Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoNUNGESSER SPEAKS UP: Lieutenant governor pushing own tax proposal — and pushing back

Lt. Gov. Billy Nungesser is sounding the alarm about the Landry Administration’s proposal to alter a key funding stream his department relied on for tourism promotion.

In an interview with LaPolitics, Nungesser said he’s also concerned about the potential loss of Louisiana’s subsidies for film promotion and historic structures restoration, both of which he considers important tourism drivers.

As an alternative, Nungesser is circulating his own tax idea, based on a former governor’s proposal from more than 40 years ago.

The Louisiana Office of Tourism receives most of its funding from the Louisiana Tourism Promotion District, a special taxing district that covers the entire state. State law authorizes the district to levy and collect a sales and use tax of up to 0.03 percent, and the state Department of Culture, Recreation and Tourism gets an average of about $30 million per year from that fund.

The taxing district would go away under the administration’s proposal, but CRT would still get the money, Revenue Secretary Richard Nelson told LaPolitics last month. (LaPolitics was unable to speak with Nelson on Monday.)

“We’ll just dedicate a portion of the tax to that cause,” Nelson said. “So substantively, it doesn’t change anything.”

But Nungesser said being forced to ask the Legislature for funding every year could be a dicey proposition.

“I don’t feel really good about having to go up against health care, education, fixing our roads, all the other valuable things in the budget, unless it’s set in stone that the funds are going to tourism,” Nungesser said.

Relying on an annual appropriation doesn’t lend itself to the multiyear planning that the job requires, Nungesser argues.

“We have to plan out four or five years on these projects we do all over the world,” he said. “I haven’t seen the details of how they’re going to commit that it will be there. And I think that the easiest and best way is to leave it like it is.”

Nungesser is likewise uneasy about the proposals to sunset programs for the state’s film incentives and restoration of historic buildings. Combined, the two programs cost about $220 million or so per year, money the administration wants to use to offset the revenue lost from slashing income tax rates.

But Nungesser argued the film sector offers more benefits than many people realize, including boosting tourism. He points to a recent study that indicates up to 6.2 percent of visitors to Louisiana were motivated to visit by films or TV shows, resulting in up to $1.16 billion in additional revenue for the state.

“I hate to see us get rid of it when all these people invested billions in building these incredible studios,” he said, adding that there could be ways to tweak the program to add value for the state.

As for the historical tax credits, he said they have helped revitalize core areas in many towns across the state. Along with tourism, CRT also oversees the Louisiana Main Street program.

Without the restoration tax credits, many projects that are in the works now likely will not go forward, Nungesser said.

“You’re talking about empty buildings in a lot of these communities,” he said.

So what should the state do? Nungesser has an idea.

In 1982, then-Gov. Dave Treen proposed the Coastal Wetlands Environmental Levy, or CWEL Tax. The goal: generate money to restore Louisiana’s deteriorating coastline, while addressing a budget crunch that Treen saw coming.

Lawmakers once again are planning for a fiscal cliff, and the need for coastal restoration might be more urgent now than it was during Treen’s administration. Has the time for Treen’s failed tax proposal finally come?

Nungesser is proposing a 5 cent tax per cubic foot of natural gas, a 50 cent fee per barrel of oil, and a 1 cent per gallon levy on pipeline-refined gasoline.

The billions the fees would raise could provide a financial base for the state, funding everything from coastal restoration to raises for teachers and police officers, Nungesser says. Rather than fighting for Industrial Tax Exemption Program exemption to save 80 percent of their property taxes for 10 years, companies could be exempt indefinitely, so there would be something in it for industry.

And while Louisiana residents would not be exempt from the price increases the new fee might spur, they could be given an annual rebate check, not unlike Alaska residents get from mineral revenue.

Know the most important news affecting Louisiana

Get our free weekly newsletter that covers government, policy and politics that impact your everyday life—in 5 minutes or less.

IT’S TRUMP: Bitter POTUS cycle comes to an end, control of Congress is next

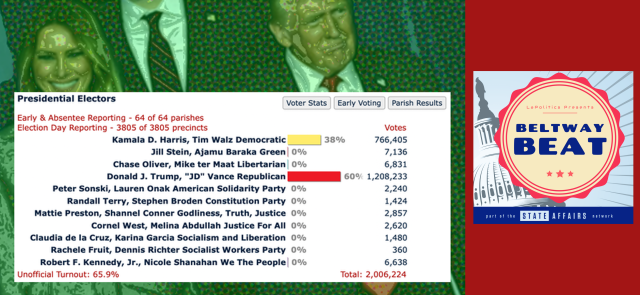

The big race wasn’t even remotely close in Louisiana, with former President Donald Trump capturing the Bayou State and his old job with 60 percent of the vote to Vice President Kamala Harris’ 38 percent. Trump, as expected, delivered a commanding performance here, winning 57 of Louisiana’s 64 parishes. Harris, meanwhile, notched wins in Caddo, East Baton Rouge, East …

Delegation Roundup (11.06.24)

— QUICK TAKE: Every member of the Louisiana delegation, save Congressman Garret Graves, who chose not to run again, has been re-elected. Replacing Graves in the new 6th District will be Congressman Cleo Fields, who got over the finish line with a 51 percent vote haul. — WHY CLEO MATTERS: While Dems have a tear in their …

AMAR: Federal excise tax on trucks should be repealed

As part of Gov. Jeff Landry’s goal to rid our state of job-killing and antiquated taxes, the state legislature heads into another special session this year to reform our state’s tax code. Our nation is, at the same time, electing a new president and administration to enact similar reforms. While our state has its share …

Election Day 2024: State Affairs brings you the fair, transparent, nonpartisan coverage you deserve

Election Day is here and State Affairs stands ready to bring you the kind of election coverage you deserve — fair, transparent and rooted in a commitment to nonpartisanship. Across the states, voters are casting their ballots, deciding on leaders and policies that will shape our communities and futures. And as the results come in, …