Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoPart IV: Critics Question Costs

Credit: Alessandro Marazzi Sassoon (State Affairs)

- Hundreds of movies and TV shows filmed in Georgia since 2005 have drummed up more than $24 billion in economic activity.

- Supporters trace the film industry’s local boom to tax credits worth billions of dollars.

- Critics say film out-of-state companies benefit too much by selling tax credits to the tune of $2.9 billion since 2016.

Amid the rosy picture, Georgia’s film credits have faced stiff criticism from some local tax analysts and economics experts, including a pair of harsh reports from the state’s own internal auditing department. Last year, state auditors questioned whether economic-development officials had inflated the film industry’s spending impacts by several billion dollars – a charge that drew swift backlash from the credit’s supporters who said the estimates were accurate.

J.C. Bradbury, an economics professor at Kennesaw State University, has also slammed the state’s film-related economic estimates, calling the motion-picture business in Georgia “a very small part of the economy.”

“It’s very, very expensive,” said Bradbury, who authored a study criticizing the state’s estimates for 2018 and calculating the credit program’s cost to each taxpaying household at $220 per year. “There have been no peer-reviewed studies that indicate there is any [economic] benefit from this.”

See the flow of film tax credits in a given fiscal year. (Credit: Brittney Phan for State Affairs.)

Critics frequently point to the amount of tax revenues Georgia never collects due to the credits as a reason for reining in the incentive program’s scope. Film credits potentially ate up roughly $1 billion that Georgia may have generated in tax revenues during the 2020 fiscal year, rounding out to about 3% of the state’s total budget, according to the state’s most recent annual tax expenditure report.

“As the evidence demonstrates, the state did perform well on attracting the (film) industry and creating jobs,” said a study published last year by Augusta University researchers. “However, the cost of the program raises questions about return on investment, which is relatively low, and the sustainability of a high-cost program.”

Even the number of jobs created by the film industry is contested. The MPAA in 2018 claimed some 92,000 jobs were created locally by productions, but the Augusta University researchers put that number closer to 15,000 in 2017, citing federal labor figures. In a 2019 policy brief, Bradbury estimated a more “realistic” number was around 32,000 jobs.

Local workers in Georgia and those from other states make up different shares of jobs and wages involved in credit-receiving film productions. (Credit: Georgia Department of Audits and Accounting)

The credit program’s supporters have countered that it’s impossible to measure how much the state actually loses in tax revenues from the credits, given many film companies may never have picked Georgia in the first place without the incentive.

No one is calling for an outright end to the credit program, Bradbury said, noting the local presence of major studios such as Tyler Perry Studios and the U.K.-based Pinewood Studios as signs of the film industry’s permanent impacts. Rather, critics have pushed for more sunshine on the credit program to better understand its scope, echoing claims from state auditors last year who found lax oversight on what kinds of spending by film companies end up qualifying for credits. Those findings prompted state lawmakers to pass a bill last year requiring that all credits be audited for accuracy over the next few years, rather than just a portion, as was previously the practice.

Prior to 2021, Georgia was one of only three states that did not require audits for individual film credit applications. State lawmakers changed this policy in mid-2020 to require audits. (Credit: Georgia Department of Audits and Accounts)

While that bill aimed to boost transparency, it’s still difficult to track results of film-credit audits. State revenue officials denied State Affairs’ request to review individual credit audits conducted so far this year, citing state law that bars public disclosure of tax-related documents. Similarly, public records on who is awarded credits, in what quantity and who buys and sells them are also withheld on confidentiality grounds.

“The amount of information they’re able to withhold is really unfortunate,” said the GBPI’s Kanso. “It’s one of the contributors against giving Georgians the facts to make a decision.”

NEXT

Part V: The Market of Film Credits

Professionals still face licensing delays amid state’s transition to online system

The Gist Georgia’s professionals and business owners are still struggling to obtain professional licenses in a timely manner. As the Secretary of State’s Office rolls out its new Georgia Online Application Licensing System to expedite the process, the efficiency of this new process is being put to the test. What’s Happening Thursday morning at the …

Controversy over AP African American Studies class grows

Rashad Brown has been teaching Advanced Placement African American Studies at Atlanta’s Maynard Jackson High School for three years. He’ll continue to do so — even though the state’s top education official removed it from the list of state-funded course offerings for the upcoming school year. While Brown prepares to start teaching his class on …

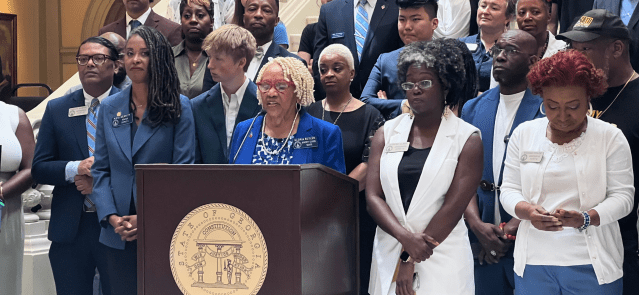

Students, teachers, lawmakers blast decision to end AP African American history classes

ATLANTA — A coalition of lawmakers, civil rights leaders, clergy, educators and students Wednesday called on the state’s education czar to rescind his decision to drop an advanced placement African American studies class from the state’s curriculum for the upcoming school year. “This decision is the latest attack in a long-running GOP assault on Georgia’s …

Kamala Harris’ presidential bid reinvigorates Georgia Democrats

Georgia Democrats have gained new momentum heading into the November election, propelled by President Joe Biden’s decision to bow out of his reelection bid and hand the reins to Vice President Kamala Harris. The historic decision, announced Sunday, is expected to prove pivotal in the national and state political arenas and breathe new life and …