Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoLooking to buy a home but don’t have the down payment? Help is here

(Credit: Curtis Adams)

- The state and a major banking organization team up to offer homebuyers down payment help

- Eligible homebuyers can get up to $27,500 under the new partnership

Prospective homebuyers in Georgia needing help with down payments can get an assist from the state and a major banking organization.

The Georgia Department of Community Affairs and Federal Home Loan Bank of Atlanta have teamed up to help would-be homebuyers get money from existing programs in both organizations.

The partnership enables eligible homebuyers to receive a combined grant of up to $27,500 to put toward down payments and closing costs.

The two organizations have enlisted the help of the following lenders:

- Ameris Bank

- BankSouth

- Capital City Bank (Capital City Home Loans)

- Colony Bank

- FirstBank

- Movement Bank (Movement Mortgage)

- Presidential Bank FSB

- ServisFirst Bank

- Southern First Bank

- Synovus Bank

- TowneBank

- Truist Bank

Increased housing costs have put pressure on low- and middle-income families, especially those in metropolitan areas such as Atlanta, according to the Bipartisan Policy Center. Between September 2018 and September 2023, median home list prices in metro Atlanta rose 65%, the center noted.

Through its Home Ownership Affordability Monitor Index, the Federal Reserve Bank of Atlanta measures the ability of a median-income household to absorb the annual cost of owning a median-priced home. In March 2022, the Atlanta metro fell below the index’s affordability threshold for the first time in more than a decade, where it remains as of the index’s last update, the center said.

“Rising home prices and inflation have created an extremely challenging market for prospective homebuyers,” Kirk Malmberg, Federal Home Loan Bank of Atlanta’s president and CEO, said. “With similar down payment assistance programs and a number of common bank providers, we partnered with DCA [Department of Community Affairs] to create an opportunity to increase the amount homebuyers can receive to put toward down payment and closing costs on a home.”

In February, Federal Home Loan Bank of Atlanta announced it was making $40 million available for down payment and closing costs assistance this year through its First-Time Homebuyer and Community Partners program. Borrowers are eligible for up to $15,000 to buy a home through the bank’s program.

Similarly, the Department of Community Affairs’ Georgia Dream Homeownership Program offers up to $12,500 per borrower.

Borrowers can get up to $27,500 from those programs through a participating lender.

“DCA is committed to partnering with mission-aligned organizations to increase homeownership opportunities and make communities stronger,” Department of Community Affairs Commissioner Christopher Nunn said in a release.

Interested homebuyers can work with a participating lender to determine eligibility and how to apply. Borrowers must meet program and income requirements set up by the two organizations and complete homebuyer counseling.

Find more details about the Department of Community Affairs’ program here and the federal bank program here.

Have questions, comments or tips? Contact Tammy Joyner on X @lvjoyner or at [email protected].

Professionals still face licensing delays amid state’s transition to online system

The Gist Georgia’s professionals and business owners are still struggling to obtain professional licenses in a timely manner. As the Secretary of State’s Office rolls out its new Georgia Online Application Licensing System to expedite the process, the efficiency of this new process is being put to the test. What’s Happening Thursday morning at the …

Controversy over AP African American Studies class grows

Rashad Brown has been teaching Advanced Placement African American Studies at Atlanta’s Maynard Jackson High School for three years. He’ll continue to do so — even though the state’s top education official removed it from the list of state-funded course offerings for the upcoming school year. While Brown prepares to start teaching his class on …

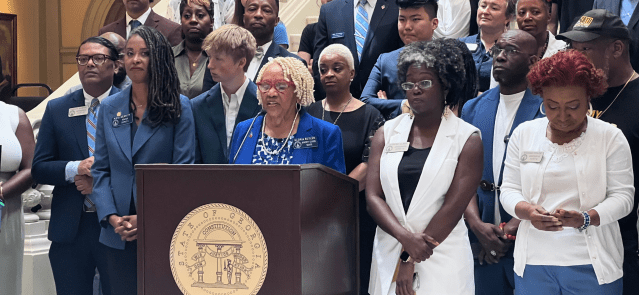

Students, teachers, lawmakers blast decision to end AP African American history classes

ATLANTA — A coalition of lawmakers, civil rights leaders, clergy, educators and students Wednesday called on the state’s education czar to rescind his decision to drop an advanced placement African American studies class from the state’s curriculum for the upcoming school year. “This decision is the latest attack in a long-running GOP assault on Georgia’s …

Kamala Harris’ presidential bid reinvigorates Georgia Democrats

Georgia Democrats have gained new momentum heading into the November election, propelled by President Joe Biden’s decision to bow out of his reelection bid and hand the reins to Vice President Kamala Harris. The historic decision, announced Sunday, is expected to prove pivotal in the national and state political arenas and breathe new life and …