Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoBraun’s big plans for Indiana: Taxes, health care and IEDC’s future top the list

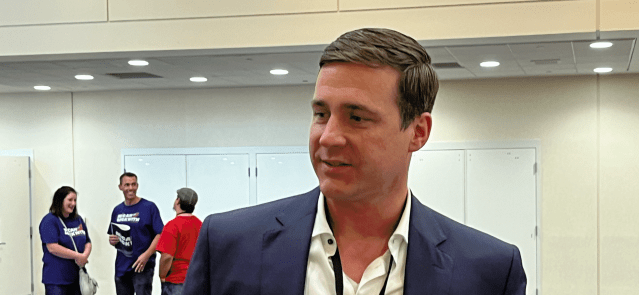

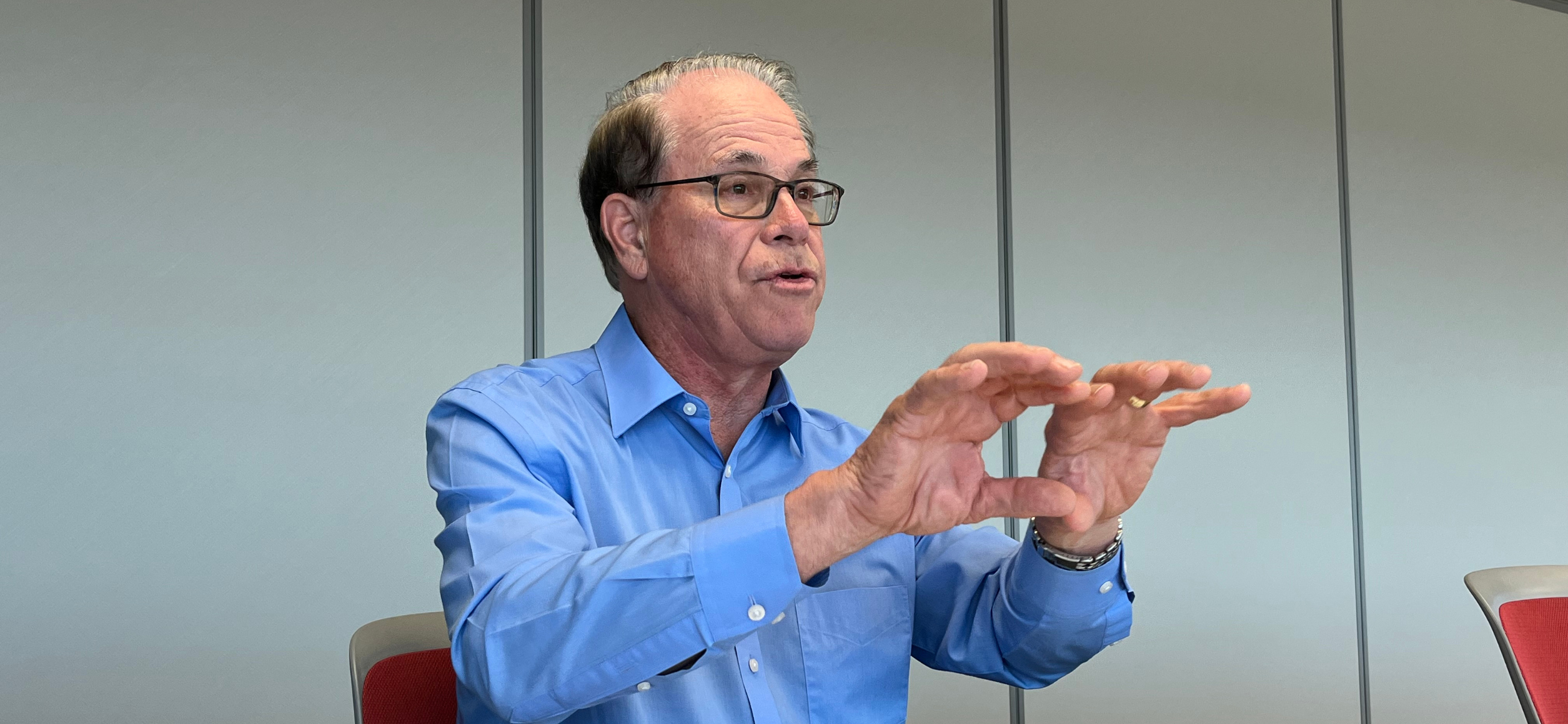

Republican gubernatorial candidate Mike Braun speaks with State Affairs reporters on Oct. 3, 2024. (Credit: Tom Davies)

U.S. Sen. Mike Braun, the Republican candidate for Indiana governor, rolled out policy proposals on taxes, health care and other key issues in recent weeks.

State Affairs sat down with Braun to drill down on the specifics of his plans and to ask him about the future of the Indiana Economic Development Corp. and his campaign strategy heading into the final weeks before the Nov. 5 election.

Responses have been edited for clarity and brevity.

Q. The Indiana Economic Development Corp. has changed a lot in recent years. It has become a real estate developer. It has offices overseas. How would you run the IEDC if elected?

A. It’ll be no different than what I’ve been blessed to do in the 37 years prior to getting into politics. Economic development is something that’s going to be fairly easy to understand in the sense that I did that in a microcosm, [developing] a very small business into a regional company and then into a national one that’s sprawling now, with 90 locations in 40 states and several in Canada.

I’ll be looking at how to keep the state humming by finding the highest stratum of wages, which is generally going to be associated with STEM degrees. I won’t get a perfect view of [the IEDC] until I get in there and start looking at it, but it’ll be with a couple things in mind.

There’s going to be a lot of transparency associated with it. I think that’s maybe where they got into a little bit of trouble with LEAP [Lebanon Innovation District], for instance, because that was so different. There were several cases where the cart may have been in front of the horse.

Who we can get into the state is one thing, but there’s another approach. How do you have the folks within your state who are going to be probably a lot easier to grow than it would be to compete for the most expensive ones [larger, out-of-state companies] that you bring in? It’ll be to keep the best of what we’re doing but not overlook the businesses already here that may need a boost or some help.

The other component will be entrepreneurs and small businesses, which are the least expensive way to actually grow the economy because you can create thousands of them if you have the right environment for it.

Q. You mentioned the LEAP District. IEDC bought property for that deal. Do you think that was well executed?

A. I know why they did it. In many cases, you have to have something ready to go or you’re going to miss out on the opportunity. But you can see it’s created more of a dust-up than it should have. And I think it looks like it’s going to get resolved. We’re lucky to have one of the best companies in the country, Eli Lilly, here. We’ve got them, and it’s nice that they’re wanting to grow within Indiana.

That goes back to what I said earlier. With any of our companies, we need to be speaking to the ones that are here and show prospects. I’m going to try to learn who the up-and-comers are. It’s very easy to grow a company 100% when you’re starting at $1 million [in initial investment]. It’s very difficult to grow a company even at 10% to 15% when you’re at $1 billion.

Q. So, you expect to continue the LEAP District project?

A. There’s no way I can tell you that until I get in there and measure what they were doing before, what was working and what wasn’t. But that’s not going to be difficult for me to see because, again, I’ll draw on what I did for 37 years.

I think when I get in there, I’m going to see that probably there was merit to some of it. And maybe it was just the process that needed to be improved.

Q. The LEAP District has been so heavily discussed and publicized. Why haven’t you been able to formulate what you’d want to do?

A. Because I’m looking at it from the outside and I don’t know a lot of the details.

[Braun’s LEAP plan] will be based upon emphasizing supporting smaller businesses, fertilizing the field of entrepreneurs, looking at businesses already here and seeing what we can do to help them. They’re already dedicated to the state.

And then when it comes to that one approach [IEDC has] taken — since it’s novel, since it’s new, since it’s not been transparent — I’ll see what was good about it or what wasn’t and make adjustments accordingly.

Q. How big of a factor will the pending statewide water study be in your decision?

A. I think that’s going to formalize what we already know pretty well. I’ve talked to folks who are in the business of water utilities, and it’s very clear we’ve got water in the northern quarter of our state to spare. Maybe at the one-third area you run out of the glaciated aquifers, and the aquifers from the Great Lakes, you’re then starting to get into the Lafayette area. And Lafayette’s still got an aquifer, but probably not enough to maybe share, other than for its own growth.

And then you look down south of Indy, which is where all the population is. There’s not going to be an easy way when it’s costly to pump water once you get beyond 40 miles. So you’ll have to be careful of what kind of businesses come in.

Indiana is in better shape than most states because we’ve got a major river on the southern border, but again, you can only bring water out of it about 40 miles before it gets very expensive.

Getting a reservoir permitted somewhere in this day and age — I’d say that won’t be as easy as what it was for Patoka and Monroe. That would be politically interesting and possible but, I’d say, difficult.

Q. Your health care plan addresses costs, but not the major issue facing the state right now: the big growth in Medicaid. There was a $1 billion forecast error. How would you address that?

A. I’m going to try to make Medicaid less expensive. That was just a glitch that I think will be fairly easy to get through. [The Legislature] has already done some remediation to it. They underestimated it and tanked the budget.

That’s the blessing of making sure we maintain good cash flow. Because if we didn’t have that reserve and a structural positive cash flow that I think has been managed pretty well, we’d really be in trouble. If that is something that we are going to have to experience year after year to some degree, it becomes an issue. That’s when you’d have to somehow modify what you’re doing to make sure there isn’t going to be a hemorrhage. My understanding at this point — since it does have a federal nexus, which is cost sharing for those who can’t afford health care — is that the plan is going broke in D.C. as well.

Q. You’re trying to lower costs, but you haven’t provided any estimates on how that would impact the Medicaid program.

A. Until I’m there [in office] and can use the full force of the budgeters and all that, we just know the dynamic. I think that’s going to be fixable. Trying to put out a solution to it now, when you don’t know if it’s going to be repeated … I understand that it’s going to put a tourniquet on it, but you’re not going to know all that until you get there.

Q. One of the things Indiana did that some other Republican states didn’t was accept Medicaid expansion under Gov. Mike Pence. Would you consider pulling the state out of that?

A. Even if you have to have more involvement with them, 42 or 43 other states have done it, and everything I know about it from the federal side of it and from those states is they are glad they did the expansion. But I want to point out that Medicaid is not fiscally sustainable in terms of how much we’re spending on it anyway.

That gets back to the fact that the health care system costs us too much. That was a reason I was able to get Sen. Bernie Sanders to be the co-author of a health care transparency and competition bill that is now bipartisan beyond just the two of us. And he didn’t agree to doing that because he doesn’t think the system is fixable. And I said, “Bernie, if you can lower the costs of hospitals, make it to where competition is more involved; make it more consumer driven, wouldn’t you like to have to pay less, potentially for Medicare and Medicaid reimbursement?” He couldn’t say no, and his chief adviser knew that made sense.

Q. So, you’re focused on your efforts to lower costs, but we’ve got 600,000 people on Medicaid [through Affordable Care Act expansion programs].

A. There’s a lot that needs to be looked at to see how you get health care to cost us more like 13% to 14% of our GDP [gross domestic product] versus 18% to 19%. Most one-payer systems are down closer to 9% to 12%, but then you’re going to probably be complaining about rationing and not having as speedy a service and some of the things we’ve become used to.

All I can tell you is, in my own health care plan, if you look at it as a microcosm, and I’m doing it on the user side, it would take it down to under 13% or 14% of our GDP.

Q. One of the ideas that’s been kicked around the Statehouse as a way to fix the growing cost of Medicaid is increasing the cigarette tax.

A. I’m going to first see what we can do to lower costs before I try to raise revenues on something that already costs too much. That doesn’t mean I wouldn’t consider it.

Q. Would cannabis reform be a potential solution there?

A. Cannabis in terms of medical use of marijuana is something I am open to.

Q. I’m talking about as a potential revenue source.

A. Well, yes, it would be, but I don’t think it’s going to be enough to pay for the underlying complications and issues with health care in general.

Q. I was looking over your tax plan. I had a question about indexing the state income tax brackets. Can you explain that, since Indiana has a flat tax?

A. It means if inflation is rampant, unless it’s almost nothing, you’d have to be indexing or accounting for inflation so you don’t get thrown into higher tax brackets. It’s probably got more applicability to federal taxes than it does state, but it still has some applicability there.

Anything that mitigates your tax bill becomes outdated at a point to where you lose its punch if you don’t index it for inflation. That’s an idea we’re going to look at.

Q. You haven’t put out any estimates on what this would cost, correct?

A. No, because we don’t have the figures to do that. It’s just an area we’re going to look at.

Q. We have no idea how much retirement income there is in the state. Certainly that would comprise a big chunk of the income.

A. If it’s a big chunk, it probably means you’d have to modify what you’re going to exempt from taxation. All I can tell you is I’m going to keep a balanced budget. I’m going to find savings in the system that I don’t think you’ve talked about.

We’ve got 30 agencies. I don’t think there’s been any attention to how efficiently they run. Almost all of them can probably improve their performance to where they’re getting better productivity. I’m going to listen to the people who have been running them. I’m going to listen to people who actually interact with the agencies and on a $22 billion annual budget.

I’m guessing there’s 3% to 5% that can be saved. I can tell you that in my own business — which would have run much more efficiently than any aspect of state government — when we had to, we could find 5% to 10% savings and it was not the end of the world. There’s always room to run things more efficiently, and that’s a subject of looking at processes and probably technology. Government is notorious for not embracing technology, and it doesn’t have a lot of incentive to actually fix things because there aren’t generally bonuses tied to it.

Q. Is it realistic to suggest individual tax relief? You’re talking about a time when the Legislature has already enacted an income tax decrease until 2027.

A. It depends on how well I can run the government. If I’m actually running it better, that’s how you finance a lot of the things that would either be investing more in areas that are going to give you a good return on investment.

Q. You also propose sales tax holidays, and that’s actually been something Democrats have been advocating, especially for back to school. But whenever related bills have been introduced, they haven’t been heard.

A. I think I’m gonna have a little better chance with the Legislature. And I made that point with Jennifer McCormick at the debate. You can talk about all kinds of things, but if they’re coming from the policy direction she’s talking about, it’s impractical that any of it would resonate with the Legislature. But if I’m leading on it and it seems to have general appeal, and even if it is an idea that came from the other side of the aisle, that isn’t going to make any difference. You may be able to get it there.

Q. Legislative Republicans have not been supportive of tax holiday plans.

A. That’s because they’re doing what they should be doing, and that’s being inherently frugal. Unless you’ve got an executive branch that’s going to really be interested in running it more efficiently, like I’ve told you, you couldn’t do any of that because otherwise you’d be shrinking your inherent, structurally good cash flow.

But if you’re predicating it on savings that you’re finding, maybe you don’t need an agency the size it is. In almost all cases, many things run better once you lean them up. And I just don’t think we paid attention to that. I think [former Gov.] Mitch Daniels did a lot of that when he came onboard. And Mitch does not have near the total background that I had. He’s a brilliant mind, and his nickname was “The Blade,” correct? And that’s because he was good at [cutting costs], because he’s exceptional. And he knew that that was the way you took a state in the red and got it back into the black. I’ve done this for a living, and I think I’ll know, just out of practice, what to do and what to look for.

Q. Sales tax is by far the biggest revenue for the state. Is proposing tax holidays at a time when some in the Legislature talked about expanding the sales tax to cover services something that’s feasible?

A. That will create a dust-up. But sales tax is high, generally, compared to other states. And it’s got a regressive nature to it, and it is missing a large part of the economy that is now tax-free, but you’re running out of revenue sources once you get beyond sales tax for the state and income taxes. You’re getting into fees and other things.

Q. What can we expect from your campaign in the final weeks before the election?

A. I’m running on the kitchen table issues, and I think I’ve got a good feel for what makes sense. I am going to put a lot of emphasis on staying in touch with the constituents, which I’ve done faithfully now for nearly six years.

about braun

- Age: 70

- Hometown: Jasper, Indiana

- Education: Master of Business Administration, Harvard Business School (1978); Wabash College (1976)

- Family: Married to Maureen Braun since 1976, with four children, Ashley, Kristen, Jason and Jeff

- Job: U.S senator from Indiana since 2019

- Work history: Member of the Indiana House of Representatives from the 63rd district from 2014 to 2017; owner of Meyer Distributing (formerly Meyer Body) since the mid-1980s

Read this related story:

Mike Braun on why he wants to be in politics ‘at a level of significance’

Contact Rory Appleton on X at @roryehappleton or email him at [email protected].

Know the most important news affecting Indiana

Get our free weekly newsletter that covers government, policy and politics that impact your everyday life—in 5 minutes or less.

The man behind the governor: Josh Kelley’s journey to Indiana leadership

As Gov.-elect Mike Braun’s transition team and priorities take shape, his right-hand man prepares to lead the staff tasked with ensuring the incoming governor’s vision becomes reality. Josh Kelley has quickly established a political career marked by several key achievements, including anchoring two statewide campaign victories, serving as Braun’s chief of staff in the U.S. …

COLUMN: Trump should seek Ukraine NATO membership on day 1

INDIANAPOLIS — The North Atlantic Treaty Organization is a military alliance founded in 1949 following World War II to keep Soviet influence in check. The United States is one of 12 founding members. There are 32 members, including Canada, the United Kingdom, Germany, Poland, France, Spain and Italy. Article 5 of NATO’s charter states that …

Howey Politics Indiana celebrates 30th anniversary

Storied Indiana political columnist Brian Howey was honored Tuesday at a gala celebrating his 30th year at the helm of his namesake newsletter, Howey Politics Indiana. Howey was joined at the event by his wife Susan, his fellow State Affairs teammates and political insiders. Know the most important news affecting Indiana Get our free weekly …

Incumbents win in 2 tight Indiana House races; Cash-Stoner outcome uncertain

The election outcome remained uncertain in one Indiana House district where Republican incumbent Becky Cash was leading Democrat Tiffany Stoner by less than one-tenth of a percentage point. Two other House incumbents — Republican Rep. Dave Hall and Democratic Rep. Wendy Dant Chesser — prevailed with narrow victories that aren’t expected to face recount challenges. …