Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoNCSL: National housing shortage requires tailored solutions

State Reps. Randy Bridges, April Berg and Steve Elkins discuss housing policy. (Credit: NCSL)

- All states are facing a housing shortage, but each needs to find a tailored solution

- State legislatures have been trying for three years to identify and address root causes

- Several states have implemented creative approaches to rectify the issue

No state is immune from the nationwide shortage of 1.5 million housing units, but each must find its own approach to target its unique challenges, state lawmakers said Tuesday.

Cameron Rifkin, a policy associate with the National Conference of State Legislatures, said during an NCSL summit panel discussion that the shortage has been increasing over the years as construction has failed to keep up with demand, among other factors.

In the past three years, however, state legislatures have been attempting to address root causes.

Common themes include incentivizing construction, preventing displacement, strengthening eviction protections, preserving naturally existing affordable housing, revising zoning regulations, permitting more density, expanding transit-oriented development and regulating investor purchases and short-term rentals.

Kansas, for example, enacted the Affordable Housing Tax Credit Act and the Housing Investor Tax Credit Act (HB 2237 of 2022) for affordable housing projects.

This year, Maryland prohibited local governments from restricting placements of manufactured homes in a zoning district that allows single-family residential use.

Illinois has proposed imposing a tax on certain real estate investment trusts and limited liability companies that purchase single-family residences.

Kentucky, this year’s NCSL summit host, has launched an affordable housing caucus and has a Housing Task Force that is exploring a myriad of comprehensive approaches, similar to Ohio’s Select Committee on Housing.

“We started seeing bills roll into local governments with good intentions, but you’ve got to look at unintended consequences,” Kentucky Rep. Randy Bridges, R-Paducah, said. “We decided to put a task force together to bring anyone and everyone to the table. Hopefully next session we’ll have a lot of good legislation to push forward.”

While Kentucky’s housing shortage has doubled in the past three years, housing-related tax credits are “not an option,” Bridges said.

“We’re consecutively lowering our income tax from 6% to now 4%, and it’s scheduled for 3.5% in 2025,” he said. “We can’t give up revenue to gain revenue.”

Perhaps the largest recent investment came from Minnesota, where Gov. Tim Walz, now the Democratic nominee for vice president, last year signed a $1 billion housing omnibus.

The massive bill was possible due to a multibillion-dollar surplus that had built up as lawmakers repeatedly failed to agree on uses, Minnesota Rep. Steve Elkins, DFL-Bloomington, said.

It included $200 million for down payment assistance programs, $200 million in housing infrastructure investments, among other earmarks, and created a permanent funding stream for housing needs across the state.

This year, the Minnesota Legislature is focused on enacting reforms.

“We all agreed it doesn’t matter how much we appropriate” if there are still barriers to build, Elkins said.

He helped introduce another omnibus, tackling “every zoning reform issue under the sun,” but has decided to break it into component parts and chip away at issues one at a time, he said.

“I’m hopeful that will give us the leverage we need to get stuff done,” Elkins said.

A “build-more” experiment in Minneapolis has already seen success, he said, compared with a St. Paul initiative for rent stabilization.

“You have to keep building,” Elkins said. “Housing is a commodity, and the overall market is driven by supply and demand. If you want to keep it at a reasonable level, build more housing.”

Washington state Rep. April Berg, D-Mill Creek, said she has been trying to increase property taxes for homes over $3 million by 1%, which would be used as a dedicated funding source for a housing trust fund.

Further complicating Washington’s fiscal response to the housing crisis is the state’s constitutional uniformity clause that prevents a progressive property tax, as well as the 1% levy cap.

In a creative move, the state has enacted an annexation sales tax credit to encourage cities to take on parts of unincorporated counties. That translates to better service for residents and increased tax bases for municipalities, Berg said.

“We put a sunset on it because we want it to happen quickly,” she said.

The state successfully passed the Covenant Homeownership Act, which provides down payment assistance for people negatively affected by redlining.

Berg said it is the first legislation of its kind in the nation.

Krista Kano is a staff writer for Gongwer Ohio/State Affairs. Reach her at [email protected] or on X @krista_kano.

COMMENTARY: Happy 100th birthday, Mr. Jimmy!

“I missed you at Sunday school today,” Mr. Jimmy said to me as he entered the back door of what once was a boarding house where his parents lived when they were first married. He always stopped to speak with me in the kitchen before mingling with the nearly 45 people gathered in anticipation of …

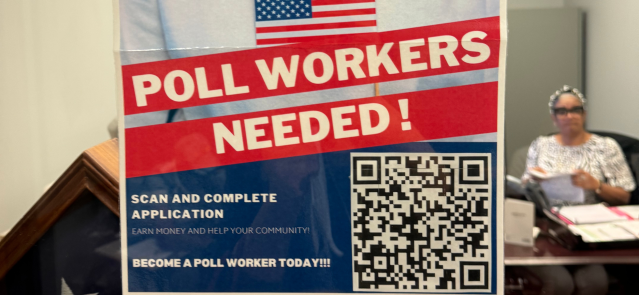

Want to see the election process up close? Become a poll worker

Looking for a temporary job that gives you a glimpse of how the American election process works? If so, Georgia election officials are looking for you. Many local election offices have begun training thousands of temporary poll workers and other essential staff for the Nov. 5 general election, according to W. Travis Doss III, president …

Rogers, Slotkin lean into China, national security in US Senate battle

LANSING, Mich. — Michigan voters are faced with a choice for U.S. Senate in November between two candidates with strong national security credentials but with sharply different views on how to effectively address threats to the U.S. Both Southeast Michigan candidates, Republican Mike Rogers of White Lake and Democratic U.S. Rep. Elissa Slotkin of Holly, have been …

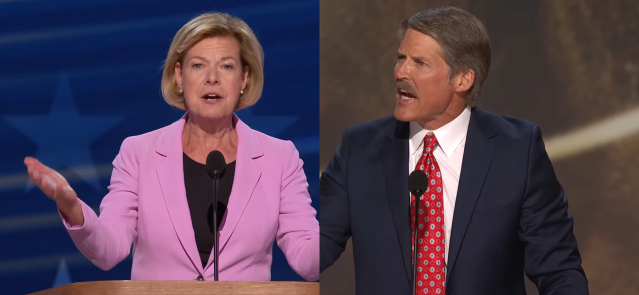

Tammy Baldwin faces tough reelection: Can Trump supporters push her past the finish line?

MADISON, Wis. — Tammy Baldwin may need some Donald Trump supporters to secure her reelection. The two-term U.S. senator plays up the “buy American” language she pushed for federal infrastructure projects and touts policies favored by Wisconsin’s dairy industry such as seeking to ban labeling plant-based products “milk.” Her GOP rival Eric Hovde, meanwhile, wants …