Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoHomeowners and renters: Start setting aside some money now as property taxes are expected to jump

The Gist

Assessed values of homes across the state have skyrocketed, which will result in higher property tax bills on average when they’re mailed to Hoosier homeowners this spring.

The total residential tax liability in Indiana is expected to jump 15%, according to a new analysis by Policy Analytics LLC for the Association of Indiana Counties. David Bottorff, executive director of the Association of Indiana Counties, said each household will pay on average an extra $228 towards property taxes this year compared to last.

Lawmakers have filed at least nine bills this legislative session in an effort to provide some sort of relief or adjust the property tax process.

One proposal, which would cap increases in property taxes dedicated to schools from some already passed ballot measures, was discussed in committee. But beyond that, Republican leaders have indicated a desire to wait to address rising property taxes until they know the extent of the problem in order to avoid unintended consequences or impact previous initiatives like the implementation of property tax caps.

To their point, there are some unknowns. Just because your home’s 2022 assessed value went up a certain percentage that year, doesn’t necessarily mean your income taxes will increase by that same percentage, experts say.

“We’re making sure … we’re going to get at the root causes of the increases that are occurring,” Holcomb told members of the media last Thursday. “We’re in close conversation with the House and Senate leadership and members on having the ability to do something that doesn’t change fundamentally the advances we’ve made.”

The issue with waiting: Hoosiers likely won’t receive their tax bills until March or April, and lawmakers statutorily have to wrap up by April 29. Oftentimes they do so before that date.

That means there could be a last-minute push to add property tax-relief initiatives into the two-year budget. Even then, it would likely have no impact on this year’s property tax bills.

The other dilemma is that whatever lawmakers do to provide relief to homeowners could impact other entities, either by shifting the tax burden to others or reducing the money cities and schools have to provide resources by millions of dollars as inflation increases spending. Property taxes only go toward local governments, not to the state.

Bottom line: Prepare to pay this year regardless of what lawmakers do.

“When this bill hits, elected officials are going to hear about it,” said Larry DeBoer, a Purdue University economics professor. “I wouldn’t want to be a mayor running for reelection with this thing going on.”

Why are residential property taxes going to increase?

- Assessed values of homes are up.

What you owe on your property tax, all of which goes to local governments — including schools — is based on your share of the total value of property in your community. To determine that, local governments use property assessments from the prior year, which are based on home sale prices the year before.

That means the booming housing market in 2021 drove up home assessments in 2022, which in turn will influence property taxes in 2023. The average home in Indiana was assessed for $181,500 in 2020 and jumped to $211,000 in 2021, Bottorff said.

“It was like it was three years of growth,” Bottorff said.

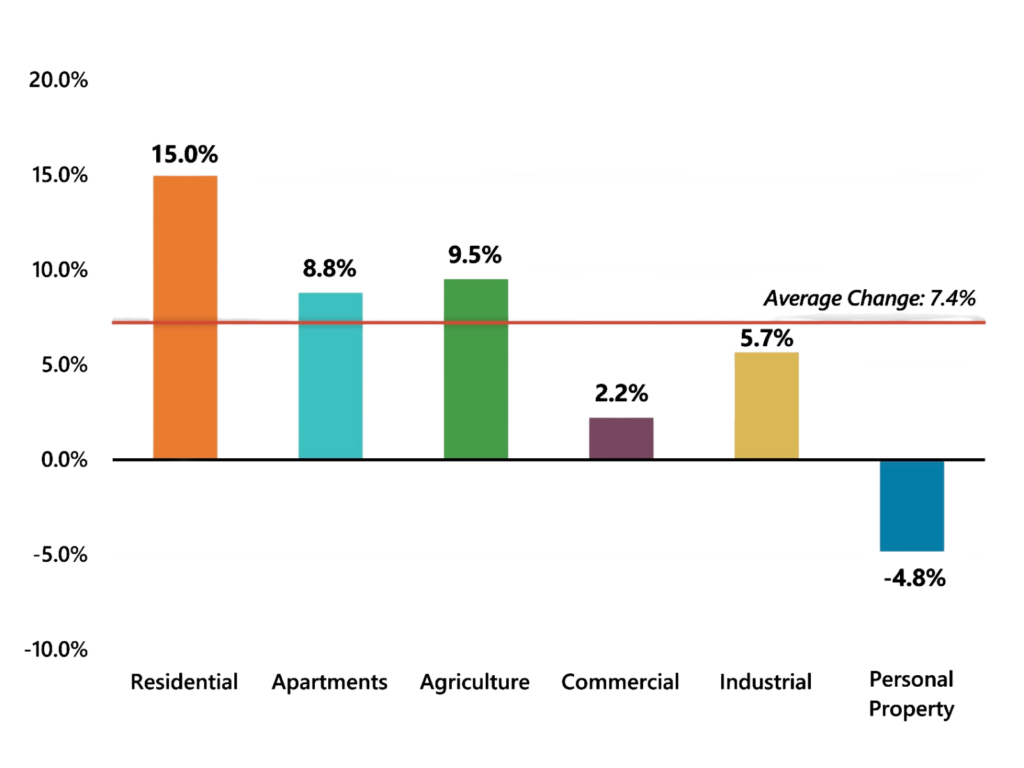

The total assessed value for residential areas in Indiana went up 16.5% year over year, according to the Policy Analytics analysis. While that does include increased assessments due to new construction, nearly all of that increase simply comes from the red-hot housing market driving up appraisals, said DeBoer.

Meanwhile, the total assessed value of other types of property in the state didn’t increase as quickly. For example, take the value of business equipment. It jumped only 1.3%. That means when tax bills come due, homeowners will be picking up a larger share of the overall tab.

Lawmakers are considering a proposal to reduce which business property has to be taxed, which could exacerbate problems in future years.

Assessments, though, are just one piece of the picture.

- Hoosiers’ income also increased.

Typically when the assessed value rises, the tax rate drops. Normally that means property tax rates wouldn’t jump so much. But a big increase in the average Hoosier’s pocketbook is leading to the change in taxes. Here’s how it works:

How much local governments are allowed to increase their yearly budgets, and thus how much total taxes they can collect, is based on the six year average nonagricultural income across the state. Income taxes in 2021 especially went up a sizable amount as the economy rebounded from the pandemic and stimulus checks were distributed.

Because of that, local budgets are allowed to increase by up to 5%, the highest rate in 20 years, said DeBoer, the Purdue economic professor.

Some lawmakers also blamed the projected property tax growth on the increasing popularity of tax increment financing, a redevelopment tool that can shift primarily commercial property taxes away from the general funds of local governments and toward redevelopment costs. That leaves homeowners with a bigger share of the tax burden.

Who will be impacted the most?

How much your tax bill will increase largely depends on where you live.

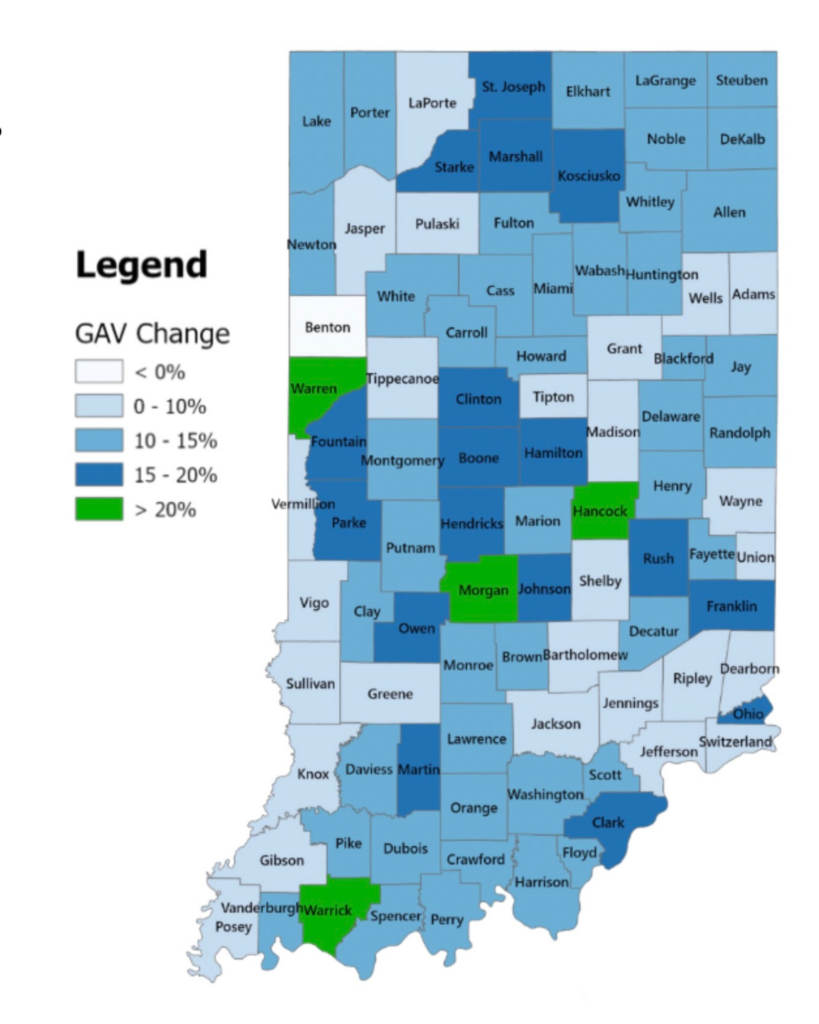

The total assessed value of residential properties in Morgan, Hancock, Warren and Warrick counties all increased by more than 20% year over year, according to information provided by the Association of Indiana Counties. An additional 17 counties were in the 15-20% range.

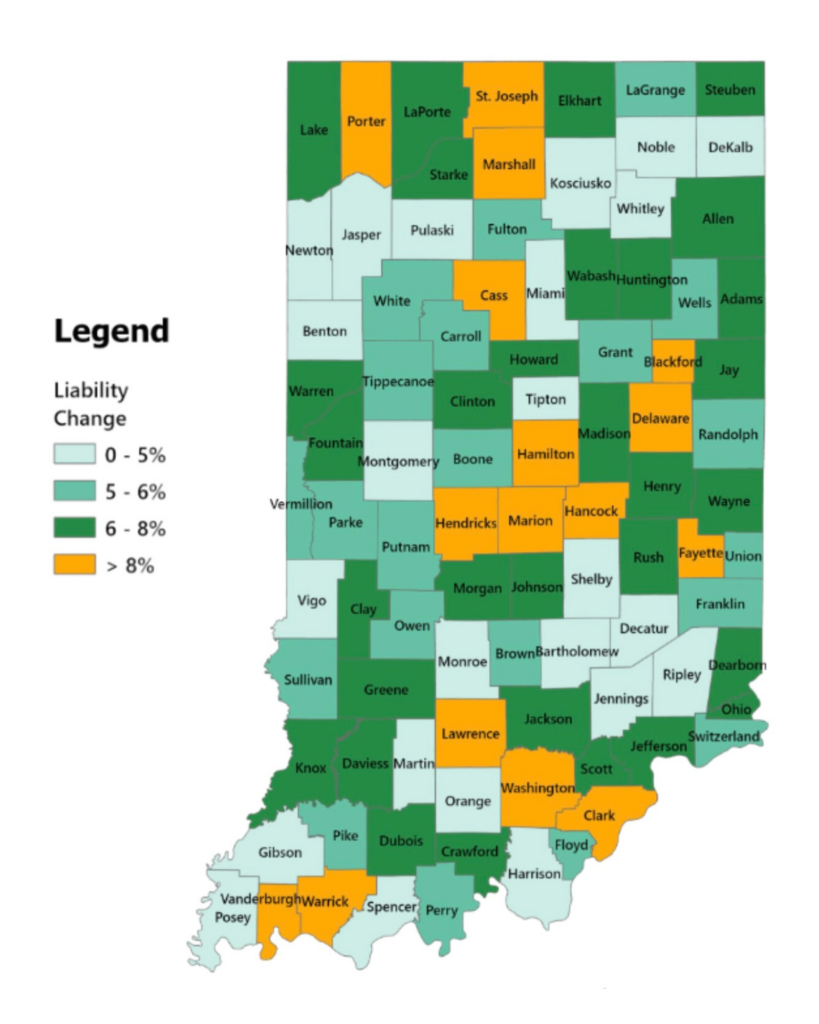

However, in terms of total tax liability, 16 counties are expected to have totals that increase by more than 8% year over year, including Marion, Vanderburgh, Hamiton, Delaware and St. Joseph counties. That increase includes new construction and all property types as well, but if you own property in those counties, still expect to pay a lot more on your property regardless if you’ve made changes to it. Renters would likely also be impacted as landlords hike rents to offset the added property tax costs.

Sen. Brian Buchanan, a Lebanon Republican who has studied the issue, said that when he looked back at 15 years of data, property taxes have typically increased a little over 3% each year. The highest annual increase in residential property taxes was 7.1%.

That makes this year, with an estimated increase in residential property of 15%, an anomaly.

DeBoer, whose own property’s assessed value went up 30%, said the other issue that will come into play is the state’s property tax cap system, which limits property taxes to 1% of a homestead’s assessed value. With assessed values going up, it’ll be more challenging to hit that tax cap. That also means local governments will in actuality likely collect over 7% more taxes from Hoosiers this year, because fewer people will hit the caps, DeBoer said.

While people all across the state could struggle with high bills, seniors on fixed incomes especially could feel its impact.

“The predominant message I keep hearing is, ‘Can we do something for our seniors?’” said Sen. J.D. Ford, an Indianapolis Democrat who has proposed legislation to try to alleviate the concerns of seniors.

For example, take Suzanne deVaucenne, a 77-year-old who lives in Zionsville in a house she bought and moved into in 1999. She has an income of roughly $30,000 per year from social security and the animal shelter she runs, and she struggles to afford the basics. Right now, she can’t afford to fix her broken water heater or make other improvements to her aging house, but she doesn’t want to move into an apartment and give up both her space and ability to take care of homeless cats.

The assessed value of her property went up 13% last year, according to online property records, and she’s bracing for this year’s tax bill. She guesses her property taxes have already tripled since she moved in decades ago, and she now pays more than $1,000 each year. She doesn’t have additional money to spare.

“What happens in this situation now is you’re strapped for cash for every item,” she said. “Bit by bit, you’re kind of going backwards.”

Lawmakers’ proposals

Lawmakers on both sides of the aisle have filed at least nine bills to attempt to provide relief, even as legislative leaders have issued warnings to pump the brakes on backtracking until more data is available. Senate Republican leadership want to study the property tax system as part of a broader study of all of Indiana’s taxes.

“The challenge with doing anything right now would be that anything that we do would not be able to impact the property tax bills that people are going to get in March,” said Senate President Pro Tempore Rodric Bray, R-Martinsville.

One proposal from Buchanan, the Lebanon Republican, would require local entities to provide a credit to any homeowner whose property taxes increased by more than 10% year over year, excluding school referendum dollars.

“We’re just trying to do something that doesn’t totally disrupt the system, but really provides a little bit of certainty,” Buchanan said.

Another from Ford, the Indianapolis Democrat, would freeze the property tax liability for seniors who have owned their home for 10 years. The state would backfill that money to local governments.

Two proposals appear more likely to move forward because they’re being carried by the House’s lead budget writer, Rep. Jeff Thompson, R-Lizton. House Bill 1498 would cap increases in total existing school operating referendum dollars to 5%, while Thompson’s House Bill 1499 would temporarily lower the 1% cap on residential property taxes and give homeowners an additional tax credit.

Meanwhile, Huston has floated a proposal to temporarily prohibit schools from putting new operating referendums on the ballot to increase property taxes. “Asking people for substantial increases on what is already going to be high property tax bills in this era of uncertainty just frankly doesn’t make a whole lot of sense to me,” Huston said. “I hope some of these people reconsider that.

“If not, we might help them reconsider,” he added.

Days after Huston announced his support for such a hold, Indianapolis Public Schools nixed a controversial plan for a ballot measure in order to raise $400 million.

Who could lose out if changes are made?

All of the proposals would create winners and losers. Under Buchanan’s bill, local governments would eat the costs. A fiscal analysis of the bill shows schools, counties, cities, libraries and other local entities would lose a combined $23.5 million in 2024.

“It would be a decrease in revenue to local governments, and I don't think that's a tenable solution to the problem,” said Matthew Greller, chief executive officer of Accelerate Indiana Municipalities (AIM). “Any reduction to our bottom line I think is going to be tough to support.”

Meanwhile, Ford’s proposal requires the state to backfill money lost by local governments, a price tag of $15.4 million for the state in fiscal year 2026. That’s an unlikely option as Republicans grapple with numerous budget requests for big-ticket items like an increase in public health spending.

Under Thompson’s proposal, the schools would lose out. Without this bill’s passage, operating referendum fund levies across the state would increase by $55 million between 2023 and 2024. If the bill passes, the total fund would increase by only $22 million, a loss of $33 million for schools.

“They’re going to collect more either way,” Thompson pointed out during a hearing on House Bill 1498 on Thursday.

Dennis Costerison, executive director of the Indiana Association of School Business Officials, warned that schools counting on referendum dollars to fulfill promises to their communities made during referendum campaigns could feel that loss. Inflation has hit schools when it comes to the cost of utilities. One Marion County district, he said, has seen its electric and natural gas bill go up $1 million.

Costerison added that this bill boils down to a local control issue.

“We’re concerned that House Bill 1498 overrules the local decision of the majority of the voters in that school corporation,” he said. “The voters have made that decision on that tax rate, not the General Assembly.”

Want to tell lawmakers what you think? You can find your lawmaker here.

Contact Kaitlin Lange on Twitter @kaitlin_lange or email her at [email protected].

Twitter @StateAffairsIN

Facebook @stateaffairsin

Instagram @stateaffairsin

LinkedIn @stateaffairs

Header image: Property tax bills are expected to increase this spring. (Credit: Brittney Phan)

Read this story for free.

Create AccountRead this story for free

By submitting your information, you agree to the Terms of Service and acknowledge our Privacy Policy.

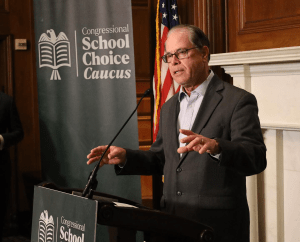

Mike Braun on why he wants to be in politics ‘at a level of significance’

EDITOR’S NOTE: This is one in a series of profiles of the candidates running for Indiana governor.

JASPER, Ind. — Mike Braun was a former two-term state representative in 2018 when he compared himself to the ultimate “outsider”: President Donald J. Trump.

Braun used that label to defeat two sitting congressmen in a Republican U.S. Senate primary race he had begun with about 1% of support in an internal poll. Then he used five Trump Make America Great Again rallies and $11 million of his own money (and another $20 million from an undisclosed donor) to upset Democratic U.S. Sen. Joe Donnelly.

“Here, we come in as a sitting senator — it’s a much different dynamic in how the political market is going to accept you,” Braun said of his current campaign, as opposed to the one he largely self-funded in 2018. (A conciliation agreement made public in late March revealed that the Federal Election Commission fined Braun’s 2018 campaign $159,000 for failing to properly disclose more than $11 million in transactions from July 2017 through December 2018.)

“I think we’re in good shape because we’re fairly solid when you look at the record I’ve got,” he said of the current campaign, in which he repeatedly invites Hoosier voters to examine his record in office. “Politically, this is less of a mystery in terms of what to do. We just need to execute in a similar way to what we did in ’18 and get the message out that will resonate with Hoosiers. I feel confident we’re going to be able to do that.”

Sen. Braun continues to bill himself as the “outsider” — along with former Commerce Secretary Brad Chambers — as he steers through an unprecedented six-person Republican gubernatorial field that also includes Lt. Gov. Suzanne Crouch, businessman Eric Doden, former state Attorney General Curtis Hill and Indianapolis mom Jamie Reitenour.

Normally, Hoosier Republicans coalesce around a single candidate for an open governor’s race, often turning a simple candidacy into a movement. But not this time.

Past Republican nominees and governors were not outsiders — they were ultimate insiders. Edgar Whitcomb sought the office while serving as secretary of state; Doc Bowen as speaker of the House; Richard O. Ristine, Robert Orr and John Mutz as lieutenant governors; Linley Pearson as attorney general; David McIntosh and Mike Pence as congressmen; Mitch Daniels as an outgoing White House budget director; and Eric Holcomb as a former aide to Daniels, U.S. Rep. John Hostettler and U.S. Sen. Dan Coats (before becoming a state GOP chair and then lieutenant governor).

Toward the end of the first homestretch debate at the Carmel Palladium on March 11, Hill wondered why Braun was seeking the governor’s office if his one term in the U.S. Senate had been so successful.

“I thought he was very well equipped for the job,” Hill said. “He talks about how tough it is in D.C. I want him to go back and continue the fight; he gave up the fight. Will he give up the fight as governor?”

Braun responded, “I spent 37 years building a little scrappy business into a regional, national and international company. And that is what I ran for Senate on. It resonated overwhelmingly. If you like me as your senator, you’ll like me better as governor.”

Throughout Indiana history, former governors — from Oliver P. Morton to Evan Bayh — found career-end refuge in the U.S. Senate. Braun is doing it in reverse.

“You know why?” he asked in his unassuming office at his company Meyer Distributing in Jasper. “Because they’re from the farm system of politics. The people who got done being governor just weren’t done with politics. They wanted to continue. My blessing is I did something in the real world first before I decided to get into politics at a level of significance.”

Asked if he is more of an executive than a legislator, Braun responded, “I feel I’m good at both because legislatively I knew what to get done as a legislator. I passed a unique regional authority bill that helped us down here on a road project we talked about for 40 years in the abstract. To me, if you’re an entrepreneur, you know how to get from here to there.”

During the Carmel debate, Braun called himself the “most fiscally conservative” Republican and a freshman who has been honored by independent groups for passing legislation. Chambers reminded him: “You’ve been in the Senate for an additional $7 trillion to $9 trillion in borrowing.”

Asked if he would like to make a rebuttal, Braun said, “I think I’ve got one,” while the audience laughed.

Braun is proud of his Senate record. “I base that mostly upon all the hard work invested as a senator, but a record that is generally resonating with Hoosiers and the fact that I visit all 92 counties each year,” he said. “Something you probably aren’t aware of, but we recently announced we’ve completed 11,000 cases for Hoosiers. We did that on behalf of veterans, immigration, Social Security and the whole spectrum of how you can get entangled with the federal government. That is one of the proudest parts of being a U.S. senator.

“It’s very important for anyone who wants to lead our state [that they’d] better be there with a track record,” he said at the Carmel debate. “You won’t have to figure out what they might do when they say they want to aspire to something like this. You need to be willing to flesh out those ideas. Of anyone on the stage here, I have the most recent track record on what’s happened, when you have to vote, what you’re really for, not what you say you’re going to be for.”

“I think when [Braun] talks about being a proven conservative, he’s served in the U.S. Senate for six years and has votes that can reaffirm that,” Laura Merrifield Wilson, an associate professor in the History & Political Science department at the University of Indianapolis, told State Affairs. “He had been in the General Assembly before that and could point to certain things. That’s going to help especially with your Republican primary in the state of Indiana, which is going to be very heavily conservative.”

Braun and the city of Jasper

To understand what makes Mike Braun tick, you have to travel to Jasper, a small city about an hour northeast of Evansville. “I have been blessed to be raised in a place like Jasper,” he said during the Carmel debate. “It’s a community based on faith, family, freedom and opportunity.”

Braun left Jasper to attend Wabash College and then earned a Master of Business Administration from Harvard University. He said many of his classmates went to Wall Street or Silicon Valley, but he headed back home. He bought what he calls a “hardscrabble” company — Meyer Body — and built it into a sprawling 1,500-employee national enterprise that distributes various products, from auto parts to industrial supplies.

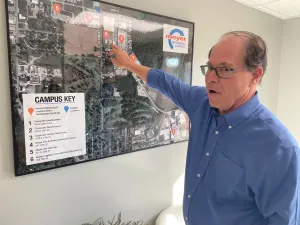

“There’s no substitute about seeing the context of where you’re coming from,” the 70-year-old said last November during a walking tour of this 270,000-square-foot complex. “My major piece of work — you’re looking at it right here.”

In Hoosier politics, a candidate for governor most likely points to his public service record, which in Braun’s case is his 10 years on the local school board, three years in the Indiana House and five-plus years in the U.S. Senate. But he attributes much of his policy underpinnings to the seven acres in Jasper that are home to Meyer Distributing. It is a beehive of activity, with beeping forklifts and transporters shifting and loading product onto tractor-trailers while Aerosmith rock music blares in the background.

It was here 15 years ago where he pursued a new path toward providing more cost-effective health care options for his employees that has transformed his viewpoint on commodity-draining states and private industries. “I fixed health care in my own business, have healthier employees, cut costs 15 years ago, created health care consumers out of my employees and know some of the things I can do for coverage of our own state employees,” he said.

“We’ve got one of the highest health care costs of any state and some of the poorest health care outcomes,” Braun added.

Will that translate to 6.8 million Hoosiers? Can you take those fundamental building blocks on health coverage and bring them to the masses?

“Sure, you can,” he responded. “That’s owning your own health care and well-being. That’s basically what I did here. I gave the best tools to my employees to do that. I put skin in the game on their minor health care to where they shop around for the small stuff, and they’ve got the best coverage when they get critically ill or have a bad accident. Insurance companies told me all of that. They were making so much money on our plan back then I decided to self-insure and basically solved health care as most companies would love to do, but had to be entrepreneurial. I just basically took what the insurance companies told me, saw how much money they were making covering my business, created it as a cost center and not a profit center and that’s how I fixed things.”

What would a Gov. Mike Braun administration look like?

“What I’ll bring to bear as the governor will be someone who will be entrepreneurial politically,” Braun said. “To me, if you’re a good entrepreneur, politics is easier than building a business. It’s just got tighter compression in terms of the political hurdles you need to jump.”

On his campaign website, Braun expresses optimism about Indiana’s future and says his concerns for the next generation’s welfare are driving his run for governor. Having served Hoosiers in Washington, he believes that solutions to the state’s issues lie locally, not with “special interests and career politicians in D.C.”

Braun has laid out a 12-point agenda that includes growing Hoosier jobs and the economy; improving education; implementing affordable health care; embracing reliable, affordable and clean energy; preserving agriculture; and cutting taxes while reducing the size of government.

His campaign website also addresses hot-button issues:

- “Put kids first” by “making sure divisive theories like critical race theory or discussions about sexual orientation and gender identity have no place in our public schools.”

- “Protect parental rights”: He will fight to “protect the rights of parents to shield their children from divisive ideologies by ensuring parents have transparent access and meaningful input on curriculum and materials in our schools.”

- “Stand up to woke corporations”: He says, “ESG [environmental, social and governance] puts investors and retirees at financial risk and will have no place in the Indiana state government.”

- “Pro-life means pro-family”: “State lawmakers must work to ensure the gains we have made to protect life are secured and strengthened, while working to help mothers and their infants receive the care and social support they deserve to ensure a healthy start to life.”

- “Standing with law enforcement”: He vows “to make sure the justice system is not failing them [law enforcement] by refusing to detain dangerous criminals, manipulating the bail system, and intentionally refusing to enforce laws based on a political ideology.”

- “Securing our southern border”: Braun explains, “Joe Biden and the left have created a humanitarian and national security crisis on our southern border. [I] will work to fund solutions that keep criminals and drugs, like fentanyl, from entering our country.”

- “Defend our constitutional rights”: “The rights of law-abiding gun owners, the freedom to practice our religion, and the rights of parents to protect their children from leftist ideology are under attack.” He says he “will never waver when it comes to defending every Hoosier’s rights to life, liberty, and the pursuit of happiness.”

- “Election security and reform”: “The right of Americans to cast their vote in fair and secure elections is essential to the survival of our Republic. Hoosiers must trust that our elections are free from fraud and guarantee that every legal vote is counted accurately.”

- “No more mandates or lockdowns”: “The lockdowns during the COVID-19 pandemic were a disaster for our state and led to business closures, job losses, mental health issues, learning loss, and still failed to protect the most vulnerable. As Governor, Mike Braun will never lockdown our state, mandate masks for our kids, or tell someone their job or business is not essential.”

At the Palladium on March 11, Braun added that the government “came up with the term ‘you’re essential; you’re not essential’” during the COVID-19 pandemic. “I never thought that would happen in our own Hoosier State,” he said. “When you have that type of bureaucratic determination, try to explain that to my wife and all the other merchants in downtown Jasper. They were out of business for a long time. You never know when it’s going to creep into your own state. It was very disappointing.”

Endorsed by Trump

Braun possesses one important element in his primary race: the imprimatur of Donald Trump. “I can tell you that every one of my opponents would have loved to have the endorsement in a state like Indiana,” he said in his Jasper office.

When Trump endorsed Braun, the former president was facing 91 criminal charges in two federal jurisdictions and two in Manhattan and Georgia (since reduced to 88 when three charges were dropped in Atlanta).

“There’s a political intertwining,” Braun said of the charges facing Trump, who the senator has twice voted to acquit during Senate impeachment trials. Following his 2021 acquittal vote, Braun said, “The riot on January 6th was horrific and should be universally condemned, and while I listened to both President Trump’s defense and the House Managers’ arguments, I believe it is unconstitutional to hold a trial to remove a former President from an office he no longer holds and feel a vote to convict would have deep negative implications for the First Amendment and due process.”

“Whether those indictments get parlayed into a conviction, I’m just extrapolating what I see Republican primary voters are doing,” he said. “I don’t think that makes much difference.”

In the days leading up to Jan. 6, 2021, Sen. Braun was supportive of efforts to challenge Electoral College certification. But after the Trump-inspired mob overran the U.S. Capitol, assaulting more than 150 cops while seeking to hunt down Vice President Mike Pence, Braun reversed course, saying he “didn’t feel comfortable with today’s events.” He said election integrity is “still a valid issue.”

Since Jan. 6, Trump has talked about nullifying the U.S. Constitution and called for the execution of the outgoing chairman of the Joint Chiefs of Staff, Gen. Mark Milley. Does that type of rhetoric concern Braun?

“Obviously, that stuff is not the stuff I would put out there,” he responded during the November tour of his company. “I think that hurts rather than helps the cause because it further polarizes the people that might even like his policies. That’s a difference in approach. I respect everyone’s ability on how they’re going to sell themselves. I would stick on looking at the record in terms of the way it was pre-COVID, and the stuff you can’t change, I don’t know really what the point would be to further talk about it, because you can’t fix it. That toothpaste is out of the tube.”

Wilson of the University of Indianapolis said of Braun: “He’s been able to effectively align himself with Donald Trump. He did that back in 2018, in the Republican primary for U.S. Senate against Todd Rokita and Luke Messer. He was clearly the Trump candidate, and that plays well in Indiana, where Donald Trump has won by 20% in the last few presidential election cycles.”

What type of governor would Braun be?

When Mike Braun served on the local school board, Mitch Daniels was governor. During Braun’s three-year General Assembly tenure, Mike Pence and Eric Holcomb were governors. What did he glean from their leadership styles?

“I’ll be able to distill best practices,” he said. “Look what Mitch Daniels did. He came in 2004, he inherited a budget that was in the red that had been run recently by Democrats. So he had to get the state’s financial cash flowing. And then you look at what he did when he started to address issues. We are the ‘Crossroads of America’ and we weren’t even funding roads the right way. Almost every penny of the fuel tax was being spent on other stuff. He started fixing things that would have been most apparent that needed to be fixed.”

Braun noted that Gov. Daniels wasn’t afraid to spend political capital.

“One reason he did that with good leadership, besides the fact that he’s a brilliant mind, was he was also willing to take risks,” Braun said. “If you’re not willing to take risks, you’re going to be in a broad band of mediocracy, whether it’s in business or government. You don’t want to take on too much; you want to leave your neck intact politically and operationally, and he was willing to do that. I think Pence and Holcomb inherited a much better-run state government and have enhanced it in their own ways since then.

“The difference between me and a Pence or a Holcomb would be [that] I spent my time in the trenches of building a business from scratch,” added Braun, who said he will continue to invite anyone to Jasper on Fridays to talk about issues. “That’s why I took time to show you.”

Statehouse reporter Rory Appleton contributed to this story.

about Braun

- Age: 70

- Hometown: Jasper, Indiana

- Education: Master of Business Administration, Harvard Business School (1978); Wabash College (1976)

- Family: Married to Maureen Braun since 1976, with four children, Ashley, Kristen, Jason and Jeff

- Job: U.S senator from Indiana since 2019

- Work history: Member of the Indiana House of Representatives from the 63rd district from 2014 to 2017; owner of Meyer Distributing (formerly Meyer Body) since the mid-1980s

read these related stories

- Eric Doden is running from behind but hopes his ‘bold vision’ will propel him forward

- Suzanne Crouch positions herself as a ‘different’ candidate for the voiceless

- Who is Jamie Reitenour? Indianapolis mom mobilized volunteers to make governor’s ballot

Brian Howey is senior writer and columnist for Howey Politics Indiana/State Affairs. Find Howey on Facebook and X @hwypol.

Who is Jamie Reitenour? Indianapolis mom mobilized volunteers to make governor’s ballot

EDITOR’S NOTE: This is one in a series of profiles of the candidates running for Indiana governor.

ZIONSVILLE, Ind. — It wasn’t the largest campaign event the 2024 election cycle is likely to see.

About 15 people, some of them children, gathered on a rainy April night at Our Place Coffee, nestled just feet from the watchful eye of Zionsville’s Abraham Lincoln mural. But Republican gubernatorial candidate Jamie Reitenour, an Indianapolis mom with no previous political experience, spoke with every single one of them.

It was one part coffee-and-issues politicking and one part informal Bible study, complete with scripture quiz questions for the kids in attendance.

Reitenour, well-worn Bible in hand, shared her oft-repeated story of being called by God to run for governor about six years ago — a destiny confirmed by friends and strangers alike along the way, she said. This charge, she told the group, would allow her to rise above traditional campaign currency, such as fundraising dollars and polling numbers.

Suzanne and Shon Hough sponsored the event after meeting Reitenour at their shared church, Horizon Christian Fellowship in Lawrence.

“As soon as we met her, we knew this is someone to support,” Suzanne Hough said. “We knew she wasn’t a politician. She was called. She has a love and compassion for people.”

That is how Reitenour has made it this far — how she gathered the 4,500 state-mandated signatures to qualify for the May 7 primary ballot, how she’s made it onto a stage filled with more experienced and wealthier opponents. For more than a year, she’s hosted several small events per week throughout the state, traveling some 35,000 miles, by her count.

The dozen or so latte-sipping supporters had a part to play, the candidate said.

“Go to your contact lists and tell them about our Facebook,” Reitenour said. “We could reach 144 people today if we all did that.”

The call

Reitenour’s purpose changed in 2017 while walking through downtown Indianapolis with her husband, Nathan.

“I just heard a whisper: You’re going to be the governor of Indiana,” Reitenour told State Affairs.

The couple wandered over to the governor’s mansion.

“We looked at it and thought, ‘That does not look like our family,’” she recalled. “So I just put the calling on the shelf.”

Indiana requires gubernatorial candidates to have lived in the state for at least five years. She had only just moved from Michigan.

Reitenour believed the country was in a good spot under then-President Donald Trump. Why would she need to run?

“I just thought about it,” Reitenour said. “Why would the Lord call an ordinary person to something like that when the nation was doing so well? But the reality of scripture is that you see these times where people are called, and you can see the reasons for the calling around them.”

Her regular Bible contemplation soon took her to the Book of Nehemiah, who was a governor. Another sign, she said.

The state’s response to the COVID-19 pandemic set off alarm bells for Reitenour, who considered steps like mask requirements an affront to personal liberty. She brings up the subject often, and it made it into her coffeehouse remarks.

“How am I in a conservative state, but I don’t feel free?” she told the crowd.

After COVID-19 and the election of President Joe Biden, Reitenour began to think more seriously about running for governor.

Her mission was affirmed first by a close friend, whom Reitenour said received a similar calling from God to help her candidacy, and then by strangers, whom she said confirmed her destiny during separate chance meetings at a Panera Bread location.

She began to meet with church groups and advocacy organizations that align with her views, including Moms for Liberty and Indiana Right to Life. Despite being referred to as an activist on the campaign trail, Reitenour said she is not part of any activism group.

Getting on the ballot

This network of like-minded supporters would soon serve as the volunteer arm of Reitenour’s campaign.

Indiana requires candidates for governor to collect at least 4,500 signatures from voters, including at least 500 from each of the state’s nine congressional districts. It’s a tall order even for seasoned politicians, who often hire specialized operatives for the task.

“The mystery of how we did that will also be the mystery of how we win,” Reitenour said.

She focused on growing supporters and gathering signatures at each small event she hosted, then mobilizing those attendees to gather still more for her.

“I had a formula in my heart for this that the Lord gave me at 4 a.m. one morning,” she said.

The campaign

Reitenour made the ballot, but she is the least-known candidate in a field that includes Sen. Mike Braun, Lt. Gov. Suzanne Crouch, former state Attorney General Curtis Hill, former state Secretary of Commerce Brad Chambers and Eric Doden, a Fort Wayne businessman and previous president of the Indiana Economic Development Corp.

She has no previous political experience. She is a stay-at-home mom who also homeschools her five children and volunteers through ministry. Her previous work experience includes compliance management at a mortgage company, secretarial work and even a stint as an assistant coach in women’s field hockey.

Reitenour was selected in the governor’s race by just 2% of respondents in a recent State Affairs/Howey Politics Indiana poll, tying her with Hill for last place behind front-runner Braun (44%). She has consistently polled in the low single digits.

While other gubernatorial candidates can draw from years of campaign fundraising experience or millions in personal finances, Reitenour had raised just a little more than $54,000 as of March 31.

She has thus found herself paddling in a proverbial ocean of campaign spending.

The four top-polling candidates — Braun, Chambers, Doden and Crouch — have spent a combined $20 million.

After participating in the first gubernatorial debate on March 11, Reitenour did not qualify for a March 27 debate hosted by WISH-TV due to her fundraising numbers, as the television station required candidates to have raised $300,000 by December.

She was also excluded from a March 26 Fox59/CBS4 debate for not reaching a 5% polling threshold. She will be included in the final April 23 debate, hosted by the Indiana Debate Commission.

Reitenour has campaigned using a constantly shuffling group of volunteers. She has only one full-time employee: campaign assistant Casey Pierce, who met Reitenour through his mother’s church.

“It just felt like the right thing to do,” Pierce said of joining the campaign. He has never worked in politics before.

Pierce called his initial meeting with Reitenour “a Holy Spirit encounter.”

Reitenour’s platform

Reitenour described education as the state’s “greatest vulnerability,” and thus her primary platform.

“The next generation is not being educated well, and this has been a long time coming,” Reitenour said.

She has received guidance from the Hamilton County chapter of Moms for Liberty, which made national headlines in 2023 after using a quote attributed to Adolf Hitler in its first newsletter. The nonprofit, which pushes against socially minded education reforms like critical race theory, subsequently apologized.

Reitenour likewise opposes ideas like social-emotional learning in classrooms. Her plan also proposes removing technology from grades K-5, calling for private businesses to sponsor classrooms and requiring all students to pursue an apprenticeship before high school graduation.

She also favors an audit of the Indiana Economic Development Corp., tax cuts, a focus on investing in small towns and generally “pointing Indiana in the direction of family.”

The future

At her coffee shop appearance, Reitenour shied away from admitting her long odds in the race.

“The political system is meant to squeeze people out, but I am working against it,” she said.

She pledged to continue organizing no matter the primary election results.

About Reitenour

- Age: 44

- Hometown: Indianapolis

- Education: Psychology degree from Missouri State University

- Family: Married to Nathan Reitenour, with five children, ages 13, 11, 10, 9 and 4

- Job: Stay-at-home mom, homeschool teacher

- Work history: Former compliance manager at Windsor Capital Mortgage, former athletic director at Calvary Christian School (at Calvary Chapel Vista church in California)

Read these related stories

- Eric Doden is running from behind but hopes his ‘bold vision’ will propel him forward

- Suzanne Crouch positions herself as a ‘different’ candidate for the voiceless

Contact Rory Appleton on X at @roryehappleton or email him at [email protected].

And subscribe to State Affairs so you do not miss an update.

Facebook @stateaffairsin

Instagram @stateaffairsin

LinkedIn @stateaffairs

Child care: Where Republican candidates for governor stand

Six candidates are seeking the Republican nomination for Indiana governor in the May 7 primary. State Affairs is providing looks at their stances on several issues. Jennifer McCormick is unopposed for the Democratic nomination.

Indiana’s high cost of child care ranks as a primary concern for many of the state’s families.

According to Child Care Aware of America, a nonprofit organization that studies child care costs, Indiana ranks as the eighth most expensive state for infant and toddler care. The cost for caring for a baby averages 14.5% of a family’s median income, while toddler care is 12.9%.

Only 5% of Indiana families can afford infant care, the Economic Policy Institute found.

State Affairs asked each of the six Republicans vying for Indiana governor — U.S. Sen. Mike Braun, former state Secretary of Commerce Brad Chambers, Lt. Gov. Suzanne Crouch, Fort Wayne businessman Eric Doden, former state Attorney General Curtis Hill and Indianapolis mother Jamie Reitenour — how they would lower Indiana families’ child care costs if elected.

Here are their responses.

Mike Braun

“The high cost of child care burdens Hoosier families and businesses, who are trying to recruit and retain the best workers. As governor, I am open to and will work on solutions that will reduce the cost of child care, which is a win for our economy and families.”

Brad Chambers

“As governor, I’ll explore strategic expansions of all-day pre-K for 3- and 4-year-olds, including potentially increasing the income eligibility level for state-funded pre-K programs. I’ll create a state-level child care tax credit that requires recipients to work to be eligible to receive it.”

Chambers said he would also explore incentives for employer-sponsored child care.

Suzanne Crouch

“First, I would lead the effort to eliminate the state’s individual income tax, which will mean more money in families’ pockets and help reduce the financial strain of child care expenses … As governor, I would propose that the General Assembly put a priority on early childhood education throughout Indiana.”

Crouch would also support the expansion of at-home and religious-based child care, she said, noting Indiana has “some of the highest relative child care costs in the country.”

Eric Doden

“I’ve offered a bold plan to expand pre-K access to every community in the state. By partnering with communities, nonprofits and education partners, we will begin addressing this important need. … We need a state with thriving communities and access to opportunity. Cost of child care concerns are downstream of family formation rates, good-paying jobs, home ownership and a host of other economic and community issues.”

Curtis Hill

“The government is not responsible for providing child care for private sector employees. Its responsibility is to dismantle the licensing and regulatory burden that prohibits new child care providers from entering the market. If we want to lower the cost of child care, we must cut the government regulations forcing child care facilities to either close or raise prices to meet unnecessary government requirements.”

Jamie Reitenour

“We cannot bear down on taxpayers for everything. We just cannot do it. But we can talk to the private sector and reason together. Can we have in-house day cares at offices? Yes. Can we have employers operate growth centers for employees’ kids? Yes. Taxpayers are not the answer; the private sector is. With competition for qualified workers, larger businesses already employ creative benefits, including child care assistance, to attract talent.”

Read these related stories:

Contact Rory Appleton on X at @roryehappleton or email him at [email protected].

And subscribe to State Affairs so you do not miss an update.

Facebook @stateaffairsin

Poll finds Holcomb popular among Republicans even as potential successors keep distance

Indiana Gov. Eric Holcomb remains popular among Republicans, according to a State Affairs/Howey Politics Indiana poll, even as the GOP candidates to take his place have kept their political distance from him. The polling results released Thursday show Holcomb with an overall positive job-approval rating of 69% among self-identified Republicans and Republican-leaning independents. The results …