duties of heading the Senate’s Fulton County Jail subcommittee which is looking into problems at the Atlanta facility where 13 inmates have died in the last year.

In addition to his committee work, Robertson is the majority whip in the Senate, the fourth-highest ranking member of Senate leadership behind the president pro tem, Majority Leader and lieutenant governor.

Robertson spoke with State Affairs about the motivation behind the legislation he has sponsored. The conversation has been edited for clarity and brevity.

Q. You had a productive legislative session. You sponsored or co-sponsored a total of 369 bills during the session, making you the senator who introduced the most pieces of legislation in the Senate. What was your motivation?

A. There’s a big difference between sponsoring and co-sponsoring. Sponsoring is that individual bill that I sat down and have written up and walked through with the attorneys. The co-sponsorships a lot of times are issues I absolutely agree with and I’ll support a sponsor as they carry that bill forward, as far as debating the issue and voting for the issue and things like that.

Q. What legislative goals did you set for yourself for the 2024 session?

A. Well, to basically just finish the drill. In 2023, we passed the Prosecutorial Qualification Commission. And there’d been a change that the [Georgia] Supreme Court had asked us to make. We were able to do that with new legislation. Then, the completion of our bail bond reform legislation that we had done and just a few other things related to adoption and election integrity. Those were my primary drivers.

Q. So you got those things done?

A. We were able to get those done, for the most part. There was a bill on adoption that, for some reason, did not get through. So that’s something we’ll continue to work on. The bill would have allowed an adoptee the opportunity to get their original birth certificate once they turned 18. That was something we were hoping we’d be able to get done and sadly, we weren’t. But we’ll be back championing that legislation next session.

Q. What were you looking to accomplish with bail bond reform?

A. In the previous year, a lot of groups would come forth and they would say there are people in jail who could not afford to make bond. So we have now included in the law that nonprofits can actually establish bonding companies under Title 17 in Georgia. And since they have the opportunity to raise money, this would put them in a better position to help get some of these individuals out of jail that they’re concerned about being left there.

Q. So this will help make that a little bit easier?

A. It’s a matter of risk. Bonding companies would love to get everybody out but the problem with that is some individuals, even though they have bonds, they are at greater risk of flight, of not showing up in court, which would put the bonding companies in a precarious situation. So we tried to explain this to a lot of these groups [who felt people should still be able to get out on bond]. So we expanded the opportunities for other groups that wanted to be a part of the bail bonding community.

Q. What percentage of your bills were passed?

A.I don’t know. I don’t track that. Like I said, a lot of them I was just a co-sponsor on or I signed on with somebody else. I try not to get caught up in that. Some people worry about that. You just support good, quality legislation and understand that what doesn’t get through this year, if it’s something that is still an issue next year, then there’s always that opportunity to bring it back. The most important thing we have to do is get a balanced budget put out for the taxpayers and then those public safety issues, health care issues and things of that nature. Those are the most important things to get out there in session. Once those get out, everything after that a lot of times are just small pieces to correct particular issues.

Q. How has your career in law enforcement shaped your time in the Senate?

A. Well, my experience not only in law enforcement but working in the infrastructure of a local government that is subject to a lot of state laws, rules and regulations has had a huge influence on me.

In law enforcement, you’re out in the real world. And sadly, we have some legislators that really don’t understand what abject poverty is. They don’t understand what abuse is. They’ve never seen domestic violence up close. So I tell everybody, as human beings, it seems like the vast majority of us live in the zoo, where everything is controlled and we get fed, we get water we get really taken care of. But there’s a lot of people still trying to survive out in the jungle, on the Serengeti and in the forest where life is real. And, law enforcement is one of those careers that puts you out there in that environment to see what goes on.

I was primarily raised by a single mother — me and my two sisters. And so my mother worked two jobs. The things that we thought were hard growing up, now I realized were blessings. So now I am able to support a cross section of Georgians, whether they be Democrat, Republican, Independent or whatever. Poverty doesn’t know a political party. Crime doesn’t know a political party. So to have the experiences I’ve had, I feel it’s really benefited me in the Georgia Senate.

Q. What were you hoping to achieve for your constituents, and Georgians in general, through the types of bills that you sponsored or co-sponsored?

A. For the citizens, the one thing I really wanted to accomplish was lower taxes. With the economy the way it is and the recession moving up and down, it doesn’t seem like prices are changing at all. It seems like we’re still paying exorbitant amounts for fuel and other things. So, lowering taxes in Georgia I think was probably the biggest win.

Q. Of all the bills you introduced or co-sponsored, which were you the most proud of?

A. The Prosecutorial Qualification Commission and the bail bond reform.

Q. What was the impetus behind creating the Prosecutorial Qualification Commission?

A. We had an experience in my district with a district attorney. He came in and instead of enforcing Georgia laws and prosecuting Georgia laws, he was just going to pick and choose what he prosecuted and what he didn’t. He violated Georgia law in several ways that he chose to do that and he ended up going to prison.

The problem with that is there should have been something before that where citizens had a voice in getting that district attorney removed other than a recall, which is extremely cumbersome and very, very, very rare in Georgia.

So, just by putting this Prosecutorial Qualification Commission in place, we’re going to address those prosecutors who don’t do their job according to Georgia law. Out of the 50 to 60 prosecutors in Georgia I think we’ve had four that spoke out against it. All the rest of them realize if they’re doing their job, they never have to worry about this.

THE RANDY ROBERTSON FILES

Title: Georgia state senator representing the counties of Troup, Meriwether and Harris as well as parts of Columbus-Muskogee County.

Age: 61

Birthplace: Hamilton

Residence: Cataula

Education: Harris County school system. Columbus State University where he majored in criminal justice. The FBI National Academy and a few other specialty schools throughout his career.

Career: Served 30 years with the Muscogee County Sheriff’s Office, retiring in 2015 as a bureau commander at the rank of major.

Hobbies: He enjoys exercising. He also is an avid reader and collector of books. He estimates he has around 1,800 books.

Family: He and his wife Theresa have three children and five granddaughters. (He recently shaved his beard so that his five-year-old daughter would see his actual face for the first time in her life.)

What would you be doing if you weren’t in the Legislature: “I’d be doing research in public safety, and maybe writing a book or two about how we can make policing better, more professional, how we can avoid the occasional bad apples and reduce crime and uplift citizens all at the same time.”

Top 5 Bill Sponsors in the Georgia Senate

Sen. Randy Robertson, R-Cataula: 369 bills

Sen. John Albers, R-Roswell: 365 bills

Sen. Steve Gooch, R- Dahlonega: 361 bills

Sen. John Kennedy, R-Macon: 358 bills

Sen. Kay Kirkpatrick, R-Marietta: 349 bills

Source: LegisScan

Have questions, comments or tips? Contact Tammy Joyner on X @lvjoyner or at [email protected].

And subscribe to State Affairs so you do not miss any news you need to know.

X @StateAffairsGA

Instagram@StateAffairsGA

Facebook @StateAffairsGA

LinkedIn @StateAffairs

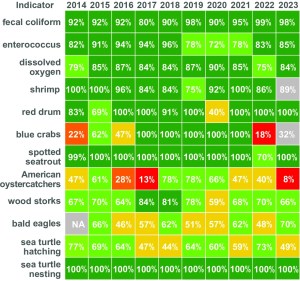

Spotted sea trout surged, shorebirds struggled, and the water’s safe for swimming

The Gist

Spotted sea trout flourished, sea turtles and shorebirds struggled, and blue crabs crawled their way out of trouble in ever-warming coastal waters last year. Those are a few of the findings in the Coastal Resources Division’s annual Coastal Georgia Ecosystem Report Card, released today.

What’s Happening

Every year since 2014, the Department of Natural Resources collects data on 12 indicators of coastal ecosystem health that impact humans, fisheries and wildlife and issues a report card.

Based on data collected in 2023, Georgia’s coastal ecosystem this year earned a B, which equates to a “moderately good health score” of 78%, up from last year’s score of 74%.

Click here to see the full 2023 Coastal Ecosystem Report Card.

The ecosystem indicators and scoring methods for the report card were developed with the University of Maryland Center for Environmental Science, which has helped to create other ecosystem health assessments around the country.

This year, red drum remained plentiful and spotted sea trout numbers improved, as the sea trout count in the Wassaw and Ossabaw sound systems rebounded. The report said a 2016 regulation that increased the minimum catch size limit for sea trout is helping.

Shrimp numbers improved a bit, too, just in time for their recognition as the state’s official crustacean by the Georgia Legislature this year.

According to the Department of Natural Resources, the dockside amount of wild-caught “food shrimp” brought in by commercial fisheries increased to 2.6 million pounds from 2.1 million pounds in 2023 (though the overall dockside value of Georgia shrimp decreased to $9.4 million from $11.3 million, largely due to competition from foreign suppliers of lower-priced, imported frozen shrimp).

Blue crabs got a D in the report but improved from a score of 18% last year to 32%. Warm coastal waters and increased salinity in the water could explain why crab numbers were low in the survey, but the report also noted its sample size of crab was skewed because its trawling vessel was out of commission for part of 2023. The amount of blue crab caught by commercial fisheries increased to 3.4 million pounds in 2023 from 3.1 million pounds in 2022, with a dockside value of $7 million.

Overall, the dockside value of all commercial fisheries tracked by Natural Resources in Georgia in 2023 was $19.7 million, about $2 million less than in 2022.

The lowest scorers

As was the case last year, shorebirds in general and American oystercatchers in particular were the animals that scored the lowest. Wildlife biologist Tim Keyes said big storms that hit the coast washed out and degraded the beaches and marsh islands where oystercatchers nest. Shorebirds, including wood storks, were also preyed on by raccoons, opossum, coyotes and hogs that live in remote coastal areas.

Keyes said the Coastal Resources Division is working with the Army Corps of Engineers to build new 10-foot-high sand islands and sandbars using dredged-up sediment near Cumberland Island and along the Intracoastal Waterway to give the birds a boost and a better place to roost.

Loggerhead sea turtles, a threatened species, dropped to a C grade from a B, primarily due to increased predation. Sea turtle nesting sites were plentiful once again, with 3,431 loggerhead nests located, and a 52% emergence rate for hatchlings. But many of the eggs and baby turtles were gobbled by wild hogs, raccoons, coyotes before they could make their journey to the sea, according to the Wildlife Resources Division report.

The good news

The report contains good news for humans who like to cavort in coastal waters, as the water quality index received an A, at 89%. Overall indicators show the water is generally safe to swim in and to eat local shellfish, that oxygen levels support fish and other species, and bacteria is at acceptably low levels.

Read this related story:

Have questions or comments? Contact Jill Jordan Sieder on X @journalistajill or at [email protected]

And subscribe to State Affairs so you do not miss an update.

X @StateAffairsGA

Instagram @StateAffairsGA

Facebook @StateAffairsGA

LinkedIn @StateAffairs