Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoThe debt ceiling, a lack of integrity and the possible fallout

In the coming days, the United States again confronts our statutory debt ceiling. This is a 1917 law (increased every year or so) establishing a cap on federal government debt. The law itself runs up against the 14th Amendment to the Constitution, which was intended to reassure bondholders that we pay our Civil War debts. That means the debt ceiling may be unconstitutional, giving the Biden administration the option of simply printing money to cover the debt.

The debt ceiling law is politically convenient because it offers an opportunity for members of both parties to engage in a bit of political theater. It is important to remain focused on the real issue of debt rather than the political shenanigans. I expect some sort of compromise, but that is more hope than actual analysis.

Neither the Republicans nor Democrats have performed satisfactorily on this ballooning public debt. The GOP showed zero concern about debt when a Republican president was in office. Not a single Hoosier Senator or member of Congress voted against the Trump administration’s Tax Cut and Jobs Act (TCJA) or the CARES Act. These bills fall in first and third place in terms of recent contributions to the debt.

The Democrats, who voted almost unanimously against the TCJA, voted unanimously for the American Rescue Plan, which came in second place for debt loading. There’s not a clean hand in Congress on the current debt. Insofar as I can tell, the sole Republican speaking honestly about the GOP’s profligate history is Mike Pence.

As I wrote at the time, each of these large spending bills had some merits, and there remain reasonable arguments for each. The problem is that so many now in office want to remake themselves as thoughtful budget hawks, but when it mattered, they were nothing of the sort. It is the lack of integrity that highlights the real problem. No one can be honest about the root of the problem.

In 1946, right after winning World War II, our debt-to-GDP ratio stood at 119%. Today it sits at 121%, down from 127% two years ago. But, there is no peace dividend. Our spending problems are not about our military spending, which is today at near historical lows as a share of GDP.

The big-budget items driving our deficit are spending for Medicaid, Medicare, Social Security, and federal government and military retirements. And yes, I know Social Security and Medicare are supposed to be separate budget items. They are not.

If we cut all foreign aid (including Ukraine defense), housing subsidies, environmental remediation, research, discretionary education spending, immigrants, parks, and clean air or water, we wouldn’t make a dent in our debt. Altogether, these spending items wouldn’t even cover the interest payments on our debt.

In order to reduce our debt in the coming decades, we are going to have to do two very unpopular things: raise taxes and cut spending. We are going to have to do more of both than almost anyone really imagines.

On the revenue side, we are going to have to sunset the TCJA and raise marginal income tax rates on middle- and high-income households. By middle, I mean everyone who pays an income tax. Also, we probably must extend the Social Security taxes (FICA) across all earned income types.

On the spending side, we are going to have to extend retirement age, probably to 70 years or so for younger workers. We won’t have to means-test benefits, because we will have higher taxes on more affluent households. But, we will reduce retirement benefits for younger workers, and end the practice of increasing Social Security for older adults who work. We are also going to have to reduce the rate of inflation adjustments for Social Security recipients.

If all of that sounds distasteful to you, too bad. What I have just outlined is probably the easiest resolution to our current debt problem. But, what if we choose a different path?

We could cut defense spending. I’d vote to eliminate the entire Marine Corps. If we did that, it would only take another 117 years to eliminate today’s debt, though that wouldn’t come close to balancing the current budget. So, we’ll have to cut something else. If we cut our foreign aid, we could pay off the current debt, not counting interest, in 600 years. Alternatively, we could reduce overall Social Security costs by 10%, through later eligibility, and extend FICA taxes to a further 10% of earnings, and retire the debt in 60 years.

It is probably wise to ignore the political talking points about our debt and focus on the arithmetic. Still, many might wonder what if we ignore all this and blow off our debts, and default. After all, many Americans declare bankruptcy. Well, that step would be somewhere between a crisis and a full-blown economic catastrophe.

The United States borrows money like every other government does. We have treasury bills notes, bonds, inflation-indexed securities, floating rate notes, domestic series bonds and the like. Altogether this is about $31.5 trillion in borrowing. About 13 cents on every federal tax dollar collected goes to paying interest on these debts (or about twice the annual cost of the entire Marine Corps).

The reason the U.S. can borrow all this money is simply that everyone believes we will pay it back. Our creditworthiness ensures a reasonably low rate of borrowing and keeps our currency as the world’s reserve currency. So what happens if we default?

Well, there will be a flight away from U.S. securities. This will lead to financial markets devaluing our bonds, leading to higher borrowing rates on futures. Since our bonds turn over all the time, that would mean an almost immediate increase in the share of taxes we have to spend to service the debt.

If the U.S. defaults on our debts, the stock market will decline precipitously. It would strengthen China and Russia, while weakening the U.S., perhaps sliding our economy into recession along with most of our allies. The worst forecast I have seen suggests that an extended default would result in a Great Recession-level shock to the global economy.

I think this is an unlikely scenario, only because the domestic political backlash would be so severe we will come to some compromise. But, I’m a notoriously bad political forecaster. Rather than risking default, we’d be wise to heed the rare wisdom of then-President Donald Trump’s advice on the debt ceiling: “That’s a sacred element of our country. They can’t use the debt ceiling to negotiate.”

Michael J. Hicks, Ph.D., is the director of the Center for Business and Economic Research and the George and Frances Ball distinguished professor of economics in the Miller College of Business at Ball State University. He can be reached on Twitter @hicksCBER.

Header Image: Debt ceiling (Credit: Douglas Rissing / Getty Images/iStockphoto)

4 things to know about Braun’s property tax proposal

Sen. Mike Braun, the Republican candidate for Indiana’s governor, released a plan for overhauling property taxes Friday morning that would impact millions of Hoosiers, Indiana schools and local governments. “Nothing is more important than ensuring Hoosiers can afford to live in their homes without being overburdened by rising property taxes driven by rapid inflation in …

Bureau of Motor Vehicles looks to add new rules to Indiana’s driving test

The Bureau of Motor Vehicles wants to amend Indiana’s driving skills test, putting “existing practice” into administrative rule. Indiana already fails drivers who speed, disobey traffic signals and don’t wear a seatbelt, among other violations. Yet the BMV is looking to make the state’s driving skills test more stringent. A proposed rule amendment looks to …

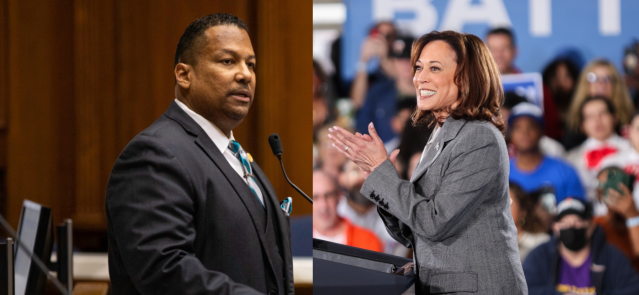

In Indianapolis, Harris says she’s fighting for America’s future

Vice President Kamala Harris, the presumptive Democratic presidential nominee, told a gathering of women of color in Indianapolis on Wednesday that she is fighting for America’s future. She contrasted her vision with another — one she said is “focused on the past.” “Across our nation, we are witnessing a full-on assault on hard-fought, hard-won freedoms …

Indiana Black Legislative Caucus endorses Harris, pledges future support

The Indiana Black Legislative Caucus unanimously voted Wednesday to endorse Vice President Kamala Harris’ presidential run and will look at ways to assist her candidacy, the caucus chair, state Rep. Earl Harris Jr., D-East Chicago, told State Affairs. The caucus is made up of 14 members of the Indiana General Assembly, all of whom are …