Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a Demo

Lawmakers are considering several new tax measures to lower state income and property taxes, and to increase the child tax credit. (Credit: Jose Manuel Gelpi and USGirl)

In this election year and constant social media bemoaning of the cost of groceries and other consumer items, legislators are working on several tax measures to return money to Georgia taxpayers.

Here’s what the bills would do if they pass in both chambers and the governor signs them.

The House of Representatives passed three bills to provide income and property tax breaks to Georgians, all of which are now under consideration in the Senate:

- HB 1015 cuts the state income tax for individuals to 5.39% from 5.49%, retroactive to Jan. 1. The bill would accelerate a graduated tax drop that already started, per a 2022 law, at a top tax rate of 5.75%, which is planned to decrease to 4.99% by 2029. At the time, House Ways and Means Chair Shaw Blackmon, R-Bonaire, said the cuts, once fully implemented, would save a family of four with an income of $75,000 about $650 per year.

If the Senate and governor approve the new bill, Georgia residents who earned $58,000 in 2024 would save another $34 in annual income tax, according to a Georgia Budget & Policy Institute analysis. Those earning $105,000 would save an additional $72, and those earning $183,000 would save $128, according to the institute.

| GEORGIA 2024 INCOME TAX RATE CUTS | ||

| Enacted and Proposed | ||

| Estimated Annual Savings from Tax Rate Cuts | ||

| Annual Income | From 5.75% to 5.49% (Enacted) | From 5.49% to 5.39% (Proposed) |

| $14,000 | $57 | $5 |

| $33,000 | $91 | $16 |

| $58,000 | $207 | $34 |

| $105,000 | $353 | $72 |

| $183,000 | $556 | $128 |

| $424,000 | $876 | $282 |

| Top 1% ($1.87 Million) | $3,445 | $1,346 |

| Note: Both tax rate cuts are planned to be effective Jan. 1, 2024. | ||

The state is expected to collect $1.1 billion less in income tax revenues this year if the latest tax rollback is approved.

- HB 1021 increases the state income tax deduction for each child or dependent (including an elder parent) to $4,000 from $3,000. The Georgia Budget & Policy Institute estimated that families will save about $54 per dependent per year through this tax exemption if implemented in fiscal year 2025, which begins July 1, 2024.

The change would cost the state about $152 million in revenues in fiscal year 2025.

- HB 1019 increases the homestead exemption on the assessed value of an owner-occupied home to $4,000 from $2,000. Bill sponsor Rep. Matt Reeves, R-Duluth, noted that tax bills vary according to the assessed value and local tax rates and said that average savings to homeowners in his Gwinnett County district would be about $100.

Meanwhile, the Senate passed a competing bill that would prohibit local governments from raising home property assessments more than 3% a year. Senate Bill 349, sponsored by Sen. Chuck Hufstetler, is now under consideration in the House.

Both bills to change how residential property taxes are calculated would require a majority two-thirds vote in both chambers and voter approval through a state referendum in November.

Have questions or comments? Contact Jill Jordan Sieder on X @journalistajill or at [email protected].

And subscribe to State Affairs so you do not miss an update.

X @StateAffairsGA

Instagram@StateAffairsGA

Facebook @StateAffairsGA

LinkedIn @StateAffairs

Professionals still face licensing delays amid state’s transition to online system

The Gist Georgia’s professionals and business owners are still struggling to obtain professional licenses in a timely manner. As the Secretary of State’s Office rolls out its new Georgia Online Application Licensing System to expedite the process, the efficiency of this new process is being put to the test. What’s Happening Thursday morning at the …

Controversy over AP African American Studies class grows

Rashad Brown has been teaching Advanced Placement African American Studies at Atlanta’s Maynard Jackson High School for three years. He’ll continue to do so — even though the state’s top education official removed it from the list of state-funded course offerings for the upcoming school year. While Brown prepares to start teaching his class on …

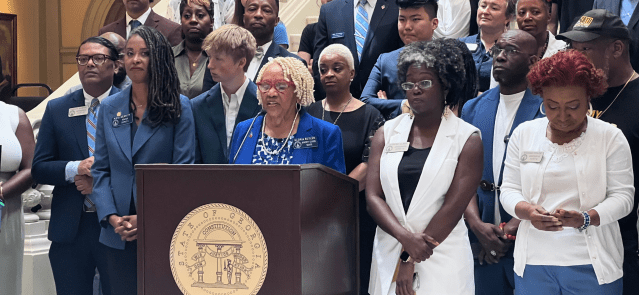

Students, teachers, lawmakers blast decision to end AP African American history classes

ATLANTA — A coalition of lawmakers, civil rights leaders, clergy, educators and students Wednesday called on the state’s education czar to rescind his decision to drop an advanced placement African American studies class from the state’s curriculum for the upcoming school year. “This decision is the latest attack in a long-running GOP assault on Georgia’s …

Kamala Harris’ presidential bid reinvigorates Georgia Democrats

Georgia Democrats have gained new momentum heading into the November election, propelled by President Joe Biden’s decision to bow out of his reelection bid and hand the reins to Vice President Kamala Harris. The historic decision, announced Sunday, is expected to prove pivotal in the national and state political arenas and breathe new life and …