Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoLawmakers plan another run at rent control legislation

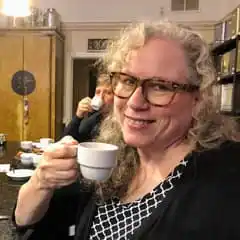

Smyrna resident Gladys Dancy, 83, told the Senate Urban Affairs Committee members that her landlord plans to raise her rent by 39% in October. (Credit: Jill Jordan Sieder)

The Gist

ATLANTA — Skyrocketing rents and punitive fees by homeowners associations that place some Georgia residents at risk of losing their homes are among the targets of several housing-related bills that Sen. Donzella James, D-Atlanta, and other members of the Georgia Legislative Black Caucus hope to revive in the next legislative session. Four such housing bills stalled in the Senate this year.

What’s Happening

The Senate Urban Affairs Committee met Wednesday to discuss the proposed legislation designed to protect renters from sharply escalating rent prices, and what some senators and presenters described as unfair fees, eviction and foreclosure processes imposed by property owners and private associations that manage homes, apartments and condominiums.

James, the committee chair, is the sponsor of SB 125, which would repeal state law enacted in the 1980s that prevents local governments from regulating rent. Georgia is among 30 states in the U.S. that prohibit rent control by municipalities or counties, and among several states now considering repealing such laws.

“We’re attempting to lift that ban so cities and counties … can work with residents to stop rental leases and bills that are doubling and tripling and causing foreclosures and evictions,” said James. She noted that as the cost of living increases, “we’re seeing more families struggling to pay rent in metro and rural areas, and consequently many of those people can’t afford it anymore and have become homeless, or are staying in day hotels when they can afford to do that.”

Two other housing-related bills were also on the agenda. SB 29 would limit the ways homeowners, condo and property associations can penalize people for nonpayment of fees, and requires them to seek arbitration before placing liens on a property. And Senate Resolution 37 would create a study committee to let lawmakers take a comprehensive look at the policies and practices of such property associations.

Why It Matters

Rents have increased sharply in Georgia in recent years. According to the U.S. Department of Housing and Urban Development, fair market rents — the monthly cost of rent for standard-quality units in a local housing market — increased by an average of 24% from 2019 to 2023 in the U.S. In Georgia, fair market rents increased by 33% over that time. A one-bedroom apartment in Georgia now averages $1,115, and a two-bedroom is $1,283.

Rental costs are considerably higher in some Georgia cities, especially those where out-of-state private equity firms have purchased large numbers of residential properties and jacked up rents. In Atlanta, the fair market rent for a one-bedroom is now $1,375 and a two-bedroom is $1,553.

Some apartments cost much more. Nothing in Georgia law limits how much a landlord can raise the rent.

The Urban Affairs committee heard from several tenants whose rents have increased precipitously. Among them was Gladys Dancy, 83, who lives at Galleria Manor Senior Apartments, an affordable housing complex in Smyrna. She said when she moved in 10 years ago, the rent for her two-bedroom apartment was $780, and has since climbed to $908. In July, she received a notice from the building’s owners that her rent will rise to $1,215 in October, a 39% increase.

“They’re pushing me out,” said Dancy, adding that her only income is from Social Security. Dancy has a leg impairment that requires her to use a walker.

Noting that she lives two blocks from Truist Park, the Atlanta Braves stadium, which was an undeveloped wooded area when she moved in, she said, “All the rents around here have gone way up, and now they say they’re switching from an affordable property to market price. Is that legal?”

Other people testified about negative experiences with homeowners associations.

One man said he was fined $4,000 by his HOA for cars parked on the street near his home, even though he doesn’t own a vehicle. His neighbor said the HOA doled out $1,600 fines for covenant violations such as lack of shutters on windows and has placed $10,000 liens on multiple tenants’ homes.

David Washington, a real estate broker, said he specializes in helping people faced with foreclosure to stay in their homes. He said he recently worked with a 91-year-old client whose property was foreclosed on for delinquent HOA dues and related late fees, even though the woman had never missed a mortgage payment.

“Georgia is a creditor-friendly state,” said Washington. The state’s legal code related to rent “is not designed for if life happens,” he said. Even if over a 30-year period a homeowner has a sterling payment history, an HOA does not take costly life events into account the way that some loan companies do, offering forbearance, he noted. “Whether it’s COVID, a car accident, a divorce, a death — if you owe $5,000 to an HOA, they will foreclose on you,” he said. “And the law allows it.”

James noted that small liens issued by HOAs or banks can quickly lead to foreclosure, if not paid or legally resolved within a few months.

“Once you get $2,000 worth of liens, that house can go up on the courthouse steps and be sold from under you,” she said.

Rep. Billy Mitchell, D-Stone Mountain, the House Democratic Caucus chair, told committee members that the “draconian” Georgia law that permits HOAs to foreclose on a property because of overdue HOA fees is “bad legislation and I think we should join the overwhelming majority of states which do not allow that.”

Preventing and reducing evictions is another legislative focus of the committee.

Mableton resident Alonzo Williams told the committee that he and his disabled mother were evicted from their apartment after the landlord doubled the rent during the pandemic. He said he works in education and his mother has a fixed income. “We struggled mightily to pay it, but we couldn’t,” he said, adding that they are now living in temporary housing, and so far unable to find a rental unit they can afford.

Elizabeth Appley, an attorney and fair housing advocate, said that as of April, 14% of Georgians were behind on rent, according to the National Equity Atlas, a data site run by PolicyLink, a research and advocacy firm. Those Georgians owing rent included 181,000 households, 72% of which were low-income families. More than half were households with children.

The average rent debt in Georgia is $1,400, said Appley, noting that that amount is considerably less than the cost of eviction to local communities in the state, which averages $11,200 per eviction, according to a University of Arizona law school analysis. That eviction tally takes into account the cost of emergency shelter, medical, welfare and juvenile delinquency costs.

Legislation to give local communities more control over rental costs, as well as to provide more tenant protections statewide is needed, Appley said.

Besides the rent control and property association-related bills, she encouraged the Senate committee to support HB 404, the Safe at Home Act, which would put a two-month cap on rental security deposits and require landlords to give tenants at least three days’ notice and the opportunity to pay overdue rent and fees before eviction proceedings can start. The bill unanimously passed the House but was not called for a vote in the Senate last session.

“While the idea of rent control may appear an attractive solution to the affordable housing crisis, it is critical to understand its counterproductive and damaging consequences,” said Stephen Davis, government affairs director for the Atlanta Apartment Association.

National research shows that rent control policies reduce housing supply, lower property values and disincentivizes new construction of apartments, he said.

Davis pointed to a 2021 St. Paul, Minnesota, rent control bill that capped annual rent increases to 3% and led, he said, to an 80% drop in building permits for multifamily housing. Overall, new housing starts in St. Paul decreased by 30% over the next year, resulting in an amendment of the law in 2022 that allows some landlords to make larger rent increases.

Adding additional housing units to a market is the best way to address housing costs in communities with climbing rents, Davis said.

“The key is to increase housing inventory,” he said. “But most local governments are installing additional regulations and burdens on development. They’ve raised millage rates and impact fees. … Every condition put on a new development has a cost,” which is often passed on to the renter, he said.

What’s Next

SB 125, the rent control bill, did not move in the State and Local Governmental Operations committee last session. Sen. Frank Ginn, R-Danielsville, who chairs the committee, told State Affairs he does not support state regulation of local rent policies.

“I think that should be between the owner of the property and the renter,” Ginn said. “I don’t think the government should interfere in that process. There are other things that we can do to help local governments to lower the cost of housing, and to address things that drive the cost of housing up.”

James said she and other legislators are inclined to consolidate and amend several housing-related bills still alive in both chambers. She told State Affairs that requiring mediation before evictions and foreclosures can occur and appointing a state ombudsman to give people involved in housing disputes “a place to take their complaints before they lose their homes” are two key elements that should be included in housing legislation to be pursued in 2024.

James said the Urban Affairs Committee plans to meet at least once more prior to the start of the next legislative session in January.

Check out our summary on TikTok:

Have questions, comments or tips? Contact Jill Jordan Sieder on X @JOURNALISTAJILL or at [email protected].

X @STATEAFFAIRSGA

Facebook @STATEAFFAIRSGA

Instagram @STATEAFFAIRSGA

LinkedIn @STATEAFFAIRS

Header photo: Smyrna resident Gladys Dancy, 83, told the Senate Urban Affairs Committee members that her landlord plans to raise her rent by 39% in October. (Credit: Jill Jordan Sieder)

Professionals still face licensing delays amid state’s transition to online system

The Gist Georgia’s professionals and business owners are still struggling to obtain professional licenses in a timely manner. As the Secretary of State’s Office rolls out its new Georgia Online Application Licensing System to expedite the process, the efficiency of this new process is being put to the test. What’s Happening Thursday morning at the …

Controversy over AP African American Studies class grows

Rashad Brown has been teaching Advanced Placement African American Studies at Atlanta’s Maynard Jackson High School for three years. He’ll continue to do so — even though the state’s top education official removed it from the list of state-funded course offerings for the upcoming school year. While Brown prepares to start teaching his class on …

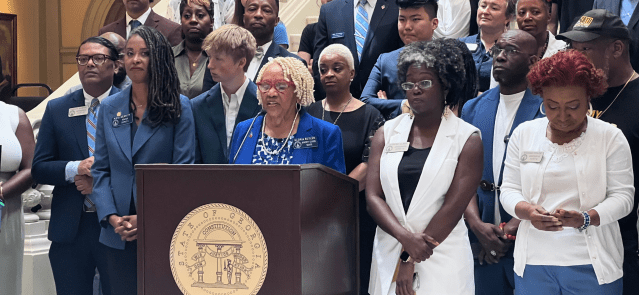

Students, teachers, lawmakers blast decision to end AP African American history classes

ATLANTA — A coalition of lawmakers, civil rights leaders, clergy, educators and students Wednesday called on the state’s education czar to rescind his decision to drop an advanced placement African American studies class from the state’s curriculum for the upcoming school year. “This decision is the latest attack in a long-running GOP assault on Georgia’s …

Kamala Harris’ presidential bid reinvigorates Georgia Democrats

Georgia Democrats have gained new momentum heading into the November election, propelled by President Joe Biden’s decision to bow out of his reelection bid and hand the reins to Vice President Kamala Harris. The historic decision, announced Sunday, is expected to prove pivotal in the national and state political arenas and breathe new life and …