Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a Demo

(Design: Anna Leckie)

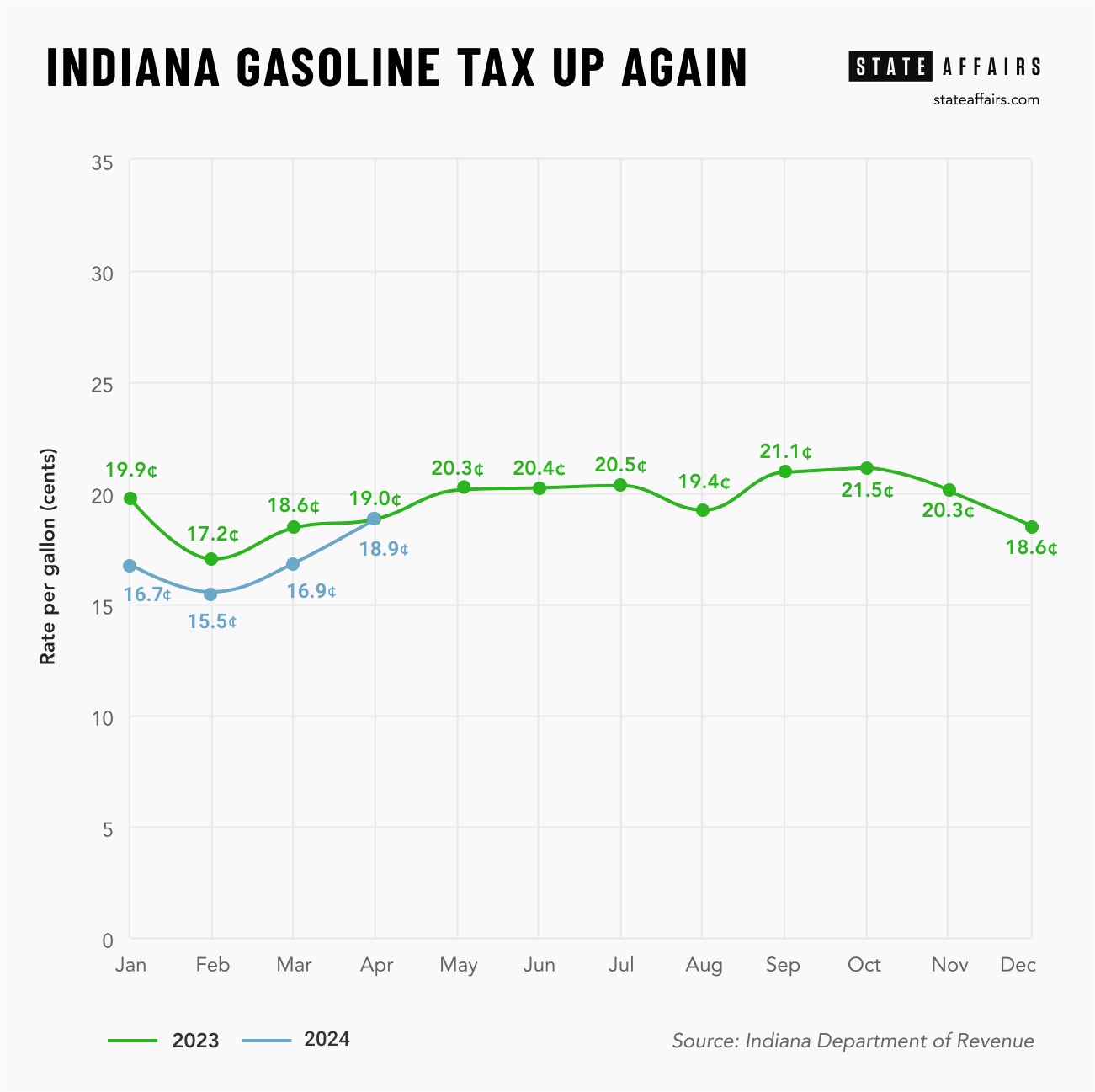

Indiana’s sales tax on gasoline will jump by two cents a gallon for April as the rate increases for the third consecutive month — and at least one Republican candidate for governor is trying to make the gas tax a campaign issue.

The gas sales tax rate will be 18.9 cents a gallon starting April 1 under an update released Thursday by the state Department of Revenue. The rate had fallen in March to 15.5 cents, the lowest since May 2021.

The rate fluctuates because Indiana’s 7% sales tax on gasoline is calculated monthly, in addition to a flat tax of 34 cents a gallon directed to road projects that is poised to increase by a penny in July.

GOP gubernatorial candidate Curtis Hill has called for a reduction in the state’s gas taxes — a move that Republican legislators have rejected when sought by Democrats.

The new 18.9-cent sales tax rate will be the highest since November’s 20.3 cents.

The rate spiked to more than 29 cents a gallon in the summer of 2022 as gas prices soared following the Russian invasion of Ukraine.

After Republicans rejected calls from Democratic legislators in 2022 to suspend the gas sales tax temporarily, GOP fiscal leaders inserted a provision in the 2023 state budget bill that extended the annual one-cent increase in the flat tax for road projects.

That increase has been allowed each July since 2017, when a Republican-sponsored plan boosted it to 28 cents from 18 cents. The annual increase was set to expire in 2024, but it was extended until 2027.

The state government will collect a total of 52.9 cents a gallon from the two gasoline taxes for April (18.9 cents from the sales tax and 34 cents from the flat tax rate).

Hill, the former state attorney general, said during a candidates forum this week that the higher gas tax “has generated lots of revenue but has taken money directly out of the pockets of folks.”

“We can go back to 2018 levels and right away we can say 16 cents per gallon every time you fill up the tank,” Hill said. “That’s a small step in the right direction.”

Gov. Eric Holcomb has sided with Republican legislators who argue the gas tax revenue is needed to maintain the state’s highway construction program.

Holcomb said last week he wanted to hear more from the gubernatorial candidates about extending the state’s “20-year, $60 billion roads and bridges program.”

“We’re going to need more as our fuel taxes fluctuate,” Holcomb said.

Indiana’s combination of gasoline taxes gave it one of the five highest total state rates in the country as of last July, according to the Washington-based Tax Foundation.

Indiana’s pump price for gasoline has increased about a quarter per gallon in the past month. Tracking from AAA showed Friday’s state average gas price for regular unleaded was $3.51 a gallon, up from $3.23 a month ago.

Tom Davies is a Statehouse reporter for State Affairs Pro Indiana. Reach him at [email protected] or on X at @TomDaviesIND.

X @StateAffairsIN

Facebook @stateaffairsin

Instagram @stateaffairsin

LinkedIn @stateaffairspro

Know the most important news affecting Indiana

Get our free weekly newsletter that covers government, policy and politics that impact your everyday life—in 5 minutes or less.

Rokita, Morales push for citizenship review of nearly 600,000 voters

Democrats and voting-rights activists are lambasting a push by Indiana Attorney General Todd Rokita and Secretary of State Diego Morales for a federal agency to review the citizenship status of nearly 600,000 registered voters. The two Republican officials announced Thursday they made the request to the U.S. Citizenship and Immigration Services in a letter dated …

McCormick believes she’s on cusp of upset

Jennifer McCormick believes she is on the cusp of the biggest Indiana gubernatorial race upset since 1996. In an interview with Howey Politics Indiana/State Affairs Tuesday afternoon, the Democratic nominee said she is seeing energy from the issue of reproductive rights that will turn out her coalition. This comes a week after Republican nominee Mike …

Braun’s big plans for Indiana: Taxes, health care and IEDC’s future top the list

U.S. Sen. Mike Braun, the Republican candidate for Indiana governor, rolled out policy proposals on taxes, health care and other key issues in recent weeks. State Affairs sat down with Braun to drill down on the specifics of his plans and to ask him about the future of the Indiana Economic Development Corp. and his …

McCormick sees ways governor’s office can boost abortion rights

Democrat Jennifer McCormick is looking to use appointments to state boards and agencies — and even state Supreme Court justices — to help protect abortion rights if she is elected governor. McCormick renewed her emphasis on the issue Thursday with the release of a policy platform on steps she would take to protect abortion access …