Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoPart I: From California to Senoia

Credit: Alessandro Marazzi Sassoon (State Affairs)

- Hundreds of movies and TV shows filmed in Georgia since 2005 have drummed up more than $24 billion in economic activity.

- Supporters trace the film industry’s local boom to tax credits worth billions of dollars.

- Critics say film out-of-state companies benefit too much by selling tax credits to the tune of $2.9 billion since 2016.

When she’s not fending off zombies, actress Lynn Collins likes to stroll the local farmer’s market in downtown Senoia where the hit television series The Walking Dead has filmed for the past decade.

A California resident, Collins has taken such a shine to the small-town terrain she’s thinking about making Georgia her new home, enticed by the cozy feel of Senoia, the state’s booming film activity and lower taxes than California.

“I’m definitely thinking about it,” Collins told a reporter on a recent Saturday morning in Senoia.

Actress Lynn Collins of The Walking Dead explores the Saturday farmer’s market in Senoia. (Credit: Alessandro Marazzi Sassoon for State Affairs)

Hollywood studios and production companies have already set up shop in Georgia. Atlanta alone is host to some 1.8 million square feet of sound stage, eclipsing New York, and is now second only to Los Angeles.

Key to Georgia’s evolution into a hub for movies and TV shows is the state’s film-tax credit program, which has drawn film companies to the Peach State with policies that allow them to skip paying billions in taxes. Nearly 300 movies and TV episodes were filmed in Georgia in the past year — a huge increase from the 65 movies and episodes shot right as the credit program came online in 2005. No other state besides California and New York attracts more local filming that Georgia.

The credit program appears to be working, but it’s also one of the largest tax incentives in Georgia by a long shot, bigger even than the budgets of many essential state agencies.

Critics say the costs of attracting film companies may be at the expense of state-funded services like health care and education, highlighting a recent state audit that estimated Georgia lost out on $602 million in tax revenues due to the credit in 2016 — far more than what film companies and crews paid in income and sales taxes while shooting their movies and shows.

Along with wiping out millions in potential tax revenues each year, according to critics, the credits have also become a moneymaker for out-of-state film companies that pay little in state income taxes and nab so many credits that they end up selling off troves of “unused” credits at a profit.

“What we’re really doing is boosting the profits of these out-of-state companies at the expense of things like health care and education,” said Danny Kanso, a senior policy analyst at the nonprofit Georgia Budget and Policy Institute (GBPI). “While we may want to build the film industry, there are other ways to do that than just this subsidy.”

Tourism companies show zombie fans where The Walking Dead was filmed in Senoia. (Credit: Alessandro Marazzi Sassoon for State Affairs)

Supporters, however, have pushed back hard on that assessment, arguing that critics have low-balled estimates for how much local economic activity the film industry generates. In reality, they say, movie and TV productions have pumped roughly $24 billion into Georgia since 2005 by spending money on sets, costumes, catering and extras, according to state Department of Economic Development estimates.

It’s a model that supporters believe yields more far dividends than losses, regardless of how much Georgia gives up in tax revenue. Proof, backers say, is in big-budget studios that have opened in Atlanta and the money spent in cities and towns statewide to make movies and shows.

Bottom line, without the tax credits, many studios may never have picked Georgia in the first place, choosing to film in other states that have strong incentive programs like Louisiana and North Carolina instead, supporters say.

“Georgia is very successful because there’s a market now (for filming),” said Van Stevenson, a senior vice president with the Motion Picture Association of America (MPAA). “It’s become a model across the country because of the business that the credit’s been able to attract.”

For this story, State Affairs investigated the scope of Georgia’s film tax credits – key aspects of which are shielded by state law – and probed arguments for and against the program’s size to help taxpayers understand what’s won and what’s lost in Georgia’s “Hollywood of the South” incentive structure.

NEXT

Part II: Tax Credits Take Flight

Professionals still face licensing delays amid state’s transition to online system

The Gist Georgia’s professionals and business owners are still struggling to obtain professional licenses in a timely manner. As the Secretary of State’s Office rolls out its new Georgia Online Application Licensing System to expedite the process, the efficiency of this new process is being put to the test. What’s Happening Thursday morning at the …

Controversy over AP African American Studies class grows

Rashad Brown has been teaching Advanced Placement African American Studies at Atlanta’s Maynard Jackson High School for three years. He’ll continue to do so — even though the state’s top education official removed it from the list of state-funded course offerings for the upcoming school year. While Brown prepares to start teaching his class on …

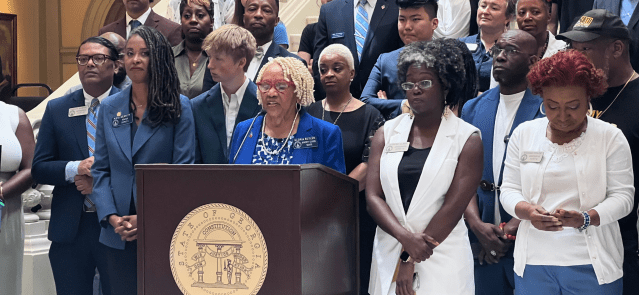

Students, teachers, lawmakers blast decision to end AP African American history classes

ATLANTA — A coalition of lawmakers, civil rights leaders, clergy, educators and students Wednesday called on the state’s education czar to rescind his decision to drop an advanced placement African American studies class from the state’s curriculum for the upcoming school year. “This decision is the latest attack in a long-running GOP assault on Georgia’s …

Kamala Harris’ presidential bid reinvigorates Georgia Democrats

Georgia Democrats have gained new momentum heading into the November election, propelled by President Joe Biden’s decision to bow out of his reelection bid and hand the reins to Vice President Kamala Harris. The historic decision, announced Sunday, is expected to prove pivotal in the national and state political arenas and breathe new life and …