Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoGuest Column: A Plan to Save Social Security

U.S. Sen. Bill Cassidy

By U.S. Sen. Bill Cassidy

The Social Security Trust Fund is going broke in nine years. When it does, there will be a 23% cut in benefits for every current and future retiree.

About 10,000 Baby Boomers become eligible for benefits every day. When Social Security began, the average lifespan was 62; now it is nearly 80.

Families are having fewer children, meaning that fewer people pay into Social Security for each recipient compared to when the program started. And the money in the Trust Fund is only invested in Treasury notes, which have a poor return on investment.

Social Security is a pay-as-you-go system. As workers pay payroll taxes, monthly checks are sent to beneficiaries.

Any extra tax receipts are put in the Social Security Trust Fund and invested in Treasury notes. If there is not enough money coming in through payroll taxes to pay current obligations, then the money in the Trust Fund supplements tax receipts.

Unfortunately, the Trust Fund has been supplementing payroll tax income for so long that it will be insolvent in nine years. When this happens, by law, benefits will be cut by about 23% to match income, which will double the poverty rate among the elderly.

If current law is ignored and the federal government just borrows to pay benefits, the accumulated debt to the taxpayer will be approximately $560 trillion over 75 years. We need to find a comprehensive solution to save Social Security, but finding this solution means daring to touch the third rail of politics.

I am working on a solution with other senators called the “Big Idea,” which invests $1.5 trillion over five years into an investment fund separate from the Social Security Trust Fund. The fund would be invested into the U.S. economy, and any dividends would be reinvested and kept in escrow for 75 years.

The U.S. Federal Railroad Retirement System also was going insolvent in the 2000s, so Congress changed it to an investment fund like I am proposing. Now the fund is in the black.

Our “Big Idea” would repeal the automatic benefits cut, while the investment fund would also offset any borrowing required to pay benefits in the meantime. Combined with some relatively minor tweaks to the program, at the end of 75 years, all the accumulated debt would be paid off, and the Social Security program would be able to cover its obligations in perpetuity.

This also gives us a chance to address the Windfall Elimination Provision and Government Pension Offset, which penalize state and local government workers who also worked in the private sector. We would also repeal the “Retirement Earnings Test,” which mandates that if someone continues to work after beginning to draw Social Security, their monthly benefit check is reduced one dollar for every two dollars earned.

One of the most appealing aspects of the separate fund is that individual beneficiaries don’t have any risk and their benefits are paid no matter what. History shows we can expect a more than 8% rate of return on our investment, compared to Treasuries that only yield between 1-5%.

There would also be safeguards preventing future Congresses from meddling in the investment strategy. In short, the “Big Idea” is a much better investment for the American people.

Know the most important news affecting Louisiana

Get our free weekly newsletter that covers government, policy and politics that impact your everyday life—in 5 minutes or less.

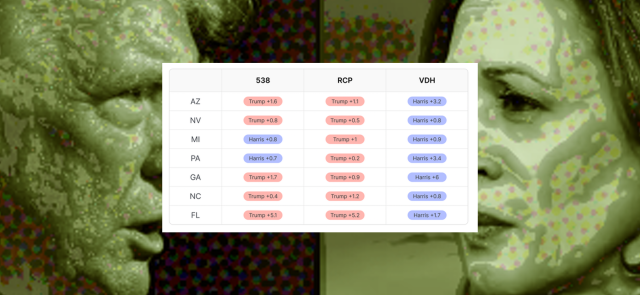

POTUS CHATTER: Would anyone from Louisiana be selected for another Trump administration? Additionally, will the presidential race end up being a “blowout,” or another close election?

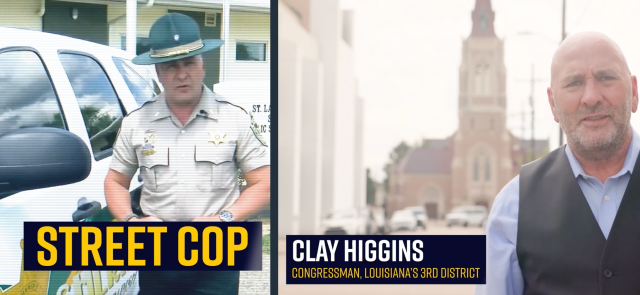

— GETTING CALLED UP: Will anyone from Louisiana be tapped to serve in another Donald Trump administration, should the former president win next month? According to Politico, both former Gov. Bobby Jindal and Congressman Garret Graves, who is not seeking re-election, are both in the mix. Jindal, who is buying ads on social media for …

Delegation Roundup (10.23.24)

— SCALISE ON THE WALL: Via Punchbowl: “House Majority Leader Steve Scalise said that the GOP would seek to fund construction of the border wall in a budget reconciliation package if Republicans keep their House majority, take the Senate and former President Donald Trump returns to the White House. Of course, all of this depends …

DUVALL: New farm bill crucial for all Americans, not just farmers

The farm bill is critical to the success of America’s farmers. It must be renewed every five years, and it provides farmers with a safety net to survive difficult times. Despite its importance, the farm bill expired in September 2023. Congress passed a one-year extension, but that too has now expired. You don’t need to …

Our History: Hurricane Rita

Hurricane Rita, the fourth-strongest Atlantic hurricane ever recorded, made landfall in the early-morning hours of Sept. 24, 2005. Rita reached a peak Category 5 intensity, with sustained winds of more than 180 miles per hour. It came ashore as a Category 3 in Cameron Parish just east of the Louisiana/Texas border, and was the strongest …