Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoThe cost to make deviled eggs is sky high, and other ways inflation impacts you

A primer on the ins-and-outs of inflation

The Gist

Inflation is currently 7.75 percent in the U.S. and 10.6 percent in Georgia, and folks are feeling it. Whether you’re grocery shopping, apartment or house hunting, looking for a new car, or staring at your power bill, you are likely experiencing the rising cost of living.

But for something that’s so impactful on so many, it’s not so well understood. Some people blame inflation on the President, or on Congress. Others blame it on Russia, or even Gov. Kemp. The Federal Reserve raising interest rates seems to be the fix, but that’s bitter medicine, especially for those pursuing loans or carrying credit card debt.

We can’t promise inflation won’t crimp your budget into next year, but we’re offering a quick lesson on inflation and how it works.

So what is Inflation?

Inflation is the gradual increase over time in the price of goods and services throughout the economy. To measure it, economists compare the prices we pay today to what we paid in the past.

The rate of inflation is the percentage change in the price of goods and services throughout the economy. The Bureau of Labor Statistics (BLS) collects data on the costs of some 80,000 goods in mainly urban areas, where most Americans live, to come up with the Consumer Price Index (CPI), which measures the changes in prices paid by consumers over time for everything from food to transportation to healthcare.

For example, turkey prices this year are up 17% nationally over the same time last year, according to the BLS, which tracks prices of everyday items. The good news is that while Georgians will pay more for their turkeys, they likely won’t be hit with a full 17% increase due to Thanksgiving specials and price promotions offered by local retailers.

But eggs are a different story. The cost of a dozen eggs in the South last month was a whopping $3.12, up from an average of $1.63 in October 2021, according to the BLS.

An inflation rate of 2 percent is what federal monetary experts aim for to encourage maximum employment and price stability. This past summer, the U.S. inflation rate was more than quadruple that — at 9.1 percent Most economists expect it to fall steadily throughout 2023, and to reach about 3 percent by next fall.

What causes inflation?

Competing factors in the global economy influence inflation, and not everyone agrees on which ones matter most. But economists generally agree that it’s a function of supply and demand, and that there are two types of inflation:

- Demand-Pull Inflation occurs when there’s an increase in demand for goods and services but not a sufficient increase in supply. Businesses can’t increase their production quickly enough to meet the demand, and they raise prices. This kind of inflation often happens when unemployment rates are low and wages are high.

- Cost-Push Inflation occurs when there’s an increase in production costs for businesses. This may lead to decrease in total supply and a resulting increase in prices. This kind of inflation often occurs when the price of oil or other raw materials increase, making manufacturing operations more expensive. It can also be due to factors like natural disasters or major world events, such as the COVID-19 pandemic or the war in Ukraine, that disrupt supply chains and reduce the amount of goods available.

What can the government, and you, do about inflation?

The federal government has the most direct impact on inflation in the U.S. through its monetary policies. Its primary lever to curb inflation is to raise interest rates. When the Federal Reserve, America’s central banking system, increases interest rates (as it has six times this year), it makes it more expensive for consumers and businesses to borrow money. So people spend less, reducing demand. As demand drops, supply chains can catch up on production of goods and services, which in turn leads to a drop in prices.

The Federal Reserve can also reduce the amount of money in circulation, which lowers inflation.

Congress and federal agencies can also reduce inflation by raising taxes and investing in infrastructure — roads, bridges, ports, railroads, energy grids — and workforce development to improve supply chains and skilled labor needed to increase production of goods and services.

As for state governments, they don’t control interest rates, but they can have some impact, positive and negative, on inflation through budgetary and policy moves.

Cutting taxes and offering tax rebates and gas tax holidays, while popular with many state governors, won’t reduce and will likely exacerbate inflation, say some economists. These tax breaks bring short-term relief, putting more money in the hands of consumers, which in turn increases spending, further reduces supply, and drives up inflation.

As with the federal government, states that invest in the supply chain side of things can help keep goods and services flowing.

For example, in Georgia, recent investments by both the state and federal governments in the recent $1 billion deepening of the Port of Savannah and improvements in shipping container capacity at the port are improving the supply chain bottlenecks there, allowing more ships, containers, trucks and goods to pass through the port into warehouses and onto trucks, helping them to arrive at their final destinations more quickly and efficiently. In the long run, this increase in supply chain capacity reduces inflation.

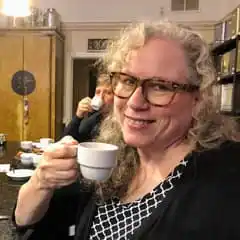

Consumers can help themselves by taking a hard look at their monthly spending habits, says Tom Smith, professor of finance at Emory University’s Goizueta Business School.

“I think most people don’t even know what they’re spending on each month,” he says. “Take a look at your cable or streaming subscriptions — how many do you really need? Are you still paying for a fitness club you never go to? Look at all the online content behind paywalls that you signed up for, like news sites that offered $1 introductory subscriptions that now cost $9 a month, and decide what you can do without.”

Other money-saving moves Smith recommends are shopping at lower-cost grocery stores like Aldi and Lidl, making your own coffee and sandwiches instead of buying them retail, cutting off nice-to-have services like landscapers and house cleaners, and putting off any big purchases like cars, large appliances or homes while prices and interest rates are so high. And if you currently have credit card debt, pay down as much as you can as fast as you can, “because with interest rates going up, that kind of debt just saps money away from you,” he says.

Join the Conversation

We’d love to hear your inflation stories. Share your thoughts/tips by emailing: [email protected]

Or join the conversation on Twitter at @StateAffairsGA, Facebook @STATEAFFAIRSUS or LinkedIn @STATEAFFAIRS

Read More

“Georgia Votes: Inflation remains top of mind for Georgians,” https://stateaffairs.com/ga/georgia-votes-inflation-remains-top-of-mind-for-georgians/

“Georgia Votes: Inflation remains top of mind for Georgians (pt. 2) https://stateaffairs.com/ga/georgia-votes-inflation-remains-top-of-mind-for-georgians-pt-2/

“Can we take the gas out of inflation in Georgia?” https://stateaffairs.com/ga/can-we-take-the-gas-out-of-inflation-in-georgia/

Header: More city dwellers are trying their hand at raising chickens. Adam Cabe of Dallas, GA enjoys maintaining his small backyard chicken coop to feed his family and friends. (Credit: Anna Reese)

Professionals still face licensing delays amid state’s transition to online system

The Gist Georgia’s professionals and business owners are still struggling to obtain professional licenses in a timely manner. As the Secretary of State’s Office rolls out its new Georgia Online Application Licensing System to expedite the process, the efficiency of this new process is being put to the test. What’s Happening Thursday morning at the …

Controversy over AP African American Studies class grows

Rashad Brown has been teaching Advanced Placement African American Studies at Atlanta’s Maynard Jackson High School for three years. He’ll continue to do so — even though the state’s top education official removed it from the list of state-funded course offerings for the upcoming school year. While Brown prepares to start teaching his class on …

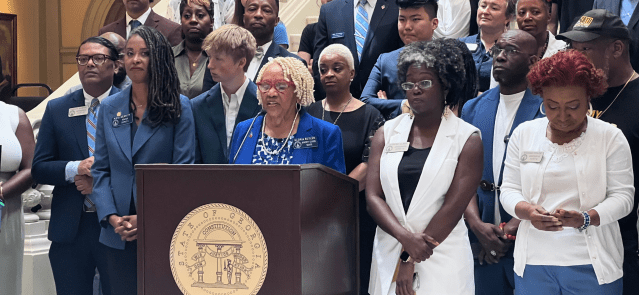

Students, teachers, lawmakers blast decision to end AP African American history classes

ATLANTA — A coalition of lawmakers, civil rights leaders, clergy, educators and students Wednesday called on the state’s education czar to rescind his decision to drop an advanced placement African American studies class from the state’s curriculum for the upcoming school year. “This decision is the latest attack in a long-running GOP assault on Georgia’s …

Kamala Harris’ presidential bid reinvigorates Georgia Democrats

Georgia Democrats have gained new momentum heading into the November election, propelled by President Joe Biden’s decision to bow out of his reelection bid and hand the reins to Vice President Kamala Harris. The historic decision, announced Sunday, is expected to prove pivotal in the national and state political arenas and breathe new life and …