Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a Demo‘We needed to try something creative’; Here’s why lawmakers are allowing Indy to create a new downtown tax

Monument Circle (Credit: Mark Curry for State Affairs)

- An effort to create a taxing district failed in 2018 largely because of opposition from the Indiana Apartment Association

- This year state lawmakers created a new rule permitting Indianapolis leaders to more easily create a district

- It was slipped into the budget after legislative leaders and the governor's office expressed concerns tied to a major state investment into Indianapolis

In the final days of the legislative session, state lawmakers quietly provided the city of Indianapolis with a gift: Mayor Joe Hogsett and the City-County Council gained the power to create a special taxing district in the downtown area.

It is a victory for boosters of Mile Square who have been advocating for a similar district designation for at least five years to pay to improve public spaces, attract new businesses and hold special events. But their efforts failed in 2018, in large part, because of strong opposition from the Indiana Apartment Association that killed a petition drive to create a district.

Now, however, Indianapolis leaders can create the district if they want. No petition signatures are required. That’s because lawmakers created a special carve-out within state law for Indianapolis.

Many observers of the Indiana General Assembly were surprised by the move. The language, inserted into the final version of the state budget bill, was never publicly discussed. Not only that, the Republican supermajority agreed to help local Democrats in a year in which Hogsett is running for reelection against a well-funded Republican candidate. Most years, Indianapolis Democrats are playing defense against bills that would weaken their authority.

The eleventh-hour deal was made possible by the rare bipartisan acknowledgment that the downtown area needs help — not only from the city, but from the state, too.

And while it is true that the creation of a new taxing district could support several quality-of-life improvements and economic initiatives, they are not the main reason the language appeared in the state budget bill.

How the language ended up in the budget bill

The special taxing district language may have emerged in the final moments of this year’s legislative session, but it stems from years of conversations about homelessness.

In 2019, the Indy Chamber led a delegation of local business and government leaders to San Antonio, where they visited a low-barrier homeless shelter. People on the trip envisioned something similar for Indianapolis: a compassionate way to address homelessness by helping people who are unable or unwilling to use faith-based shelters. (One common barrier cited by policymakers, for example, is requiring a commitment to sobriety.)

Since the start of the pandemic, according to an Indiana University Public Policy Institute report, the homeless population has generally grown. They have concentrated in the city’s downtown, advocates say, because that’s where many public services are available.

“The pandemic made it feel like an even more significant, maybe crisis level, situation that we’re still dealing with,” said Taylor Hughes, vice president of policy and strategy at the Indy Chamber. “Coupled with the reality that there aren't as many people downtown for work reasons … That makes the visibility of the challenge stand out that much more.”

In response this year, a bipartisan group of Marion County lawmakers, the Hogsett administration, the Indy Chamber and others asked state lawmakers to financially support the creation of a new shelter in Indianapolis. Those efforts followed several months of meetings on the topic in a task force co-chaired by appointees from the governor and mayor.

Gov. Eric Holcomb’s office and legislative leaders were supportive of a significant capital investment, according to several people interviewed by State Affairs, but they were also concerned: Could Indianapolis find a way to sustain funding for operations in the future?

So a small group of people, led by Indianapolis Republican Sen. Kyle Walker, dusted off some legislative language that had been floating around since at least 2021. That language enables Indianapolis to create a new downtown tax district, which the budget bill identified as an economic enhancement district.

That’s not to be confused with an economic improvement district, which is difficult to implement because it requires a large number of property owners to sign a petition.

The new language, however, skirts some of the red tape — and opposition — that typically appears when new taxing districts are created.

In the final days of the legislative session, budget writers agreed to insert the language into the budget bill as an option for Indianapolis. And then they added a line item to support the capital expenses for a homeless shelter.

The line item in the budget does not specifically mention Indianapolis. It does, however, allocate $20 million — which just so happens to be the amount advocates were seeking. Combined with the $12 million in city dollars that Hogsett has already set aside, the two pools of cash would cover the $32 million in expected capital costs outlined in a feasibility study.

The line item in the state budget, though, comes with a twist: It is structured as a grant program. That way, if Indianapolis stakeholders fail to identify a funding stream for ongoing operations of the homeless shelter — such as the new downtown taxing district — then the state would not necessarily be required to write a check.

Following a bill-signing ceremony for mental health legislation earlier this week, Gov. Holcomb told reporters he supports a state investment into a low-barrier homeless shelter.

“If nothing else, I’m supportive of local communities who are very transparent about their motives. And how can we then be a good partner?” Holcomb said. "How can we both put skin in the game? How can we both turn the cards face up? ... On this front, it's overdue. So yes, I'm not just pleased but proud to take a crack at this with them but understanding that there is local responsibility here."

Which senators championed the language?

Budget negotiations every two years typically contain extensive back-and-forth between the two chambers of the Indiana General Assembly. This year, it was important to the Senate to see both the funding of the homeless shelter and the option for Indianapolis to create the new district.

Walker, who represents parts of Marion and Hamilton counties, stepped forward as the main voice championing the deal.

“The economic enhancement district, along with the low barrier shelter, certainly will go a long way to giving Indianapolis the tools to make downtown Indianapolis more attractive and also provide valuable services to the homeless community,” Walker told State Affairs. “I worked on it pretty extensively in the final days of the session.”

Walker had several conversations with other lawmakers, budget writers, legislative leadership and the governor's office.

The language garnered broad support in the Senate, but it still required a bipartisan battle in the frenzied final days of the session. Once the Indiana Apartment Association became aware, according to those interviewed by State Affairs, the group moved quickly to lobby lawmakers to strip the language from the bill.

“That person had one job, which was to get this language out of the budget,” Sen. Andrea Hunley, D-Indianapolis, told State Affairs. “And so this was not easy to get through. There were definitely forces that were working against it."

Hunley, who represents the downtown area, described a similar battle in 2018. She was not yet a state senator, but she and her family lived in the Mile Square and went door-to-door collecting signatures on a petition that sought to create the economic improvement district.

“At that time, the apartment lobby stopped it, which was incredibly frustrating,” Hunley told State Affairs. “So we knew that we needed to try something creative.”

Lynne Petersen, president of the powerful Indiana Apartment Association, did not return a call this week from State Affairs. But in an op-ed published by the Indianapolis Business Journal, Petersen criticized the concept: “Imagine our surprise when we learned the Indiana General Assembly granted the Indianapolis City-County Council the authority to levy an additional tax assessment onto businesses and residences downtown to fund some services that presumably property tax dollars already fund.”

Senator cites wide support for district concept

Walker acknowledged the concerns raised by the Indiana Apartment Association, but he emphasized that “the vast majority of businesses and property owners” within the Mile Square are supportive of the creation of a new district. And Walker said he wanted to ensure the legislation contained both guardrails and flexibility.

The guardrails include the creation of an oversight board with representation from downtown property owners as well as appointees from the governor, legislative leadership, mayor and City-County Council leadership.

As for the flexibility? The district can levy taxes in such a way that the costs are proportionate to the benefits, Walker said. The taxing amounts can be different based on the types of properties, too: Maybe residential properties pay one amount, for example, but large commercial properties pay another.

Walker also noted: State lawmakers are not requiring any of it. The legislation, Walker said, simply gives Indianapolis one more option to help the downtown. The ultimate decision is up to local leadership.

“It's a tool, and it could be a very beneficial tool, but not without a tremendous amount of input from stakeholders,” Walker said.

Mayor Hogsett has not publicly endorsed the creation of a downtown taxing district. His administration could theoretically decide instead to set aside money in each year’s city budget to fund the new shelter, but those interviewed by State Affairs shared a fear that it would lead to a decline in public safety spending at a time when Indianapolis is already struggling with homicides, gun violence and a perception that the city is unsafe.

Late last year, however, Hogsett directed $3.5 million in American Rescue Plan dollars to help the downtown area. The money is paying for police overtime, security cameras, cleaning crews and homelessness outreach. Dan Parker, who serves as Hogsett’s chief of staff, suggested the taxing district could provide funding when the federal money runs out.

“If folks want to see it continue into the future, this is one mechanism now available to keep it going,” Parker told State Affairs. “But there needs to be support built for that, and that's the hard work that needs to be done over the coming months.”

Downtown Indy Inc CEO Taylor Schaffer, Hogsett’s former chief of staff, celebrated the proposed taxing district’s potential for Indianapolis, which is the largest city without a dedicated fund for its central business district.

“Those types of sustainable funds really help to come alongside city services and private investment to ensure that a downtown can be responsive and nimble,” Schaffer said, “but also have the level of operations that make sense for that area.”

Contact Ryan Martin on Twitter, Facebook, Instagram, LinkedIn, or at [email protected].

Twitter @stateaffairsin

Facebook @stateaffairsin

Instagram @stateaffairsin

LinkedIn @stateaffairs

Read this story for free.

Create AccountRead this story for free

By submitting your information, you agree to the Terms of Service and acknowledge our Privacy Policy.

Brad Chambers sells himself as ‘business guy’ to lead Indiana

EDITOR’S NOTE: This is one in a series of profiles of the candidates running for Indiana governor.

Brad Chambers argues big ideas and actions are needed in the coming years to propel Indiana and its economy forward.

Chambers has already put $9.6 million of his own money toward that argument as he tries to transform himself from a successful real estate developer who was virtually unknown by the general public into the Republican nominee for governor.

The first steps for his entry into the governor’s race came during his time as Gov. Eric Holcomb’s state commerce secretary and leading the Indiana Economic Development Corp. — the agency tasked with attracting business growth to the state.

A big idea from Chambers’ time with the IEDC was the LEAP Lebanon Innovation District, a planned 9,000-acre hub for tech-related industries that has been a target of criticism from the other five Republican candidates in the May primary.

Chambers remains steadfast in defending the project as a needed asset to compete with other states for major projects and asserts Indiana needs more of that kind of leadership.

“What I bring to this race is I’m not making decisions — and LEAP is proof — I’m not making decisions on three-year election cycles because I’m not an elected official,” Chambers said during an interview with State Affairs. “I’m making decisions like a business guy — which is, ‘What’s good for Indiana?’ — no matter if I’m around to see it come to fruition or not.”

Path to business success

Chambers, 59, grew up in Indianapolis as a son of prominent businessman William Chambers, who participated in numerous civic organizations and was the finance chairman for Republican Dan Burton’s 1982 election to the first of his 15 U.S. House terms, according to the elder Chambers’ 1997 Indianapolis Star obituary.

Brad Chambers traces his business career back to a lawn mowing service he started with some friends while a Lawrence Central High School student.

He said he was using his share of the profits to pay his Indiana University tuition before one of the friends bought him out a few years later for $5,000. It became the seed money to purchase a repossessed house in Indianapolis as a rental property.

“I like to say it was divine intervention that I didn’t blow it,” Chambers said of the lawn service buyout.

That first property sparked his interest in the real estate business.

“I’m like, this is kind of fun, and so I ended up rooting around and by the time I graduated from IU, I had 31 rental units,” he said.

Those rentals were the start of Buckingham Companies, the development business Chambers founded. It now claims a portfolio of $3 billion in a variety of apartment, retail, hotel and business projects with more than 400 employees in nine states.

Buckingham’s prominent Indianapolis work includes the CityWay development, which has apartments, retail sites and the upscale Alexander hotel near Gainbridge Fieldhouse.

Chambers said he stepped away from day-to-day company leadership when Holcomb selected him in 2021 as state commerce secretary, a post he held for $1 a year before resigning last August to launch his gubernatorial campaign.

The breadth of Chambers’ business is represented in his candidate financial disclosure statement, which lists ownership of 63 properties in nine states and stakes in 279 real estate or other partnerships. He said he would keep his business interests separate from state actions if he became governor.

“Indiana is obviously important, but we’re a national company, we’re doing business all over the country,” Chambers said. “We understand the rules of the road there and our guys are running the business and they’re doing a great job.”

Road to the governor’s race

Holcomb recruited Chambers to the state commerce secretary job in 2021 after the position had been vacant for about four months.

Chambers said that about a year later, others began raising the idea of him running for governor in 2024 since Holcomb couldn’t seek reelection because of term limits.

“I never really gave it too much thought until [2023,] probably second quarter of ’23, and then started thinking about it in earnest,” Chambers said. “I’m not a politician. I’ve never run for [anything]. I didn’t know anything about it. So I had to understand it and then started doing what business guys do, which is evaluate, and it was a tough decision.”

Republican Fishers Mayor Scott Fadness said he got to know Chambers after he started leading the state’s economic development agency.

Fadness, who has been mayor of the Indianapolis suburb since 2015, said he quickly became impressed with Chambers’ willingness to talk in depth about big ideas.

Those conversations grew to include discussions about whether Chambers should run for governor, although Fadness said he largely explained the hurdles Chambers would face with his campaign.

“He could be living a very good life, doing a variety of other things,” Fadness told State Affairs. “I think he just felt compelled to run because he wants to move Indiana forward. That kind of leadership and that kind of motivation is a rarity in politics anymore, and I guess that’s what kind of made me gravitate towards him.”

Many prominent Indiana business leaders have joined in supporting the Chambers campaign. Among those making sizable contributions are Eli Lilly and Co. CEO David Ricks ($100,000), Kittle Property Group CEO Jeffrey Kittle ($100,000), Indiana Pacers owner Herbert Simon ($50,000) and retired Lilly CEO and IEDC board member John Lechleiter ($50,000).

Chambers has been willing to sink own money — $9.6 million as of mid-April — into the campaign for his message that he’s “a business guy” focused on growing the state’s economy.

“That story resonates, but it’s six and a half million people to communicate with,” Chambers said of Indiana’s voting-age population. “It takes time and it takes resources.”

Critic calls LEAP District planning ‘underhanded’

Indianapolis-based Lilly was the first company making a major commitment to the LEAP District, with a $3.7 billion research and manufacturing campus now under construction.

Chambers points to the district as a major step toward making Indiana competitive with other states for major projects. He argues that Indiana lost out on perhaps landing a $20 billion Intel microchip plant to the Columbus, Ohio, area because it didn’t have a ready-to-build site available.

Chambers’ critics argue the LEAP District is an example of “top-down leadership” at the Indiana Economic Development Corp. that disregards the concerns of local residents and officials.

Project opponent Brian Daggy, a retired Boone County farmer, said Chambers hasn’t tried to engage with those whose homes would be affected by the LEAP District transforming what is now largely farmland into manufacturing and research facilities.

Daggy and his wife bought a house in the northern part of the district as their retirement spot a few months before finding out in late 2021 about the IEDC buying up land for the project. Daggy has turned down purchase offers and helped organize the Boone County Preservation Group, of which he’s now president.

Daggy said he understands wanting to see government operate more efficiently and business-like but that the IEDC under Chambers showed a disregard for the residents’ concerns.

“He has given all indication that he knows what’s best, and that’s what he’s gonna carry forward,” Daggy said. “It causes me concern, a lot of pause, thinking about that he would run the state in that kind of a manner.”

A proposed 35-mile pipeline to transport water from a Wabash River aquifer near Lafayette to the LEAP District has drawn opposition from the Tippecanoe County area over concerns such as a loss of irrigation for farmers and worries about environmental damage from pumping out potentially tens of millions of gallons of water a day.

Residents in the Lafayette area didn’t know the pumping tests were being carried out for the proposed pipeline last year until they suddenly didn’t have water from their wells or noticed sulfur odors from their water they had never smelled before, said Sandra Alvillar, president of the group Stop the Water Steal.

Chambers, Holcomb and Republican legislative leaders have said no work on building the pipeline will go ahead unless an ongoing aquifer study shows adequate supply.

Alvillar, however, called the IEDC’s planning for the pipeline “underhanded” and said Chambers and the agency have been focused on a public relations response rather than listening to local concerns.

“If they have not been transparent up to this point, once they’re safe in their little office, it’s not going to get better,” Alvillar said.

Chambers has kept his focus on the economy

Chambers has focused his bid for governor on economic issues and running a decidedly non-Trump-like campaign. He has largely avoided hot-button culture issues, pointing in his TV ads and public remarks to former Gov. Mitch Daniels, who had a similar emphasis while in office, as a leader he would emulate.

Chambers has touted his “Play to Win” plan as aiming to boost business growth in the state through steps such as more infrastructure investment and increased support for small businesses and entrepreneurs.

“The one thing that I know touches every Hoosier, not some Hooiers, is financial security and opportunity,” Chambers said. “Fundamental to quality of life is good education and public safety, and you can’t fix those or invest in those without a growing economy. I believe when people have financial security, their health is better, their kids are better, their housing is better and overall quality of life is better. So I’m just focused on the one topic where I have had some experience.”

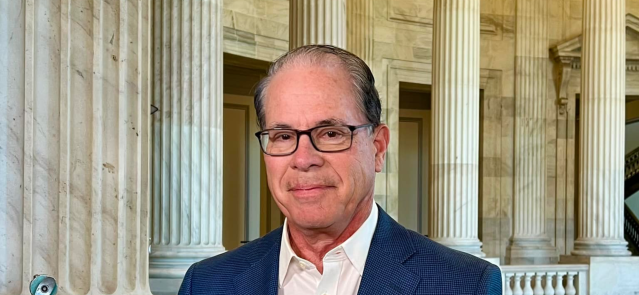

Chambers remains an underdog in the governor’s race, as a State Affairs/Howey Politics Indiana poll in early April found U.S. Sen. Mike Braun with support from 44% of likely Republican primary voters.

Chambers, Lt. Gov. Suzanne Crouch and Eric Doden each received about 10% support — and roughly 6 in 10 respondents were unfamiliar with Chambers despite the millions of dollars he’s spent statewide on TV ads.

Fadness, the Fishers mayor, said he believed Chambers would bring a needed sense of urgency and decisiveness to the governor’s office and hoped Chambers’ focus on the state’s economy would still catch on with voters.

“Those may not be the talking points that garner the most attention from people or get the headlines, but those are the things that are going to decide the trajectory of our state for many years to come,” Fadness said. “I think they’re vitally important. But I also am, I guess, a realist in that I understand that those aren’t always what folks spend their time and attention on in a political race.”

about Chambers

- Age: 59

- Hometown: Indianapolis

- Education: Bachelor’s degree in finance from Indiana University

- Family: Married to Carol with an adult son, Nick

- Job: CEO of real estate development firm Buckingham Companies since founding it as a college student in 1984

- Work history: Indiana secretary of commerce under Gov. Eric Holcomb, 2021-23; previously chairman of the Indiana State Fair Commission

Read these related stories

- Eric Doden is running from behind but hopes his ‘bold vision’ will propel him forward

- Suzanne Crouch positions herself as a ‘different’ candidate for the voiceless

- Mike Braun on why he wants to be in politics ‘at a level of significance’

- Who is Jamie Reitenour? Indianapolis mom mobilized volunteers to make governor’s ballot

Tom Davies is a Statehouse reporter for State Affairs Pro Indiana. Reach him at [email protected] or on X at @TomDaviesIND.

X @StateAffairsIN

Facebook @stateaffairsin

Instagram @stateaffairsin

LinkedIn @stateaffairspro

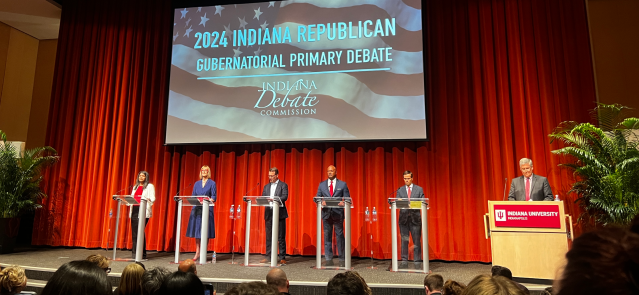

Final Republican governor debate focuses on economics, abortion

INDIANAPOLIS — Five hopefuls vying for the chance to be Indiana’s next governor took each other to task — and at times fought the questions themselves — on economic development, social issues, election integrity and more during Tuesday’s Republican gubernatorial debate hosted at Indiana University-Purdue University Indianapolis.

The debate, the last of the primary cycle and sponsored by the Indiana Debate Commission, at times spiraled into revolt, as candidates disagreed with moderator Jon Schwantes’ yes-no questions on election integrity and immigration. In other moments, the candidates stuck to their various platforms on taxes, education and beyond.

Former state Secretary of Commerce Brad Chambers, Lt. Gov. Suzanne Crouch, Fort Wayne businessman Eric Doden, former state Attorney General Curtis Hill and Indianapolis mom Jamie Reitenour participated.

Sen. Mike Braun, who has thus far led the crowded field in the polls, informed the Debate Commission on Monday that he would not attend the debate. He returned to Washington, D.C., where he cast one of 19 dissenting votes against a $95 billion aid package for Ukraine, Israel and Taiwan. The bill passed the Senate on a 80-19 vote.

Braun’s rivals targeted him several times in his absence, but the five candidates on stage mostly focused on one another throughout the debate. Gov. Eric Holcomb, a frequent target in previous debates, was hardly mentioned.

Schwantes, host of the WFYI-FM series “Indiana Lawmakers,” read from a slate of questions submitted in part by state voters and selected by the Debate Commission.

Election integrity

The night’s first major clash occurred during yes-no questioning on the safety and authenticity of the country’s elections.

Each candidate except Reitenour said they were confident in Indiana’s election integrity. All acknowledged the 2020 election was not stolen.

Asked if Joe Biden was the duly elected president, Hill and Reitenour pushed back, saying “anomalies” were not properly investigated.

The candidates essentially refused to answer a question asking if they would accept the 2024 election results, saying it was too hypothetical.

Agreement on abortion

Several questions were asked about abortion, though the candidates largely agreed on the issue.

The group was asked whether the state’s current abortion ban, which includes exceptions for rape, maternal health and other limited circumstances, was sufficient.

Chambers, Doden and Crouch agreed it was.

Hill called for increased enforcement of the ban, saying the state’s health department is not providing the necessary reports for terminated pregnancies.

“I brought 2,411 unborn babies from Illinois to have them buried in Indiana to establish their humanity,” Hill said, referencing a 2020 action he took as attorney general.

Reitenour did not answer the question directly, saying only that “we need to be a state that says we are for life.”

The group refused to answer when Schwantes asked if they agreed with the Indiana Supreme Court, which he said found the maternal health exception to be necessary under state law.

The candidates also agreed on in vitro fertilization, saying it should be allowed in Indiana. Some conservative states have targeted the procedure as part of the abortion debate.

Return to the IEDC

The Indiana Economic Development Corp. (IEDC), and particularly its LEAP Innovation District project seeking to build a ready-made space for business in Lebanon, Indiana, was a return topic from past debates. Chambers and Doden previously led the organization, and Chambers rose in defense of the LEAP District.

Reitenour called the project “putting a whale of a company in the middle of the desert with no water.”

Doden also directly criticized it, saying the IEDC existed only to help businesses navigate government rules.

Hill called the IEDC “a shadow government” that needed to be “reined in.”

Crouch used the question to launch into her plan to get rid of the state’s income tax.

“It’s a terrific contrast between career politicians and small thinking,” Chambers said in response to the criticisms.

Chambers goes after Crouch

Crouch was asked whether it made financial sense to cut the income tax, which brings in billions in state revenue each year.

Chambers seized on the topic.

“It’s a political talking point if ever there was one,” he said. “She has not told us how much she’s going to have to cut education, public safety, police, mental health or health care.”

Crouch doubled down, noting the income tax is already phasing down to below 3% in the coming years.

“Let’s just keep going in that direction when we have excess surplus in revenues,” she said.

Differing education approaches

A question about improving Indiana schoolchildren’s test scores led to a contrast in policy approach.

Doden and Crouch focused on school choice and workplace development.

Chambers said students require individualized learning opportunities.

Reitenour railed against critical race theory and social-emotional learning, saying kindergarten through fifth grade students need more focus on educational fundamentals.

Hill urged schools to stop taking federal money that requires certain programs, which Crouch joined in supporting.

Closing statements

Candidates were allowed to summarize their candidacy in final closing statements.

Chambers focused on his economic plan, likening his hopes for the state to his career as a businessman.

“We believe it’s time for a CEO, someone to run [the state] like a business,” Chambers said.

Hill leaned into social issues, railing against abortion and claiming “there are only two genders.”

“Don’t let politicians give you a laundry list of conservative talking points and say that’s enough,” Hill said. “Prove you can do the job.”

Doden focused on his platform talking points: restoring small towns, growing the economy and expanding zero-cost adoption.

“We have more plans in writing than everyone on this stage combined,” Doden said.

Crouch returned to her key proposal, which would eliminate the state’s income tax.

“My opponents say it’s a gimmick, but what they’re really saying is the government needs more of your money and you need less of it,” Crouch said.

Reitenour said God called her to run and cast doubt on Indiana’s conservative reputation.

“We live in a state that says it’s a red state and believes in conservative values, and yet I am trying to figure out where the conservatives are in government,” she said.

Read this related story

Contact Rory Appleton on X at @roryehappleton or email him at [email protected].

And subscribe to State Affairs so you do not miss an update.

Facebook @stateaffairsin

Instagram @stateaffairsin

LinkedIn @stateaffairs

Republican rivals knock Mike Braun for missing final governor debate

U.S. Sen. Mike Braun faced criticism from other Republican candidates for governor over missing their final televised debate because of scheduled Senate votes Tuesday on providing military assistance to Ukraine, Israel and Taiwan.

Tuesday evening’s 90-minute debate will go on as scheduled with the remaining five Republican candidates still expected to participate, according to the Indiana Debate Commission, the nonprofit group organizing the matchup.

“Braun’s campaign team notified the commission late Monday that he must be in Washington, D.C., for a vote,” the commission said in a statement.

A Senate vote on the military aid package wasn’t expected until at least Tuesday night.

Braun issued a statement casting blame on Democratic Senate Majority Leader Chuck Schumer for scheduling the vote three days after the Republican-led House approved the bill.

“I was looking forward to sharing my vision with Hoosiers at tonight’s debate but Chuck Schumer has called the Senate into session,” Braun’s statement said. “Tonight, I am in D.C. voting ‘no’ on a bill to send $95 billion of your money overseas instead of securing our open southern border, which puts Hoosier families in danger every day. I’m proud to stand up for you and vote against the Biden spending spree making life unaffordable for so many Hoosiers.”

The Brad Chambers campaign contrasted Braun’s potentially skipping the debate to vote on the military aid package to his missing last month’s Senate vote on a $1.2 trillion spending package avoiding a government shutdown several hours after attending an Indiana campaign fundraising event.

“Career politician U.S. Senator Mike Braun continues to insult Hoosiers and put himself first,” Marty Obst, senior strategist for Chambers, said in a statement. “He’ll skip votes in D.C. to collect checks at a campaign fundraiser but then use votes to skip a debate and hide from voters and his record.”

Braun’s campaign said he returned to his home in Jasper following a Friday-evening fundraising event and planned a return to Washington the next day for the Senate vote. But his campaign said the vote was unexpectedly held at nearly 2 a.m. that Saturday — and that Braun would have voted against the government funding bill that passed 74-24.

Tuesday’s debate is scheduled for 7-8:30 p.m. before an audience at Hine Hall Auditorium on the Indiana University-Purdue University Indianapolis campus. It will be televised by several PBS stations across the state and streamed on the commission’s website, indianadebatecommission.com.

Braun had support from 44% of likely Republican primary voters in a State Affairs/Howey Politics Indiana poll conducted in early April. Lt. Gov. Suzanne Crouch, Eric Doden and Chambers each received about 10% support.

Crouch campaign manager Liz Dessauer said in a statement that “Braun skipped a key budget vote to attend a campaign fundraiser, but now suddenly realizes he needs to do his job in order to skip the last debate?”

Long-shot candidate Jamie Reitenour, who is among those taking part in Tuesday’s debate, also knocked Braun for missing the debate for a Senate vote while not missing last month’s government funding vote.

“He’s trusting that his $7M campaign spending will trump his disrespect for the voter!” Reitenour posted on X.

Update: This story was updated to include a statement from Braun explaining his absence from the debate.

Tom Davies is a Statehouse reporter for State Affairs Pro Indiana. Reach him at [email protected] or on X at @TomDaviesIND.

X @StateAffairsIN

Facebook @stateaffairsin

Instagram @stateaffairsin

LinkedIn @stateaffairspro

Holcomb says he’s confident of investments from Brazil, Mexico trip

Gov. Eric Holcomb wrapped up his weeklong travels to Brazil and Mexico by saying he expected new business investments to emerge from the trip. Holcomb told reporters Thursday night from Mexico City that he had many productive meetings with government and business leaders promoting Indiana’s agriculture ventures. “It really does remind me that face to …