Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a Demo

Gov. Brian Kemp signing bill.

Georgia consumers have greater protections coming their way in 2024 for health care, food security and against unfair or deceptive trade practices, thanks to new laws taking effect Jan. 1.

At the top of the list is Senate Bill 20 and House Bill 528.

SB 20, better known as the Consumer Access to Contracted Health care, or CATCH Act, guarantees Georgians with insurance have access to quality health care by “setting adequacy standards for network plans offered by an insurer.” In a nutshell, the new law ensures everyone with insurance has access to primary and specialty care, mental health care, pharmacies and laboratories, and substance abuse treatment programs. It’s an amendment to Georgia’s “Surprise Billing Consumer Protection Act.”

HB 528 makes it easier to stop unwanted auto-renewal subscriptions online. The bill also protects restaurants — and ultimately consumers — from deceptive practices by third-party delivery services such as DoorDash and Uber Eats. The law requires a written agreement between restaurants and the food delivery companies. Previously, many restaurants were unaware that some third-party food delivery services were using their logos and likeness to attract customers.

Most of the new laws that were signed by Gov. Brian Kemp this year went into effect on July 1. Some of the new laws taking effect next week are merely adjustments to existing laws.

Here are other laws taking effect Jan. 1:

HB 120: Provides standards to limited driving permits for certain offenders.

HB 128: Provides for representation of minority business enterprises, women-owned and veteran-owned businesses in getting state contracts for construction, services, equipment, and goods.

HB 175: Allows prestige and special license plates to be issued for state constitutional officers and Public Service Commission members, retired members of the active reserve and Georgia National Guard and members of Kappa Alpha Psi Fraternity. It also amends the code related to constitutional exemption from motor vehicle tax for disabled veterans.

HB 453: Repeals a requirement that ambulance services pay annual license fees.

SB 90: Requires those who provide commercial financing transactions to make certain disclosures and to provide penalties, definitions and other related matters.

Also on the 2024 horizon:

Gov. Kemp signed HB 1437 into law in April 2022. It replaces the current graduated personal income tax with a flat rate of 5.49% effective Jan. 1, with gradual rate cuts until the flat rate reaches 4.99% by tax year 2029.

The governor recently announced plans to introduce legislation during the 2024 legislative session that would speed up cuts in the tax rate and save Georgia taxpayers an estimated $1.1 billion in 2024.

If approved, the proposed legislation will amend HB 1437, which provides for a step down of 10 basis points in the income tax rate, starting in 2025 and for each taxable year thereafter. If the proposed legislation Kemp wants is approved, the tax rate for 2024 would be 5.39%, instead of 5.49%. The 2023 tax rate was 5.75%.

Find out more about new laws passed during the 2023 legislature here, here and here.

Check out our TikTok summary:

Have questions? Contact Tammy Joyner on X @lvjoyner or at [email protected].

And subscribe to State Affairs so you do not miss an update.

X @StateAffairsGA

Facebook @StateAffairsGA

Instagram @StateAffairsGA

LinkedIn @StateAffairs

Professionals still face licensing delays amid state’s transition to online system

The Gist Georgia’s professionals and business owners are still struggling to obtain professional licenses in a timely manner. As the Secretary of State’s Office rolls out its new Georgia Online Application Licensing System to expedite the process, the efficiency of this new process is being put to the test. What’s Happening Thursday morning at the …

Controversy over AP African American Studies class grows

Rashad Brown has been teaching Advanced Placement African American Studies at Atlanta’s Maynard Jackson High School for three years. He’ll continue to do so — even though the state’s top education official removed it from the list of state-funded course offerings for the upcoming school year. While Brown prepares to start teaching his class on …

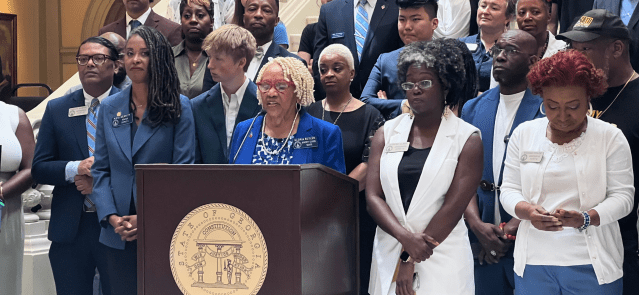

Students, teachers, lawmakers blast decision to end AP African American history classes

ATLANTA — A coalition of lawmakers, civil rights leaders, clergy, educators and students Wednesday called on the state’s education czar to rescind his decision to drop an advanced placement African American studies class from the state’s curriculum for the upcoming school year. “This decision is the latest attack in a long-running GOP assault on Georgia’s …

Kamala Harris’ presidential bid reinvigorates Georgia Democrats

Georgia Democrats have gained new momentum heading into the November election, propelled by President Joe Biden’s decision to bow out of his reelection bid and hand the reins to Vice President Kamala Harris. The historic decision, announced Sunday, is expected to prove pivotal in the national and state political arenas and breathe new life and …