Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

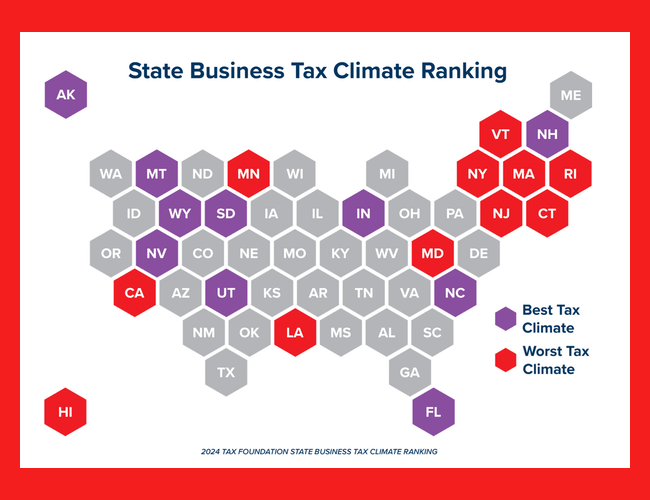

Request a DemoAn influential conservative think tank is planning a six-figure (mostly digital) media buy to support a fiscal overhaul for Louisiana that calls for a stronger expenditure limits and eventually phasing out income taxes.

The Pelican Institute for Public Policy says its plan could create 5,000 new jobs and $2 billion in economic growth in the first year.

“Budget restraint has to be part of any fiscal reform plan for the success of the state,” Pelican CEO Daniel Erspamer says by email. “This is a generational opportunity to get Louisiana’s fiscal house in order so that we can bring our kids and grandkids home and unleash economic opportunity.”

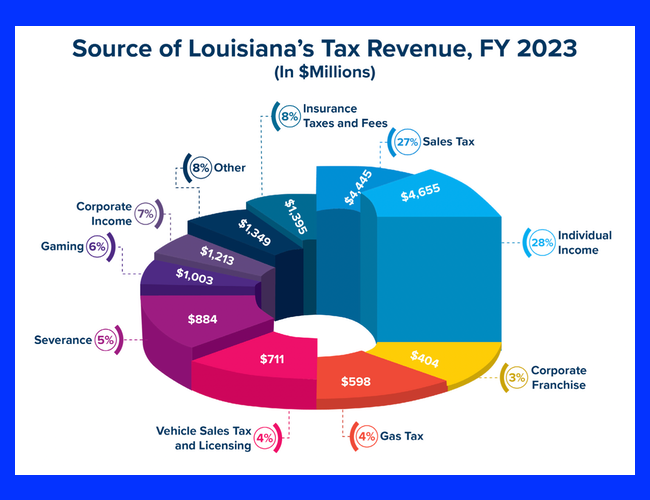

Phasing out the personal income tax would take about eight years, under the plan’s model. The first step would be replacing the current three-tiered system with a 3.5 percent flat tax and a $12,500 standard deduction.

Once the personal income tax is gone, the plan calls for phasing out the corporate income tax. Step one for the corporate side also would be a 3.5 percent flat rate, combined with the elimination of at least $500 million in tax preferences.

Other key proposals include eliminating the corporate franchise tax and establishing a spending limit that is more difficult to exceed and based on population growth and inflation.

“To further reduce complexity in the tax structure, while also helping to stabilize government revenues, it is important to consistently review all tax preferences,” according to a document that will soon be released publicly. “Lawmakers should immediately repeal at least $500 million in corporate tax preferences and all $114 million of the tax preferences associated with the corporate franchise tax.”

The proposal to implement a flat income tax rate, with an eye toward eliminating income taxes over the long term while broadening the tax base by cutting exemptions, seems compatible with what Revenue Secretary Richard Nelson has discussed publicly. Gov. Jeff Landry’s administration is hoping for legislative support to pass a tax overhaul package during a November special session.

Of course, getting people to agree to the broad outlines of a reform package is much easier than hammering out the details, especially when the beneficiary of a tax break or subsidy that could be on the chopping block has political influence.

On Thursday, the House Subcommittee on Ways and Means to study State Tax Structure will meet “to receive testimony from state and national organizations regarding the state’s tax and fiscal policies and their effect on job growth and state revenue collections.” (See the full schedule of meetings and agendas)

Know the most important news affecting Louisiana

Get our free weekly newsletter that covers government, policy and politics that impact your everyday life—in 5 minutes or less.

Guest Column: As term comes to an end, Congressman Graves is ‘running through the tape’

Diners, dives and … democracy. As a creature of habit, I frequently return to south Louisiana diners every time the U.S. House is not in session – unannounced and unscheduled – to get real-time, unvarnished perspectives from everyday folks. Constantly engaging folks where they are has proven more valuable than expensive polling and high-priced consultants, …

Our History: The death of Huey Long

When Gov. Jeff Landry opened this year’s redistricting-focused special session, he jokingly referenced the shooting of one of his predecessors. “Now I am aware Huey Long was shot over redistricting,” Landry said. “I am hopeful and confident we can dispose of this matter without you disposing of me.” On Sept. 8, 1935 Long, then a …

In Case You Missed it in LaPolitics Weekly

Here’s what you may have missed in the latest issue of LaPolitics Weekly, published last week… —PSC RACE HEATS UP: The race to succeed Republican Craig Greene, who chose not to stand for reelection, has been fairly quiet so far. But that’s about to change… —NEW CITY STILL A WORK IN PROGRESS: The founding of …

Headlines and Bylines (10.01.24)

—Illuminator: Landry boosts Medicaid payments to seven hospitals, four owned by donor, despite warning of health cuts —BRProud: FEMA money available for people in Louisiana after Hurricane Francine —The Advocate: Near Tiger Stadium, there’s a plan to dig into Louisiana’s energy future. Not everyone is a fan. —The Advocate: How the legal fallout from two …