Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoPart V: The Market of Film Credits

Credit: Georgia Department of Economic Development

- Hundreds of movies and TV shows filmed in Georgia since 2005 have drummed up more than $24 billion in economic activity.

- Supporters trace the film industry’s local boom to tax credits worth billions of dollars.

- Critics say film out-of-state companies benefit too much by selling tax credits to the tune of $2.9 billion since 2016.

On top of transparency concerns, critics have homed in on the ability of film companies to sell credits as too much of a giveaway for Georgia to stomach. Anyone in Georgia can buy film credits – typically for 80 to 90 cents on the dollar – to help offset their own annual income taxes, regardless of whether they had anything to do with a movie or show’s creation, according to several local accounting firms.

The market for buying and selling film tax credits is huge in Georgia, according to Peter Stathopoulos, a tax consultant and partner at the Atlanta-based firm Bennett Thrasher that helps clients buy credits. It’s a major reason why many big studios find Georgia so enticing as one of the only states that offers transferable credits, Stathopoulos said.

If the tax credit were “purely an income tax credit, it would not have been that useful to companies coming into Georgia to make new investments in the state that did not have pre-existing income tax liabilities in the state,” Stathopoulos said. Unlike other states that offer rebates to film companies instead of sellable credits, Stathopoulos said, “Georgia doesn’t have to cut a check for the incentive.”

Georgia is among several states that offer tax credits for film productions instead of rebates or grants. (Credit: Georgia Department of Audits and Accounts)

Critics don’t view it that way. For Bradbury and others, selling Georgia’s credits makes for a practice that’s not usually allowed with federal tax credits, resulting in a lopsided win for film companies over the state when factoring in the loss of tax revenues.

“Most film companies don’t owe any taxes in Georgia, so that tax credit itself is useless to them,” Bradbury said. “Where it becomes valuable is that they can sell it to someone else.”

Along with brokering credit sales, some accounting firms including Bennett Thrasher also help state revenue officials audit individual tax credit applications for accuracy, records show. Stathopoulos also said he’s helped draft state legislation on the credits, and he currently holds a top position in a film-industry advocacy group called the Georgia Production Partnership.

Peter Stathopoulos is a tax consultant and partner at the Atlanta-based firm Bennett Thrasher. (Credit: Peter Stathopoulos)

Some critics like Bradbury see the close ties between auditors, accountants and lawmakers as akin to “the fox guarding the henhouse” – and ripe for reform.

“The problem with the program isn’t that it’s abused and some illegal purchases are made,” Bradbury said. “The problem is that everything is totally legal. Almost every expenditure is qualified.”

For his part, Stathopoulos said his firm follows the letter of state law when it comes to keeping conflicts-of-interest out of credit sales, credit audits and his advocacy work.

“States make certain choices about which businesses they want in their state and which ones they want to pay for,” Stathopolous said. “I’m personally glad that this state chose [the film industry].”

NEXT

Part VI: The Land of Make-Believe

Professionals still face licensing delays amid state’s transition to online system

The Gist Georgia’s professionals and business owners are still struggling to obtain professional licenses in a timely manner. As the Secretary of State’s Office rolls out its new Georgia Online Application Licensing System to expedite the process, the efficiency of this new process is being put to the test. What’s Happening Thursday morning at the …

Controversy over AP African American Studies class grows

Rashad Brown has been teaching Advanced Placement African American Studies at Atlanta’s Maynard Jackson High School for three years. He’ll continue to do so — even though the state’s top education official removed it from the list of state-funded course offerings for the upcoming school year. While Brown prepares to start teaching his class on …

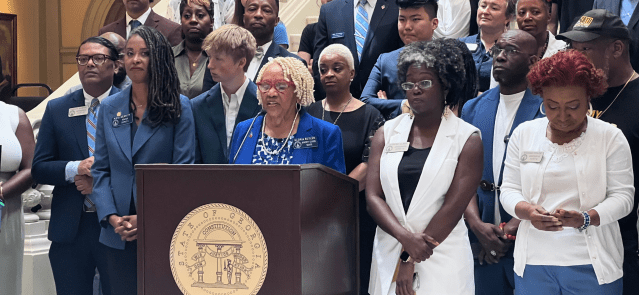

Students, teachers, lawmakers blast decision to end AP African American history classes

ATLANTA — A coalition of lawmakers, civil rights leaders, clergy, educators and students Wednesday called on the state’s education czar to rescind his decision to drop an advanced placement African American studies class from the state’s curriculum for the upcoming school year. “This decision is the latest attack in a long-running GOP assault on Georgia’s …

Kamala Harris’ presidential bid reinvigorates Georgia Democrats

Georgia Democrats have gained new momentum heading into the November election, propelled by President Joe Biden’s decision to bow out of his reelection bid and hand the reins to Vice President Kamala Harris. The historic decision, announced Sunday, is expected to prove pivotal in the national and state political arenas and breathe new life and …