Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoBraun’s state tax plans come without price tags — or assurances he’ll push for changes

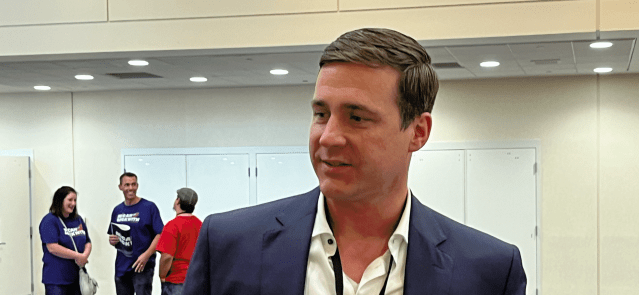

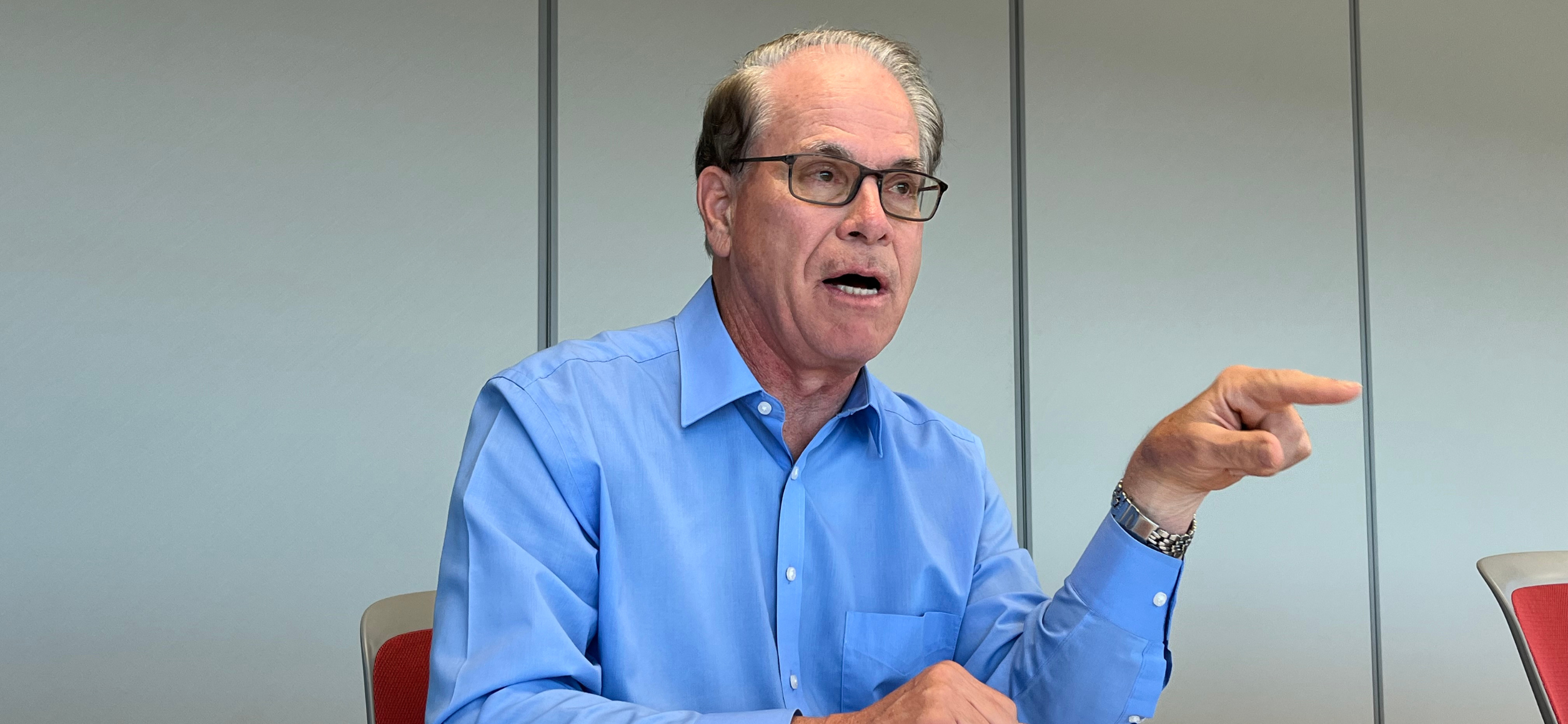

Republican gubernatorial candidate Mike Braun speaks with State Affairs reporters on Oct. 3, 2024. (Credit: Tom Davies)

- Braun’s list of possible state income and sales tax changes released without cost estimates

- Braun says he’s “going to look at” tax breaks if elected based on running the state more efficiently

- Opponent’s campaign calls Braun’s lack of cost estimates “reckless and irresponsible”

Ending state taxes on retirement income and tips, creating sales tax holidays for back-to-school supplies and indexing state tax deductions to inflation are all on Mike Braun’s list of policy proposals.

Some of those suggestions from the Republican gubernatorial candidate, however, have previously been rejected by Republicans who control the state Legislature. Braun’s campaign hasn’t provided estimates on how much the steps would cost — and Braun indicates they are something he’s “going to look at” rather than firm propositions.

Braun’s campaign released a policy paper last week highlighting his previously announced plans to address property tax increases, along with new proposals on state income and sales taxes.

Indiana’s individual income tax rate is already in the midst of gradual cuts from the 2023 rate of 3.15% to reaching 2.9% for 2027.

Braun indicated in an interview with State Affairs that further steps he proposed, such as ending state taxes on retirement income and tips, might take a while to happen.

“Depends how well I can run the government,” Braun said. “If I’m actually running it better, that’s how you finance a lot of the things that would either be investing, spending more on areas that are going to give you a good [return on investment] or, if you don’t have that, lowering your revenue.”

Braun and Democratic candidate Jennifer McCormick have offered proposals aimed at cutting residential property taxes, which have spiked in the past few years with increases in home values.

Nearly all property tax revenue goes toward county and city governments and public school districts, while state government’s revenue largely comes from income and sales taxes.

The Braun proposals on income and sales taxes — published by the Braun-aligned group Hoosiers for Opportunity, Prosperity and Enterprise and distributed by his campaign — don’t come with any cost estimates or certainty that Braun will push for them.

“We don’t have those figures,” Braun said. “I mean, not to where we can get it and do it, to where we’d be confident about it. It’s just an area that we’re going to look at.”

Braun’s campaign touts the proposals as a way to provide inflation relief.

Provisions related to state taxes include:

- Eliminating state taxes on retirement income, including pension payments and 401(k) and IRA distributions.

- Adjusting the value of state income tax deductions to account for inflation.

- Eliminating income taxes on tips for service industry workers, a step both Donald Trump and Kamala Harris have called for in their presidential campaigns.

- Establishing temporary exemptions from the 7% sales tax in August and January for school supply purchases; a spring tax holiday on biking, hiking and hunting supplies to boost outdoor recreation; and spring and fall tax-free periods for youth sports equipment to “support families and promote physical activity.”

McCormick, meanwhile, has proposed raising the threshold for low-income families qualifying for the state’s earned income tax credit. Her campaign said that could provide up to $150 million in tax savings a year “and significantly impact worker retention, particularly in rural areas where wages are lower.”

McCormick’s campaign criticized Braun’s proposals as the work of “ultra-conservative partisans” that would “obliterate the ability of the Indiana state government to function effectively.”

“At the same time, working-class and middle-class Hoosiers would bear the brunt of the financial burden,” McCormick spokeswoman Mila Myles said. “His plan lacks transparency — and fiscal policy without real numbers is reckless and irresponsible.”

Democratic state Rep. Ed DeLaney, a member of the budget-writing House Ways and Means Committee, called the Braun proposals “very amateurish.”

“Those are not serious tax proposals, they’re just not,” DeLaney said. “It just scatters little breaks to people. … They would do very little for individuals, but they would shrink the state’s revenue and our ability to fund our schools and our roads.”

It is unclear whether the Republican-dominated Legislature would embrace Braun’s tax proposals.

The Legislature’s State and Local Tax Review Task Force is slated to end its two-year discussion of Indiana’s tax system and present by Dec. 1 recommendations for action during next year’s legislative session.

Republican legislators have blocked Democrats’ previous attempts to establish a back-to-school sales tax holiday, which was estimated last year to cost the state up to $18 million for a seven-day exemption period. Republican budget writers earlier this year rejected a push to repeal the sales tax on tampons and other feminine hygiene products, a move that was projected to reduce state revenues by about $5 million a year.

Braun credited legislators for keeping an eye on tax changes as he works to extend the 20-year hold that Republicans have had on the governor’s office.

“That’s because they’re doing what they should be doing, and that’s being inherently frugal,” Braun said. “Unless you’ve got an executive branch that’s going to really be interested in running it more efficiently … you couldn’t do any of that, because otherwise you’d be shrinking your inherent, structurally good cash flow. But if you’re predicating it on savings that you’re finding, maybe you don’t need an agency the size it is. I can tell you, in almost all cases, many things run better once you lean it up, and I just don’t think we’ve paid attention to that.”

Tom Davies is a Statehouse reporter for State Affairs Pro Indiana. Reach him at [email protected] or on X at @TomDaviesIND.

Know the most important news affecting Indiana

Get our free weekly newsletter that covers government, policy and politics that impact your everyday life—in 5 minutes or less.

The man behind the governor: Josh Kelley’s journey to Indiana leadership

As Gov.-elect Mike Braun’s transition team and priorities take shape, his right-hand man prepares to lead the staff tasked with ensuring the incoming governor’s vision becomes reality. Josh Kelley has quickly established a political career marked by several key achievements, including anchoring two statewide campaign victories, serving as Braun’s chief of staff in the U.S. …

COLUMN: Trump should seek Ukraine NATO membership on day 1

INDIANAPOLIS — The North Atlantic Treaty Organization is a military alliance founded in 1949 following World War II to keep Soviet influence in check. The United States is one of 12 founding members. There are 32 members, including Canada, the United Kingdom, Germany, Poland, France, Spain and Italy. Article 5 of NATO’s charter states that …

Howey Politics Indiana celebrates 30th anniversary

Storied Indiana political columnist Brian Howey was honored Tuesday at a gala celebrating his 30th year at the helm of his namesake newsletter, Howey Politics Indiana. Howey was joined at the event by his wife Susan, his fellow State Affairs teammates and political insiders. Know the most important news affecting Indiana Get our free weekly …

Incumbents win in 2 tight Indiana House races; Cash-Stoner outcome uncertain

The election outcome remained uncertain in one Indiana House district where Republican incumbent Becky Cash was leading Democrat Tiffany Stoner by less than one-tenth of a percentage point. Two other House incumbents — Republican Rep. Dave Hall and Democratic Rep. Wendy Dant Chesser — prevailed with narrow victories that aren’t expected to face recount challenges. …