Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoLights, Camera, Tax Credits: A Peachy Deal for Hollywood, but What About Georgia Taxpayers?

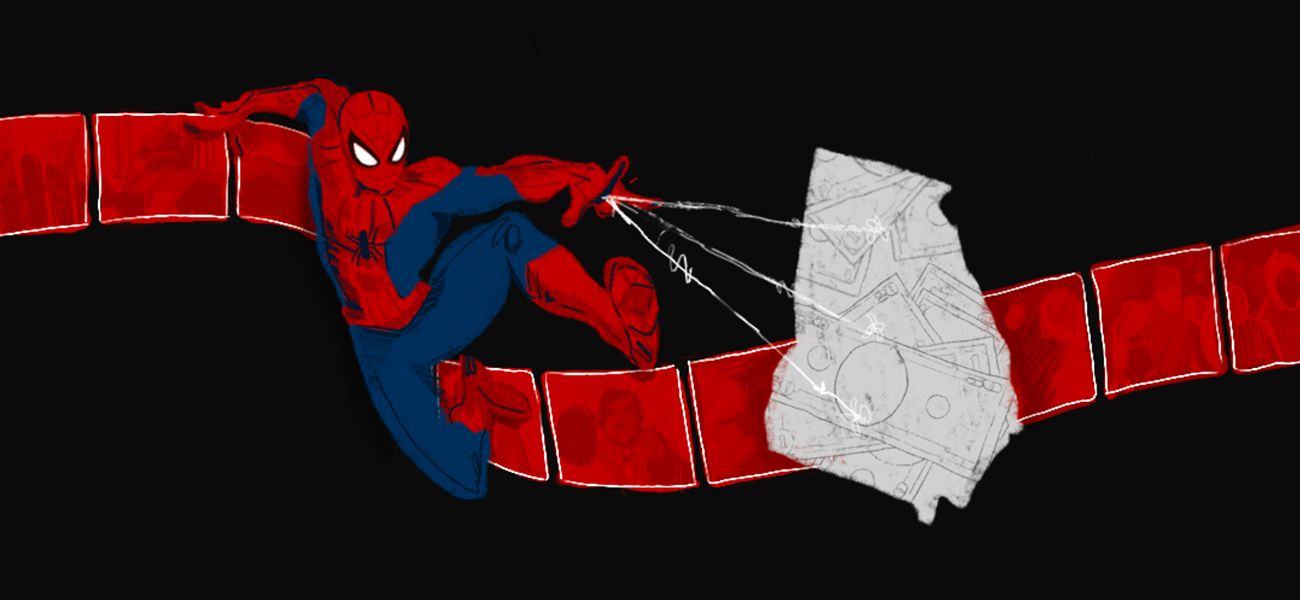

Illustration by Brittney Phan (State Affairs)

- Hundreds of movies and TV shows filmed in Georgia since 2005 have drummed up more than $24 billion in economic activity.

- Supporters trace the film industry’s local boom to tax credits worth billions of dollars.

- Critics say film out-of-state companies benefit too much by selling tax credits to the tune of $2.9 billion since 2016.

Tax incentives worth billions of dollars have helped bring big-budget movies and TV shows to Georgia, but are local taxpayers giving up too much to Hollywood?

Georgia has become the “Hollywood of the South,” hosting more movie and television productions than any state in the U.S. outside California and New York. With the burst in film activity has come scrutiny of Georgia’s film tax credits, which allow movie and TV producers to use up to 30% of what they spend locally on filming to help pay off state income taxes.

State numbers dating back to 2005 tell the story:

- 2,700 movies and TV episodes filmed in Georgia.

- $24 billion spent locally to make movies and TV shows.

- At least $4.1 billion tax credits used by film companies (and likely more).

Georgia has issued billions of dollars in tax credits for film productions since 2005 when the incentive began. (Credit: Brittney Phan for State Affairs)

While tax credits and breaks are a common way to attract industries to Georgia, film credits have expanded rapidly over the past decade or so to become one of the state’s largest tax incentives by a long shot – bigger even than the budgets of many essential state-funded services.

Amid success, the program’s growing size that has drawn criticism from some local tax experts who worry Georgia may be giving up too much in lost revenues, particularly since many film companies have sold off billions-worth in credits that they don’t use to help pay state income taxes. Supporters, however, say the tax-credit program’s large scope is a huge reason why Georgia now has a thriving film industry, boosting local businesses that lean on a clientele of production crews and putting Georgia on the map as one of the best places in the world to let the cameras roll.

In this six-part story, State Affairs investigated the scope of Georgia’s film tax credits – key aspects of which are shielded by state law – and probed arguments for and against the program’s size to help taxpayers understand what’s won and what’s lost in Georgia’s “Hollywood of the South” incentive structure.

OUR STORY

Part I: From California to Senoia

Key to Georgia’s evolution into a hub for movies and TV shows is the state’s film-tax credit program, which has drawn film companies to the Peach State with policies that allow them to skip paying billions in taxes.

Part II: Tax Credits Take Flight

Since 2005, film companies have used more than $4.1 billion in tax credits they’ve received from the state – and likely more than that.

Part III: Zombies, Vampires and Dollars

Local movie and TV spending has exploded since 2005, rising from an estimated $155 million spent that year to more than $2 billion annually in recent years.

Part IV: Critics Question Costs

Amid the rosy picture, Georgia’s film credits have faced stiff criticism from some local tax analysts and economics experts, including a pair of harsh reports from the state’s own internal auditing department.

Part V: The Market of Film Credits

On top of transparency concerns, critics have homed in on the ability of film companies to sell credits as too much of a giveaway for Georgia to stomach.

Part VI: The Land of Make-Believe

Amid a backdrop of debate over the film credits, state lawmakers have shown little appetite in recent years to pass any broad changes to the program.

What else would you like to know about tax incentives in Georgia? Share your thoughts/tips by emailing [email protected] or [email protected].

Professionals still face licensing delays amid state’s transition to online system

The Gist Georgia’s professionals and business owners are still struggling to obtain professional licenses in a timely manner. As the Secretary of State’s Office rolls out its new Georgia Online Application Licensing System to expedite the process, the efficiency of this new process is being put to the test. What’s Happening Thursday morning at the …

Controversy over AP African American Studies class grows

Rashad Brown has been teaching Advanced Placement African American Studies at Atlanta’s Maynard Jackson High School for three years. He’ll continue to do so — even though the state’s top education official removed it from the list of state-funded course offerings for the upcoming school year. While Brown prepares to start teaching his class on …

Students, teachers, lawmakers blast decision to end AP African American history classes

ATLANTA — A coalition of lawmakers, civil rights leaders, clergy, educators and students Wednesday called on the state’s education czar to rescind his decision to drop an advanced placement African American studies class from the state’s curriculum for the upcoming school year. “This decision is the latest attack in a long-running GOP assault on Georgia’s …

Kamala Harris’ presidential bid reinvigorates Georgia Democrats

Georgia Democrats have gained new momentum heading into the November election, propelled by President Joe Biden’s decision to bow out of his reelection bid and hand the reins to Vice President Kamala Harris. The historic decision, announced Sunday, is expected to prove pivotal in the national and state political arenas and breathe new life and …