Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a Demo

Credit: Office of Gov. Brian Kemp

The Gist

What would you do with $5 billion that you didn’t expect to land in your lap?

That’s what Georgia’s governor and state lawmakers are asking after raking in a record $5 billion surplus of state tax revenues through June 2022. State Affairs’ analysis shows the huge money pot could go a long way toward hiring more K-12 teachers, fixing roads or filling taxpayers’ wallets amid sky-high inflation – depending on what state officials choose to do in January.

What’s Happening

Georgia has an unprecedented surplus to pump into its more-than $30 billion state budget — which pays for public schools, colleges, prisons, Medicare, mental health, police, state government workers and that is used to fight the Covid-19 pandemic, among many other services.

Totaling $5 billion, the surplus can fund any number of things the state already pays for – from raising teacher and state worker salaries, to staffing up prisons and juvenile detention centers facing guard shortages, to widening heavily trafficked highways and replacing worn-out bridges.

“There’s going to be a lot of options on the table,” state Georgia House Appropriations Chairman Terry England (R-Auburn), who has led lawmakers’ efforts to shape annual state budgets in the General Assembly for more than a decade.

The surplus can also be handed back to Georgia taxpayers as state tax refunds. Gov. Brian Kemp and state lawmakers already did so this year, returning more than $1 billion from last year’s roughly $2.3 billion surplus. Democratic gubernatorial nominee Stacey Abrams has pledged to give another $1 billion in refunds to taxpayers if she beats Kemp, a Republican, in November.

Georgia is sitting on a record-setting roughly $5 billion budget surplus after collecting more revenues from state taxes than expected in the 2022 fiscal year. (Credit: Brittney Phan for State Affairs)

Spending $5 Billion: Let Us Count the Ways

Public Schools

The $5 billion surplus could allow Georgia’s public K-12 and charter schools to hire around 22,000 new teachers and fund starting salaries for their jobs for the next five years. That would round out to an average of 10 additional teachers in every school across the state.

The surplus could also give a pay bonus of at least $6,000 to all Georgia school teachers, administrators and staff like bus drivers and janitors each year for the next five years. That would add to a $5,000 pay hike school employees have received over the last three years.

Low pay is a common reason why many new Georgia teachers quit the profession within their first five years, said Lisa Morgan, president of the Georgia Association of Educators.

“We know there is a teacher shortage,” Morgan said. “We know there is also a problem of teacher burnout and educators leaving the profession.”

Spending on Georgia’s k-12 and charter schools has tripled over the past 25 years and outpaced the increase in student enrollment. (Credit: Brittney Phan for State Affairs)

Hiring more teachers and paying their salaries for years are tough sells for some lawmakers like England, who see this year’s $5 billion surplus as a potential blip on the radar stemming partly from people spending Covid-19 relief checks they’ve received during the pandemic.

Local schools also have many more needs than just hiring more teachers, said Margaret Ciccarelli, legislative affairs director for the Professional Association of Georgia Educators. She said many schools need more counselors, literacy programs, loan-forgiveness plans for teachers and funds to replace old buses – all of which cost money, Ciccarelli said.

“Those areas should be triaged first if we’re trying to figure out how to incentivize educators to fill those positions,” Ciccarelli said.

State Workers

The $5 billion could fund hiring around 25,000 new state government workers and keep them employed at a median pay rate of around $39,000 annually for the next five years. That could help plug staffing gaps at key agencies overseeing Georgia prisons, which have lost nearly half their workforce since 2018; and juvenile detention facilities, which have lost 25% of staff.

The full surplus could also give a one-time pay bonus of at least $10,000 for each of the next five years to all the more than 70,000 employees working in Georgia’s state government. That could help reverse the current high employee turnover in areas such as prisons, mental-health services and driver services.

“Turnover continues to create service delivery challenges due to unplanned lost productivity, increased burdens on staff, recruiting costs, training costs and impacts to organizational morale,” said the state Department of Human Services’ most recent workforce report.

Many of Georgia’s top state agencies serving millions of people saw large turnover in the 2021 fiscal year. (Credit: Brittney Phan for State Affairs)

Again, hiring thousands of new state workers from surplus tax revenues likely won’t fly for lawmakers concerned about paying their salaries after the surplus runs out.

But Kemp and the General Assembly have shown an appetite for one-time bonuses as incentive for turnover-prone employees to keep their jobs. They approved $5,000 bonuses for most state workers in this year’s budget, drawing praise from many agency heads.

England, the House appropriations chairman, hinted budget drafters could go the bonus route again with this year’s surplus.

“We’ve still got a lot of [budget] adjustments to be made for our rank-and-file employees to get them up to market rate,” England said.

Roads & Bridges

The $5 billion could repair or replace nearly 200 bridges in Georgia, based on State Affairs’ analysis of costs for bridge projects listed in recent state Department of Transportation records. That would make a dent in fixing the roughly 1,400 state-owned bridges deemed in fair or poor condition as of last year.

The surplus could also chip away at around $70 billion in construction projects state transportation officials have planned up until 2050 to repair, widen and replace thousands of miles of roads, bridges and highways across the state – particularly along trucking corridors.

“If there’s excess revenue to be invested in transportation, I think the freight and logistics and supply-chain infrastructure space would be a good place to look,” said Seth Millican, executive director of the Georgia Transportation Alliance.

Georgia’s bridges are aging beyond their average 50-year lifespan across the state. (Credit: Brittney Phan for State Affairs)

It’s tough to predict how many road and bridge repairs Georgia could add to its project roster with the surplus, given construction costs have gone up 30% recently due to inflation, Millican said.

Georgia is also losing out on around $150 million to $175 million each month in revenue from the state’s gasoline tax, which Kemp suspended in March as inflation caused gas prices to spike. The gas tax helps pay for road construction and maintenance projects, which are set to cost the state around $1.7 billion this year.

Due to inflation-driven unpredictability, England says the smart move may be to devote some of the surplus to buying right-of-way land along highways that state transportation officials would like to widen into more lanes in the coming years.

“Whatever the land price is today, I promise you it’ll be higher 10 years from now,” England said.

Tax Refunds

The $5 billion surplus could simply be returned to Georgia taxpayers as tax refunds. Based on Kemp’s last round of refunds, Georgians could get back up to around $1,250 for single filers, $1,875 for single-filer heads of households with dependents and $2,500 for married couples filing jointly.

That’s the quick and easy way to deal with the surplus, said Tibor Besedes, economics professor at the Georgia Institute of Technology. Refunds would also leave the state off the hook for funding ongoing costs from any teacher or state government workers newly hired from surplus dollars, he said.

“Especially given their fears of a recession coming, I don’t think the state wants to increase permanent funding,” Besedes said.

Prices for gas and groceries like milk, bread, meat and eggs have shot up in Georgia and across the U.S. over the past year. (Credit: Brittney Phan for State Affairs)

A big tax refund would undoubtedly be popular, but it could also potentially worsen inflation if many Georgians go on spending sprees with their refund checks, Besedes said. The U.S.’s swollen money supply – driven largely by consumers spending money from federal Covid-19 relief – is a main cause of the current high inflation, Besedes and other local economists say.

Still, Besedes said he expects the popularity of tax refunds to trump debate over whether they should be given out. It’s likely just a matter of how much Georgia officials will devote to a tax refund from the surplus, he said.

“There’s a lot more one can do with this much money,” Besedes said. “But refunds are the easiest way to do it because you can get rid of the money.”

Join The Conversation

How do you think Georgia’s $5 billion surplus should be spent? Share your thoughts/tips by emailing [email protected].

Read State Affairs’ continued coverage of the budget surplus in Georgia:

Kemp Vows To Return Portion of Budget Surplus to Georgians

Georgia’s Record $5B Budget Surplus Sets Up High Stakes Legislative Session

Professionals still face licensing delays amid state’s transition to online system

The Gist Georgia’s professionals and business owners are still struggling to obtain professional licenses in a timely manner. As the Secretary of State’s Office rolls out its new Georgia Online Application Licensing System to expedite the process, the efficiency of this new process is being put to the test. What’s Happening Thursday morning at the …

Controversy over AP African American Studies class grows

Rashad Brown has been teaching Advanced Placement African American Studies at Atlanta’s Maynard Jackson High School for three years. He’ll continue to do so — even though the state’s top education official removed it from the list of state-funded course offerings for the upcoming school year. While Brown prepares to start teaching his class on …

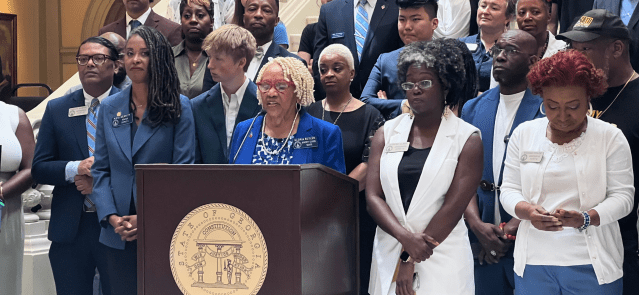

Students, teachers, lawmakers blast decision to end AP African American history classes

ATLANTA — A coalition of lawmakers, civil rights leaders, clergy, educators and students Wednesday called on the state’s education czar to rescind his decision to drop an advanced placement African American studies class from the state’s curriculum for the upcoming school year. “This decision is the latest attack in a long-running GOP assault on Georgia’s …

Kamala Harris’ presidential bid reinvigorates Georgia Democrats

Georgia Democrats have gained new momentum heading into the November election, propelled by President Joe Biden’s decision to bow out of his reelection bid and hand the reins to Vice President Kamala Harris. The historic decision, announced Sunday, is expected to prove pivotal in the national and state political arenas and breathe new life and …