Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a Demo

Speaker Jon Burns breaks another gavel. (Credit: Georgia House)

Bills to provide tax breaks, rein in prosecutors and massage a midyear state budget were among the legislation taking shape this week.

Gov. Brian Kemp’s proposed revamp of the fiscal year 2024 budget was passed on to the Senate this week after the House made its changes to the governor’s $37.5 billion proposed amended budget on Wednesday. The Senate will now do the same.

The House’s changes to the governor’s proposed amended midyear budget add more roads and bridges statewide and provide funds to recruit nurses and more summertime child care options for parents.

With two weeks left before Crossover Day — the deadline for bills to pass each chamber and the halfway point of the legislative session — activity at the Capitol has ramped up. Between visits from 10-month-old alligators Charlie and Creature on Okefenokee Swamp Day, and servings of strawberry ice cream shortcake in the rotunda, legislators tackled the business of doing the people’s work.

Here’s a rundown of some of the week’s highlights:

In the House

Triple tax relief. Three bills to provide income and property tax breaks to Georgians championed by Gov. Brian Kemp and House Speaker Jon Burns, R-Newington, passed with strong bipartisan support in the House on Thursday.

- HB 1015 reduces the state income tax for individuals to 5.39% from 5.49%, retroactive to Jan. 1. Lawmakers are accelerating a graduated tax drop that started, per a 2022 law, at 5.75% and is planned to decrease to 4.99% over the next few years. The state is expected to collect $1.1 billion less in income tax revenues this year if the latest tax rollback is approved.

- HB 1019 increases the homestead exemption on the assessed value of an owner-occupied home to $4,000 from $2,000. Asked during his House floor presentation how much a homeowner in his Gwinnett district would save under the bill, sponsor Rep. Matt Reeves, R-Duluth, said it would be about $100.

- HB 1021 increases the state income tax deduction for each child or dependent to $4,000 from $3,000. Bill sponsor Rep. Lauren Daniel, R-Locust Grove, holding her infant son in a sling, told colleagues the tax break would help ease “rising costs on groceries, child care costs, groceries and numerous other things that parents are responsible for.”

The House also passed HB 871, which provides an additional homestead exemption of up to $32,500 for the unmarried spouses and children of disabled veterans.

Both of the homestead exemption-related bills require a majority two-thirds vote in both chambers and voter approval through a state referendum. All four tax bills now go to the Senate for consideration.

Nurses dispensing oxy. The House voted 133-35 to pass HB 557, which would let nurse practitioners and physician assistants who are supervised by physicians provide adult patients with a five-day emergency supply of Schedule II opioid drugs, including oxycodone and hydrocodone, commonly prescribed for pain relief.

“While this legislation sounds well intentioned, the last thing we need while our country and our state is in the throes of an opioid epidemic is more practitioners writing prescriptions for opioids,” Rep. Michelle Au, D-Johns Creek, who is an anesthesiologist, said during the House debate.

Rep. Lisa Campbell, D-Kennesaw, said she had concerns over how those dispensing the drugs will be supervised. Campbell told State Affairs the bill allows the agreements with providers permitting nurse practitioners and physician assistants to dispense opioids to remain in place and renew “even when the supervising physician leaves or changes. … That seems like a significant gap that should be addressed in terms of oversight.”

Rep. James Burchett, R-Waycross, said that in rural Georgia certain medical providers have only a physician assistant and no doctor at all. The bill is designed to address the severe health care workforce shortages across the state by enhancing the scope of what some practitioners can do.

Rep. Mark Newton, R-Augusta, who is an emergency physician, noted the bill “only allows a five-day supply of drugs and has the proper amount of concern … about the ongoing opioid epidemic but at the same time allowing needed medications for a very short term to be done in a responsible way.”

In the Senate

Controversy over method of unionizing. After a lengthy debate Thursday, the Senate passed 31-23 a controversial bill backed by Gov. Brian Kemp and seen by opponents as anti-union. Senate Bill 362, sponsored by Brunswick Republican Sen. Mike Hodges, blocks new businesses that come to Georgia from getting state incentives if they allow union representation without first holding a secret ballot rather than a card check.

Card-checking generally makes forming a union at a company easier. “I stand with unions. This is a bad bill for the working people of Georgia,” said Sen. Gail Davenport, D-Jonesboro, who was among a group of senators wearing red bandanas to express their opposition to the bill.

“This bill does not protect big business,” Sen. Ed Setzler, R-Acworth, said. “It protects the right of conscience.” The bill now heads to the House.

Legislators exerting greater prosecutor oversight power. A bill creating an oversight committee to investigate attorney misconduct is close to being able to review allegations filed against district attorneys and solicitor generals in Georgia. Senate Bill 332 passed 29-22. It allows the Prosecuting Attorneys Qualifications Commission to operate under rules that don’t require a final review from the Georgia Supreme Court. A similar bill — House Bill 881 — passed in the House on Jan. 29.

Meanwhile, on Friday, the Senate Special Committee on Investigations held its first meeting to adopt procedural rules and discuss its mission. The committee was created as a result of the adoption of Senate Resolution 465, sponsored by Sen. Greg Dolezal, R-Cumming. The committee has power to subpoena witnesses and documents. Its main aim is to investigate alleged misconduct by Fulton County District Attorney Fani Willis. She’s in the middle of a criminal investigation into former President Donald Trump’s alleged attempts to overturn the 2020 presidential election.

Fast-tracking therapy. Marriage and family therapists will see a faster licensing process under SB 373, which passed the Senate unanimously on Tuesday. The bill allows licensed therapists from other states to practice in Georgia without having to seek additional training and certification.

Tax breaks on guns. Passed in the Senate on Tuesday, SB 344 would give Georgians a five-day tax holiday, beginning the second Friday of October each year, on sales of firearms, ammunition, gun safes, trigger locks and related accessories. Rep. Michelle Au, D-Johns Creek, filed another gun bill, HB 855 in the House that would award a tax credit worth up to $300 to gun owners who secure their firearms with safe storage devices. That bill has not moved.

Read these related stories:

Have questions? Contact Jill Jordan Sieder on X @journalistajill or at [email protected] and Tammy Joyner on X @lvjoyner or at [email protected].

And subscribe to State Affairs so you do not miss an update.

X @StateAffairsGA

Instagram@StateAffairsGA

Facebook @StateAffairsGA

LinkedIn @StateAffairs

Professionals still face licensing delays amid state’s transition to online system

The Gist Georgia’s professionals and business owners are still struggling to obtain professional licenses in a timely manner. As the Secretary of State’s Office rolls out its new Georgia Online Application Licensing System to expedite the process, the efficiency of this new process is being put to the test. What’s Happening Thursday morning at the …

Controversy over AP African American Studies class grows

Rashad Brown has been teaching Advanced Placement African American Studies at Atlanta’s Maynard Jackson High School for three years. He’ll continue to do so — even though the state’s top education official removed it from the list of state-funded course offerings for the upcoming school year. While Brown prepares to start teaching his class on …

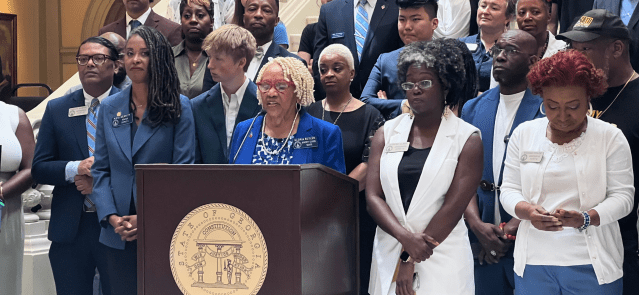

Students, teachers, lawmakers blast decision to end AP African American history classes

ATLANTA — A coalition of lawmakers, civil rights leaders, clergy, educators and students Wednesday called on the state’s education czar to rescind his decision to drop an advanced placement African American studies class from the state’s curriculum for the upcoming school year. “This decision is the latest attack in a long-running GOP assault on Georgia’s …

Kamala Harris’ presidential bid reinvigorates Georgia Democrats

Georgia Democrats have gained new momentum heading into the November election, propelled by President Joe Biden’s decision to bow out of his reelection bid and hand the reins to Vice President Kamala Harris. The historic decision, announced Sunday, is expected to prove pivotal in the national and state political arenas and breathe new life and …