Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a Demo

Rep. Peggy Mayfield, R-Martinsville, speaks on the Indiana House floor on Feb. 1, 2024. (Credit: Mark Curry)

A push to eliminate Indiana’s sales tax on tampons and other feminine hygiene products failed on the last day of this year’s legislative session without facing a vote.

Provisions exempting those products from the 7% state sales tax were included in a bill approved unanimously by the Indiana House earlier this week.

But supporters of the change said Friday it wasn’t included in any of the finance-related legislation negotiated between House and Senate Republicans during the session’s final hours.

Republican Rep. Peggy Mayfield of Martinsville, who sponsored the exemption in a House committee, told State Affairs she was encouraged that the proposal found its most support ever while still disappointed with the outcome.

“I knew it was hanging by a thread, but I still had my fingers crossed,” Mayfield said.

The exemption was projected to reduce state revenues by about $5 million a year, according to a legislative report.

Mayfield said she hopes objections to the tax elimination can be overcome next year as tampons and other feminine hygiene products are a necessity. She said eliminating the tax would have a minuscule impact on the state’s $22 billion general fund budget.

“It can’t be the cost — it’s like point 0001 [percent] is the cost,” Mayfield said.

The chief fiscal negotiator for House Republicans said the tampon tax issue was competing with others during the final hours of closed-door talks.

“The Senate had several things they didn’t go along with — that wasn’t the only one,” House Ways and Means Committee Chair Jeff Thompson said.

The proposed elimination would take effect July 1. Those products would join groceries and medicines in being untaxed.

Republican legislators have rejected multiple tries by Democrats over the past nine years to eliminate the tampon tax.

Indiana is among 21 states that charge sales taxes on feminine hygiene products, according to tracking by the Alliance for Period Supplies.

Democratic Rep. Carey Hamilton of Indianapolis praised the Republican agreement on the tax elimination earlier this week but said Friday she had received “noncommittal responses” about its fate.

“Once again, we’re not supporting women with common-sense public policy,” Hamilton said. “It’s long overdue.”

Senate Appropriations Committee Chair Ryan Mishler cited a Senate rule against unrelated topics being in a single bill for why the tampon tax exemption was removed from the legislation after a House committee had added it.

Mishler declined to throw his support behind keeping the exemption alive.

“Not at the top of my list,” Mishler said. “My phone’s not ringing off the hook.”

But even the relatively small $5 million sales tax revenue hit bothered Mishler because the Legislature isn’t taking up major fiscal matters after adopting a new two-year state budget in 2023.

“I don’t care what the tax is. What we’re taking the tax away from, that’s really not the biggest issue,” Mishler said. “It’s that it adds a fiscal [impact], and I try to hold tight on that the best I can.”

This story has been updated with failure of tampon tax elimination, additional comments.

Tom Davies is a Statehouse reporter for State Affairs Pro Indiana. Reach him at [email protected] or on X at @TomDaviesIND.

X @StateAffairsIN

Facebook @stateaffairsin

Instagram @stateaffairsin

LinkedIn @stateaffairspro

4 things to know about Braun’s property tax proposal

Sen. Mike Braun, the Republican candidate for Indiana’s governor, released a plan for overhauling property taxes Friday morning that would impact millions of Hoosiers, Indiana schools and local governments. “Nothing is more important than ensuring Hoosiers can afford to live in their homes without being overburdened by rising property taxes driven by rapid inflation in …

Bureau of Motor Vehicles looks to add new rules to Indiana’s driving test

The Bureau of Motor Vehicles wants to amend Indiana’s driving skills test, putting “existing practice” into administrative rule. Indiana already fails drivers who speed, disobey traffic signals and don’t wear a seatbelt, among other violations. Yet the BMV is looking to make the state’s driving skills test more stringent. A proposed rule amendment looks to …

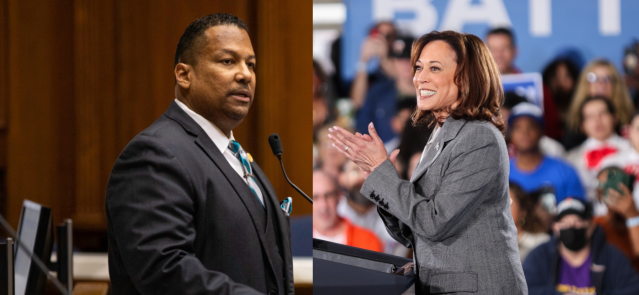

In Indianapolis, Harris says she’s fighting for America’s future

Vice President Kamala Harris, the presumptive Democratic presidential nominee, told a gathering of women of color in Indianapolis on Wednesday that she is fighting for America’s future. She contrasted her vision with another — one she said is “focused on the past.” “Across our nation, we are witnessing a full-on assault on hard-fought, hard-won freedoms …

Indiana Black Legislative Caucus endorses Harris, pledges future support

The Indiana Black Legislative Caucus unanimously voted Wednesday to endorse Vice President Kamala Harris’ presidential run and will look at ways to assist her candidacy, the caucus chair, state Rep. Earl Harris Jr., D-East Chicago, told State Affairs. The caucus is made up of 14 members of the Indiana General Assembly, all of whom are …