Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoAs part of Gov. Jeff Landry’s goal to rid our state of job-killing and antiquated taxes, the state legislature heads into another special session this year to reform our state’s tax code. Our nation is, at the same time, electing a new president and administration to enact similar reforms.

While our state has its share of taxes that place a drag on the economy, the federal government has their fair share too. Our state needs an overhaul of our burdensome tax system that hurts small businesses, and so does the federal government.

For over a century, a truck tax has been hurting the industry. First imposed in 1917, the federal excise tax on heavy-duty trucks and trailers helped America win World War I. Rather than expiring after outliving its original purpose, however, this tax has grown into a $5 billion annual burden shouldered by hardworking truckers.

The 12 percent tax on new heavy-duty trucks and trailers is the highest excise tax on any product, adding $25,000 to the cost of a new clean-diesel truck and $50,000 to a zero-emission truck. This excessive tax disproportionately impacts independent truckers, mom-and-pop operations, and other small fleets who have less access to capital. These small businesses make up the majority of the industry, especially in Louisiana, where our average trucker owns eight trucks.

All Louisianans have an interest in seeing this levy scrapped, since consumers are forced to bear the cost through higher prices when they shop. Louisianans also pay in unseen ways.

This federal excise tax forces most trucking companies to hold onto their existing equipment for as long as possible. It’s a key reason half of the trucks on our roads today are older than 15 years. Not only does this result in fewer truck manufacturing jobs, but it also delays the deployment of new trucks, which have significant advantages over the older models they would replace.

Modern trucks come with capabilities designed to reduce or prevent crashes. Standard features include stability control, lane departure warning, blind spot monitoring, and rearview cameras.

According to the Insurance Institute for Highway Safety, solutions like automatic emergency braking and front collision warning could eliminate more than two out of every five crashes where a large truck rear-ends another vehicle. Making these technologies more widespread would protect property and save lives.

In our current polarized environment, it is rare to find unifying public policies. Repealing the federal excise tax on heavy-duty trucks and trailers has bipartisan support, and it would be a major win for highway safety, good-paying manufacturing jobs and the environment.

I strongly encourage our elected leaders to join their colleagues in co-sponsoring the Modern, Clean, and Safe Trucks Act. With the support of Speaker Mike Johnson, Majority Leader Steve Scalise, Sens. Bill Cassidy and John Kennedy, and the rest of Louisiana’s congressional delegation, we can vanquish this onerous tax once and for all and fully unleash our country’s economic potential.

Renee Amar is the executive director of the Louisiana Motor Transport Association.

This column was edited for length and style.

Want to pen the next Beltway Beat op-ed? Send your pitch to [email protected] and your byline could be next!

Know the most important news affecting Louisiana

Get our free weekly newsletter that covers government, policy and politics that impact your everyday life—in 5 minutes or less.

IT’S TRUMP: Bitter POTUS cycle comes to an end, control of Congress is next

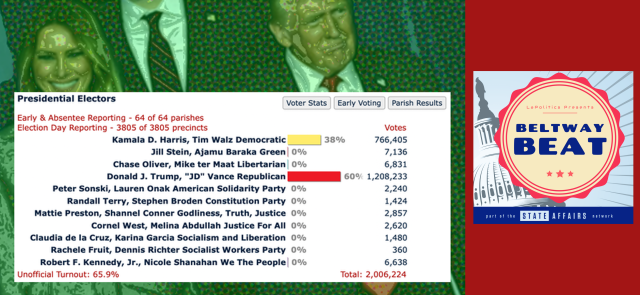

The big race wasn’t even remotely close in Louisiana, with former President Donald Trump capturing the Bayou State and his old job with 60 percent of the vote to Vice President Kamala Harris’ 38 percent. Trump, as expected, delivered a commanding performance here, winning 57 of Louisiana’s 64 parishes. Harris, meanwhile, notched wins in Caddo, East Baton Rouge, East …

Delegation Roundup (11.06.24)

— QUICK TAKE: Every member of the Louisiana delegation, save Congressman Garret Graves, who chose not to run again, has been re-elected. Replacing Graves in the new 6th District will be Congressman Cleo Fields, who got over the finish line with a 51 percent vote haul. — WHY CLEO MATTERS: While Dems have a tear in their …

Election Day 2024: State Affairs brings you the fair, transparent, nonpartisan coverage you deserve

Election Day is here and State Affairs stands ready to bring you the kind of election coverage you deserve — fair, transparent and rooted in a commitment to nonpartisanship. Across the states, voters are casting their ballots, deciding on leaders and policies that will shape our communities and futures. And as the results come in, …

Socially Yours (11.05.24)

WEDDING BELLS Ethan Estis and Laurin Turner are toasting to four years together… HAPPY BIRTHDAY! — Tuesday, Nov. 5: Rep. Stephanie Hilferty, Rep. Matthew Willard, Daryn Bovard, Cody Martin, Ricky LaFleur, Keith Leger and Al Carter — Wednesday, Nov. 6: Former Sen. Louie Bernard, former Rep. William Daniel, David LaCerte, Matt Wood, Rufus Holt Craig and Amy Alexander — Thursday, Nov. 7: Rep. Randal Gaines, Lillian Piazza, Stephanie Durand Robin and Gordy Rush — Friday, Nov. 8: Rep. Ken …