Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a Demo

Louisiana Gov. Jeff Landry, right, greets Rep. Raymond Crews, R-Bossier City, before giving his address in the House Chamber on opening day of the regular legislative session, Monday, March 11, 2024, at the Louisiana State Capitol in Baton Rouge, La.

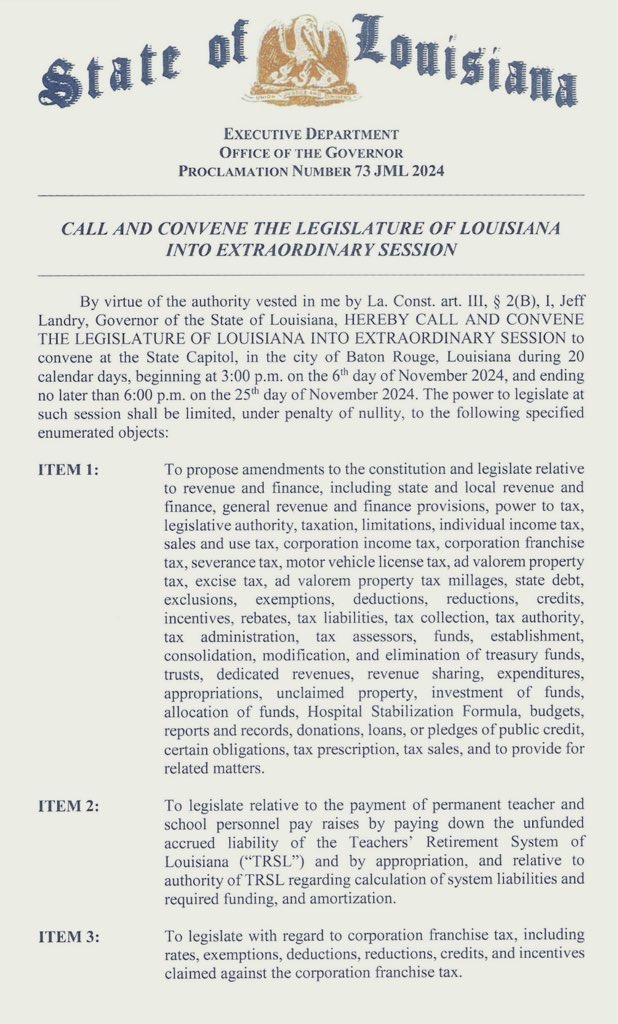

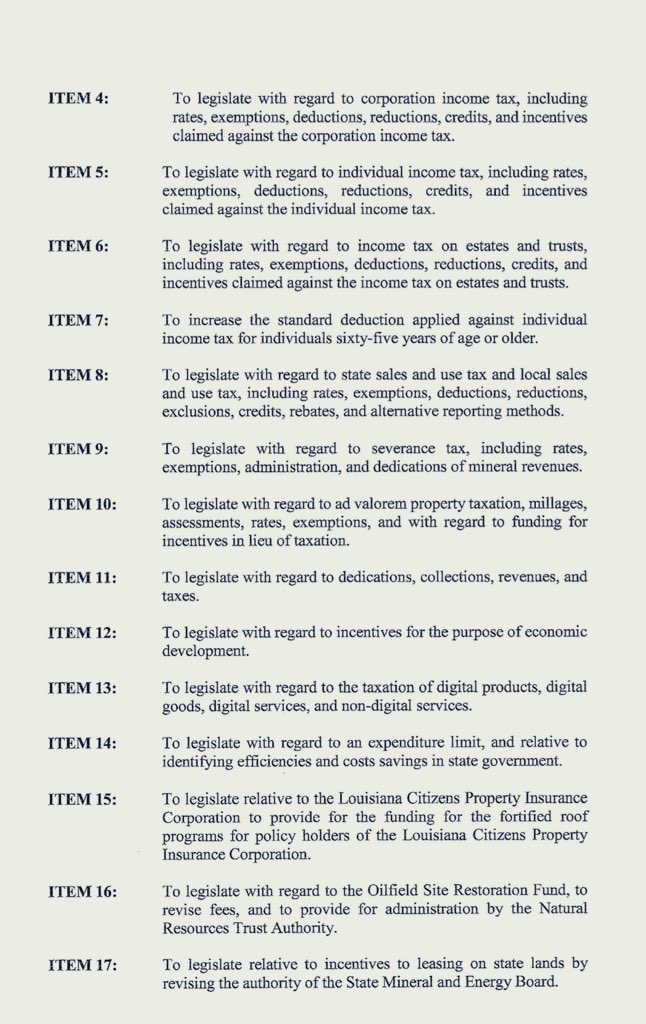

Gov. Jeff Landry finally issued his special session call on Saturday, setting the stage for a political and policy showdown over taxes that will test his influence and force what could be tough votes in the Legislature.

Senators asked for a slightly later start date than what was originally planed, with many not wanting to take a per diem on Election Day. Landry, is his proclamation, settled on Wednesday, Nov. 6 — the day after the presidential election.

Some senators still say they have serious fiscal-related questions about the package to lower income tax rates while expanding that state sales tax structure.

A wider swath of House members are ready to vote with Landry, but a segment of representatives interviewed Sunday found questions of their own in the call’s non-tax topics and one chairman at least said they were “unexpected.”

Alongside the tax items in Landry’s call are invitations for substantive changes in regard to the Judicial Branch; juvenile court procedures and crime; vocational education; and property insurance.

Landry wants as many yea votes as possible for his package, especially since it has to face voters after receiving legislative approval. Part of the Baton Rouge-based horse-trading may mean delivering on issues unrelated to taxes, hence the expanded call.

EXTRAORDINARY COVERAGE

— “Louisiana governor announces date for special tax session” by the Associated Press… This piece highlights the increasingly populist messaging being used by Gov. Landry, who described his policy package as “the first tax plan to reflect the people and not special interest.” On the concept of trading a robust sales tax structure for less income taxes, Landry added, “So your taxation will be driven by more about what you choose to buy, rather than by your labor. I think that’s fair. I hate the income tax… a man and woman’s labor should never be owned by the government.”

— “Jeff Landry issues formal call for tax special session beginning Nov. 6” by Tyler Bridges and Alyse Pfeil… Here’s a key graph that will be come part of the war cry for those opposed to the administration’s plan: “The plan would keep a regressive system where poor people pay a higher percentage of their income in taxes than the wealthy.”

— “Landry Administration provides more information about local impact of tax challenges” by David Jacobs… “Most parish governments could expect to bring in more combined sales and severance taxes than they’re collecting now under the new taxing regime Gov. Jeff Landry’s administration is proposing, according to estimates shared with lawmakers this week. The exceptions are five River Parishes (Ascension, Iberville, St. Charles, St. James and St. John) that would lose significant amounts of tax dollars they currently collect for manufacturing machinery and equipment…”

THE CALL

Know the most important news affecting Louisiana

Get our free weekly newsletter that covers government, policy and politics that impact your everyday life—in 5 minutes or less.

Socially Yours (10.29.24)

WEDDING BELLS Political pro Marie Centanni and Lafayette Assessor-elect Justin Centanni are celebrating 20 years together… Brenda Ellington and former Sen. Noble Ellington are toasting to 18 years… Elizabeth Allgood McKnight and former legislator Scott McKnight have notched 18 years, too… Plus Lindsey Stelly and Chris Stelly are celebrating another year together as well… HAPPY BIRTHDAY! — Tuesday, Oct. 29: Rep. Francis Thompson, Rep. Phillip Tarver, late Rep. Steve Carter and Bryan Jeansonne — Wednesday, Oct. …

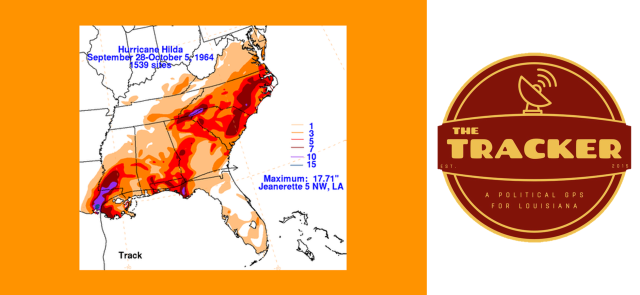

Our History: Hurricane Hilda

Hurricane Hilda made landfall in St. Mary Parish on Oct. 3, 1964. The storm first struck Cuba just prior to daybreak on Sept. 29, before entering the Gulf of Mexico later that morning. It would intensify rapidly, reaching peak wind strength of up to 150 miles per hour by Oct. 1. Thankfully, Hilda weakened to …

What You Missed in LaPolitics Weekly

Here’s what you may have missed in the latest issue of LaPolitics Weekly, published last week… — LOCAL CONCERNS: Gov. Jeff Landry’s administration is working to alleviate local concerns about his proposed taxing overhaul ahead of next month’s special session… — CASSIDY’S CASH: Sen. Bill Cassidy is flexing his fundraising muscle ahead of his 2026 …

Headlines and Bylines (10.29.24)

— The Advocate: Will massive Louisiana coastal project be allowed to die? Its future is now in question. — Illuminator: Former Louisiana state trooper avoids trial in beating death of Black motorist — The Advocate: Race for Baton Rouge judge pits state prosecutor against former City Court attorney — Illuminator: Gov. Landry’s tax overhaul depends on swapping income for …