Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoRun afoul of that HOA, your home could be at risk. And lawmakers know it.

Wanda Cooper poses in front of the Chestnut Hills entrance. (Credit: Wanda Cooper)

Gist

Some state lawmakers are attempting to address homeowner allegations that homeowner associations, better known as HOAs, are terrorizing property owners and in some cases threatening to take away their property.

No fewer than three bills have been introduced in the state Legislature this session to address the often contentious issue of homeowner and HOA rights.

Senate Bill 356, sponsored by Sen. Donzella James, D-Atlanta, would create an ombudsman who would serve as a mediator between dueling homeowners and their HOAs. The bill is currently in the Senate Judiciary Committee.

“This is a big issue because people’s homes are being taken from them,” said James, who began hearing complaints about HOAs a decade ago and who has three HOA-related pieces of legislation circulating through the Statehouse. “Also, they’re getting fined enormous amounts [at a time] when taxes have just gone up. Now, mortgage companies are even going up. So with all these costs, we need to put some kind of restrictions on HOAs.”

What’s happening

For Bryant Morris, legislation can’t come too soon.

Morris spent years “sleeping in 18-wheelers and couch-surfing” to save enough money to buy his dream house in 2018: a five-bedroom, four-bath, split-level abode in Covington, complete with a mini golf course in the backyard.

What was supposed to be an idyllic life has turned out to be five years of legal hell for Morris after he asked his homeowners association why his HOA fee was increased, and a few other choice questions: Who was heading the homeowners association? Was the HOA legit? And who voted to raise his annual fees?

Instead of getting answers, the 59-year-old homeowner was slapped with a lien totaling nearly $6,000. For a time, he feared he’d lose his home.

“I’m in my house [in my bed at night] with my pistol on my chest, scared that somebody’s going to kick my damn door in, ready to take me out of my house,” said Morris, whose fears about having his home taken were assuaged after a conversation with county officials.

Morris initially paid his HOA fees when he first moved in but stopped after he was unable to get answers to his questions. He says he repeatedly tried to meet with HOA board members but was told they were “inaccessible and unavailable.” In the end, the association worked out a payment arrangement for Morris to pay off the fees. His final installment is in March.

The whole experience, Morris said, was “very retaliatory” and gave him a glimpse into a legal process that he says has given HOAs unfettered power.

“It literally is going to have to be an entire restructuring of the hierarchy of the power ,” said Morris, who has spent the last five years delving into the inner workings of HOAs in Georgia. “The power needs to be put back in the hands of the homeowners and not in the hands of the investors and developers. This is power out of control.”

The United States is home to an estimated 365,000 community associations. Nearly a third of Americans — some 75.5 million people — live in a homeowner association community, according to the Foundation for Community Association Research. That’s up from about 2.1 million in 1970. New homes that are part of a homeowner association are growing fastest in the southern and western part of the country.

An estimated 2.2 million — roughly 22% — Georgia residents live in an HOA or some other type of community association, according to the Community Association Institute. They pay about $3.8 billion a year toward the upkeep of their communities and nearly 75,000 people serve as volunteer leaders in their community associations. By 2040, community associations are expected to become the most common form of housing in Georgia.

More people are opting for HOAs because they provide amenities like swimming pools, tennis courts and fitness centers. They also reduce homeowner responsibilities such as snow removal and community upkeep.

But increasingly, an ugly side to HOAs has emerged. For example, if an HOA doesn’t have cash reserves to cover expenses, it can impose assessments to come up with the money, according to the Community Association Institute. Historically, many HOAs are underfunded, which has led them to hike dues or seek ineffective outside funding when unexpected costs arise, according to Enterprise Bank & Trust, which suggested HOAs should try to maintain a 70% funded reserve.

Stories about people losing their homes after falling behind on HOA fees — despite being current on their mortgages — abound. In other cases, people have been hit with liens and fees that often mushroom into thousands of dollars.

Real estate broker David Washington specializes in helping people faced with foreclosure to stay in their homes.

“Georgia is a creditor-friendly state,” Washington told the Senate Urban Affairs Committee last September. “The state’s legal code related to rent ‘“is not designed for if life happens,’ ” he said. Even if over a 30-year period a homeowner has a sterling payment history, an HOA does not take costly life events into account the way that some loan companies do, offering forbearance, he noted. “Whether it’s COVID, a car accident, a divorce, a death — if you owe $5,000 to an HOA, they will foreclose on you. And the law allows it.”

That type of homeowner vulnerability prompted James to seek some solutions.

“I’ve heard of a number of cases where they’ve taken people’s homes,” James told State Affairs. She recalled one couple whose condo was auctioned on the courthouse steps after they racked up a $1,000 lien.

“They were refusing to pay the HOA fees because they were having problems with the water,” recalled James, chair of the Senate Urban Affairs committee, which has held hearings about HOAs over the last year.

It’s been nearly two years since an HOA forced Wanda Cooper out of the Douglas County home she had owned for 15 years.

“My life has not been the same since the HOA did what they did to me,” Cooper told State Affairs. She and her youngest two children have had to move three times since then. She now lives in Carrollton.

The run-in with the HOA was among a series of setbacks Cooper has had in the last five years. Prior to her HOA troubles. Cooper had sold her Douglasville home to investors to get money to enable her to recover from the effects of a botched surgery. As part of the sale, she was allowed to stay in the home and pay rent. But she ended up being hit with a series of fines for parking on the street, overgrown grass, and having a flat tire on her car. She said she even received a $775 bill from the HOA for a towing job that never occurred. The HOA fines wound up totaling $1,501.40 and the organization eventually put a lien on the home, prompting the investors who owned Cooper’s home, to evict her in April 2022. In the midst of all of that, Cooper’s mother who was living with the family during COVID-19, died.

“It turned my life upside down. It’s a serious domino effect,” Cooper, a 56-year-old legal researcher, said. “At the time, I had an excellent rental history and a 701 credit score. Now no one is going to want to rent to me, my credit score has plummeted, and on top of that, I’m dealing with depression and I’m still dealing with the loss of my mom.”

Why It Matters

Complaints about HOAs come as Georgia lawmakers are taking up other housing-related matters this legislative session. The General Assembly is considering bills that would create more affordable housing to help the state attract more workers; provide safer, more inhabitable places and rent control for apartment dwellers to live; and better oversight on housing conditions.

“The more attention we’re placing in general on housing, the more clear it became that we need … to focus on homeowners and HOAs because we don’t want to see people [put] out of their homes,” said Sen. Sonya Halpern, D-Atlanta, a member of the Urban Affairs Committee.

While other housing issues have garnered more and broader attention, HOAs are an issue in “pockets” of the Legislature.

“There are those of us in the Legislature who are very, very aware of the problems that our constituents are having related to HOAs,” Halpern said. “I don’t know if it’s kind of an overwhelming issue where all 236 of us in the Georgia General Assembly are focused on it. But it is a problem, and it is a growing problem. And we do need, as a state, to position ourselves to help people get into homes, stay into homes, keep their homes. And in this case, the HOAs that are not being run properly really are wreaking havoc on homeowners. And, and sometimes that’s leading to the homeowners actually losing their homes and having it sold out from under them.”

“The way HOAs have been conceived and developed, they do have a lot of power,” Halpern conceded. “It’s the reason why this particular bill [SB 356] tries to create some guardrails around what they can do, what they can’t do, and how they need to actually operate. And part of the problem is there really is not a clear line of oversight to HOAs.”

Here’s what James’ three pieces of legislation would do:

SB 356 also would ban HOAs from imposing liens that would immediately cause a homeowner to lose their homes.

SB 29 would limit the ways homeowners, condo and property associations can penalize people for nonpayment of fees, and requires them to seek arbitration before placing liens on a property. The bill is in the Senate Judiciary Committee.

Senate Resolution 37 would create a study committee which would take a comprehensive look at the policies and practices of HOAs and other such property associations. It’s in the Senate Rules Committee.

What’s next?

James’ bills face a lot of hurdles.

Crossover Day — the deadline when bills must pass one chamber to the other in order to still be in the running to become law –– is Feb. 29, a little over a week away.

State Affairs reached out to Sen. Brian Strickland, chair of the Judiciary Committee, and Sen. Matt Brass, head of the Rules Committee, to get a sense if James’ legislation will be considered in their respective committees. Neither legislator returned calls or emails by press time. So it’s unclear what the fate of these pieces of legislation will be.

Nonetheless, James is optimistic. “All of them are alive,” she said. “We’re just trying to move them.”

Senior Investigative Reporter Jill Jordan Sieder contributed to this article.

TYPES OF COMMUNITY ASSOCIATIONS

Here’s is a breakdown of the percentage of residential property types by association types:

Homeowner Association — 60%

Condo Communities — 38%

Co-ops — 2%

HOA LOCATIONS

This table shows homeowners associations, by U.S. region, for new construction homes:

Region New construction*

West 71%

South 70%

Midwest 52%

Northeast 38%

* 2021 data

Source: U.S. Census

WHAT HOA RESIDENTS PAY

Here are the mean monthly HOA fees for major metro areas in the United States. Note: These are a small sampling of fees. Fees can range from as little as $50 a month to over $1,000 a month.

- Atlanta: $117

- Boston: $444

- Chicago: $312

- Dallas: $98

- Detroit: $114

- Houston: $127

- Los Angeles: $366

- Miami: $283

- New York City: $653

- Philadelphia: $171

- Phoenix: $148

- San Francisco: $390

- Seattle: $189

- Washington, D.C.: $193

Source: American Housing Survey

BUYER BEWARE: What to know before you sign on the dotted line

- Read all legal documents so you know what you’re entering into contractually.

- Review the HOA or condo association budget. How much money does the association have in reserve? If it’s zero, that’s a red flag. Ask what percentage of owners aren’t paying.

- Be aware of the differences between homeowner associations and condo associations. If you’re late on your condo fee, a lien can be automatically attached to your unit. HOAs generally must file liens with the court.

- Be leery about buying a foreclosed home in an association or subdivision with few owners and lots of vacancies. You could get stuck paying for the pool and other expenses originally meant to be spread among a lot of owners.

- If you buy your property, keep records of your payments.

- If you have trouble paying your dues/fees, tell the HOA or condo association you’re having problems. Many associations are willing to work with members who are facing financial hardship due to illness or job loss.

- Try to work out a payment plan before going to court.

- Seek legal advice. But be aware, you may not have much legal recourse.

- If you do reach an agreement on back dues, pay it quickly.

Have questions? Contact Tammy Joyner on X @lvjoyner or at [email protected].

And subscribe to State Affairs so you do not miss an update.

X @StateAffairsGA

Facebook @StateAffairsGA

Instagram @StateAffairsGA

LinkedIn @StateAffairs

Professionals still face licensing delays amid state’s transition to online system

The Gist Georgia’s professionals and business owners are still struggling to obtain professional licenses in a timely manner. As the Secretary of State’s Office rolls out its new Georgia Online Application Licensing System to expedite the process, the efficiency of this new process is being put to the test. What’s Happening Thursday morning at the …

Controversy over AP African American Studies class grows

Rashad Brown has been teaching Advanced Placement African American Studies at Atlanta’s Maynard Jackson High School for three years. He’ll continue to do so — even though the state’s top education official removed it from the list of state-funded course offerings for the upcoming school year. While Brown prepares to start teaching his class on …

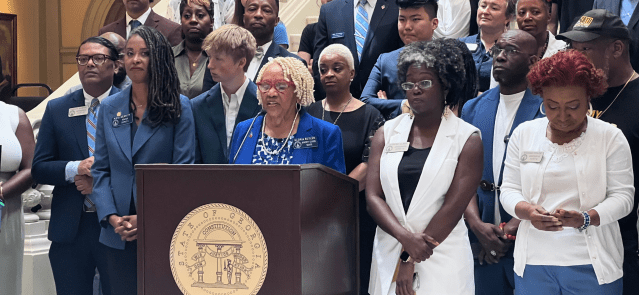

Students, teachers, lawmakers blast decision to end AP African American history classes

ATLANTA — A coalition of lawmakers, civil rights leaders, clergy, educators and students Wednesday called on the state’s education czar to rescind his decision to drop an advanced placement African American studies class from the state’s curriculum for the upcoming school year. “This decision is the latest attack in a long-running GOP assault on Georgia’s …

Kamala Harris’ presidential bid reinvigorates Georgia Democrats

Georgia Democrats have gained new momentum heading into the November election, propelled by President Joe Biden’s decision to bow out of his reelection bid and hand the reins to Vice President Kamala Harris. The historic decision, announced Sunday, is expected to prove pivotal in the national and state political arenas and breathe new life and …