Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoAs Legislation Stalls, Consumer Advocates See Rise in Payday-Type Loan Borrowers Amid Inflation in Georgia

Credit: iStock

The Gist

While measures to clamp down on certain “payday loan” programs that charge huge, unchecked interest rates have stalled in the state legislature, soaring inflation has prompted more Georgians to take out the risky personal loans to help cover everyday costs for groceries, gas and utilities, consumer advocates say.

What’s Happening

Since 2020, Georgia lawmakers have sat on a bill that would cap interest rates for so-called title pawns, which often come with sky-high rates for people in a pinch who take out small loans to pay everyday bills and in doing so, put up the title to their car as collateral.

The need to cap these interest rates – which can swell to 300% – has become more urgent as increasing numbers of low-income Georgians pawn their car titles and fall into debt amid soaring inflation, local advocates say.

In Athens, Stephanie Cockfield has seen more people than usual over the past year arrive desperate for help paying back high-interest loans at The Ark United Ministry Outreach Center, where she’s the financial education director.

Troublingly, Cockfield has been taking a lot more calls recently from people who she’s already assisted in paying off a high-interest car-title loan. The clients were calling back seeking help to pay off yet another loan they have taken out to cover household bills.

“There’s definitely an uptick in the repeats,” Cockfield said. “That’s telling me it’s a sign of the times. Folks are turning to the lenders.”

Click the image above to read out story on the recent impacts to Georgians from inflation. (Credit: Canva photo)

Unlike other kinds of payday-type loans that exist around the country, title pawns have few limits on interest rates in Georgia and tend to trap low-income borrowers in debt, local advocates say. They involve borrowers using their vehicles as collateral, in return for quick loans of around $500 to $1,000.

Title pawns have long been a problem spot for advocates like Cockfield, but she and other advocates say the situation has grown worse for struggling Georgians as inflation continues throttling Georgia. Prices for common goods like gas and food are up more than 9% across the U.S. compared to a year ago, the U.S. Bureau of Labor Statistics reported this week.

“We know that people are having to make choices and cut back on groceries, combining trips to save on the cost of gas,” said Liz Coyle, executive director of the consumer advocacy group Georgia Watch. “We’ve also had a lot more calls lately with people having trouble paying their utility bills.”

Why It Matters

Traditional payday loans – in which a borrower takes a high interest rate, short-term loan against their next paycheck – are illegal in Georgia. Instead, borrowers – many of whom have poor credit or no credit and who either can’t qualify for a traditional bank loan, or who can’t wait on the time it takes to process such a loan – often turn to title pawns for quick cash. But these title-based loans typically carry enormous interest rates, ranging from around 125% to as much as 300% – trapping many borrowers in debt, and risking ruining their credit or a worse-case scenario of having their car repossessed if they miss a payment.

Consumer advocates are seeing many Georgians like 68-year-old Athens retiree Brenda Thomas turn to these high-interest loans as their rent, utility and other bills get more and more out of hand from inflation.

Like many Georgians, Thomas has taken out multiple small-dollar loans, mostly to cover car repairs she couldn’t afford, and defaulted on some of them due to high interest charges. With Christmas around the corner last December, Thomas knew she probably shouldn’t take out yet another title pawn. But her rent, utility and car insurance bills were stacking up.

Desperate for help, she took out a loan for $600, which shot up to $774 with the interest added. She put up her lumbering 1971 Mercury Marquis as collateral. Once again, Thomas found herself in a bind just to pay the monthly interest charges, let alone the loan’s principal.

“You just feel hopeless,” Thomas said. “Unless you’ve got a lump sum of money, you’re going to be paying forever.”

Consumer advocates say Thomas’ situation isn’t unique – though it’s tough to put a number on how many title pawns and other loans Georgia borrowers take out each year.

That’s largely because title pawns aren’t tracked by the state. The state Department of Banking and Finance does regulate other kinds of small-dollar loans, called installment loans – but it declined to provide State Affairs with records on how many loans are taken out annually, citing state financial records privacy law.

This graphic shows how many complaints have been filed on predatory lending in Georgia to federal regulators in recent years compared to surrounding states in the South. (Credit: Beau Evans for State Affairs)

However, Georgians have lodged more complaints to federal regulators over predatory lending in recent years than all states except California, Texas and Florida. Complaints from Georgia are nearly double that of the next-highest Southern state, Tennessee, federal data shows.

Georgia is also home to the three largest title-based lending companies in the U.S., including the biggest, TitleMax, whose parent company TMX Finance is headquartered in Savannah. A TMX Finance spokeswoman, Josie Gregory, declined to answer questions or make any company representatives available to interview for this story.

Amid inflation and supply-chain issues, consumer advocates like Coyle are calling for new rules to lower interest rates on small-dollar loans, particularly high-interest title pawns – a move that state lawmakers have avoided for more than two years.

Stalled Legislation

In early 2020, state Sen. Randy Robertson (R-Cataula) brought forward a bill to cap interest rates for title pawns between 36% and 61%. Robertson pitched the bill as a safeguard against “the financial world where you have to borrow a little bit of money at an exorbitant interest rate,” he told a Senate committee.

That bill hasn’t budged in the General Assembly since then. Robertson didn’t respond to requests for comment.

Coyle has long pressed state lawmakers to cap interest rates at 36% or less per year. That’s the same annual cap federal regulators require for small-dollar loans given to U.S. military veterans. “If it’s right for service members,” Coyle said, “it’s right for all Georgians.”

State Sen. Randy Robertson (R-Cataula) speaks in the Georgia Senate during the 2022 legislative session. (Credit: Randy Robertson)

Georgia is among 18 states that allow interest rates above 60% per year for small-dollar loans, a recent National Consumer Law Center report shows.

Lenders like TitleMax have resisted backing stiffer caps on interest rates, arguing the interest payments help them recoup losses from risky borrowers who default. Larry Stumberger, owner of Title Experts in Cobb County, said default is a common occurrence among his customers — even if it means giving up their car. “People just borrow money and won’t pay,” Stumberger said. “You get a loan and you just don’t pay.”

Stumberger declined to say how frequently his company has repossessed vehicles from defaulting borrowers. The Consumer Financial Protection Bureau found historically one in five title-loan borrowers have had their vehicles repossessed, according to a 2016 report, the latest available.

What’s Next?

In Athens, Thomas wishes she’d heard about The Ark sooner than the fifth time she went to the title pawn. Like many nonprofits, The Ark runs its own lending program to give people like Thomas money to pay off loan debt – at a much lower 3% interest rate.

The Ark cut her a check for $747 that she immediately used to pay off the title loan, allowing her to keep the old Mercury. All she had to pay The Ark in interest was $10, she said.

The Georgia Department of Law provides advice on how to pay off loan debt and budgeting wisely to avoid the need for a high-interest loan. (Credit: Joy Spears Walstrum for State Affairs)

Without tighter interest-rate rules from state lawmakers, The Ark’s Cockfield said it falls on nonprofits like hers to provide alternative loans with far smaller interest rates, usually by partnering with sympathetic, local credit unions. The goal is to give borrowers better options to manage their debt than title pawns, Cockfield said.

“One loan at a time, I’m trying to take them down,” Cockfield said of title lending companies. “We may not be able to shut them down, but we can at least provide something else that [borrowers] can turn to.”

As for the future, Thomas said her days of title pawning to survive her rent and utility bills are over – hopefully.

“I’m not ever going to take another title loan,” Thomas said. “Not if I can help it.”

What To Do

Several organizations run programs to help Georgians pay off loan debt:

- Georgia Watch: Financial Education Workshops

- The Ark of Athens: Loan Program

- Georgia Legal Services Program: Free Civil Legal Help

- Georgia Consumer Protection Division: Consumer Ed

- National Consumer Law Center: Consumer Brochure

Join The Conversation

What else do you want to know about inflation impacts and state government in Georgia? Share your thoughts/tips by emailing [email protected].

Professionals still face licensing delays amid state’s transition to online system

The Gist Georgia’s professionals and business owners are still struggling to obtain professional licenses in a timely manner. As the Secretary of State’s Office rolls out its new Georgia Online Application Licensing System to expedite the process, the efficiency of this new process is being put to the test. What’s Happening Thursday morning at the …

Controversy over AP African American Studies class grows

Rashad Brown has been teaching Advanced Placement African American Studies at Atlanta’s Maynard Jackson High School for three years. He’ll continue to do so — even though the state’s top education official removed it from the list of state-funded course offerings for the upcoming school year. While Brown prepares to start teaching his class on …

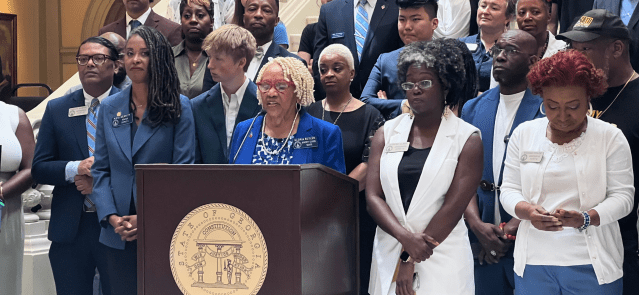

Students, teachers, lawmakers blast decision to end AP African American history classes

ATLANTA — A coalition of lawmakers, civil rights leaders, clergy, educators and students Wednesday called on the state’s education czar to rescind his decision to drop an advanced placement African American studies class from the state’s curriculum for the upcoming school year. “This decision is the latest attack in a long-running GOP assault on Georgia’s …

Kamala Harris’ presidential bid reinvigorates Georgia Democrats

Georgia Democrats have gained new momentum heading into the November election, propelled by President Joe Biden’s decision to bow out of his reelection bid and hand the reins to Vice President Kamala Harris. The historic decision, announced Sunday, is expected to prove pivotal in the national and state political arenas and breathe new life and …