Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoThe Gist

Flush with billions in cash and a AAA bond rating, Georgia faces a pivotal moment in its fiscal future.

For more than a quarter of a century, Georgia has maintained an enviable reputation when it comes to managing its money. That’s how long the Peach State has had a AAA-bond rating from the U.S.’s top three credit-rating agencies. In layman’s terms, that’s like having an 850 credit score that gets you the best interest rate when buying a car or home. Similarly, the state of Georgia gets the best rates when borrowing money or issuing bonds to build things like roads, prisons, or buildings on a college campus.

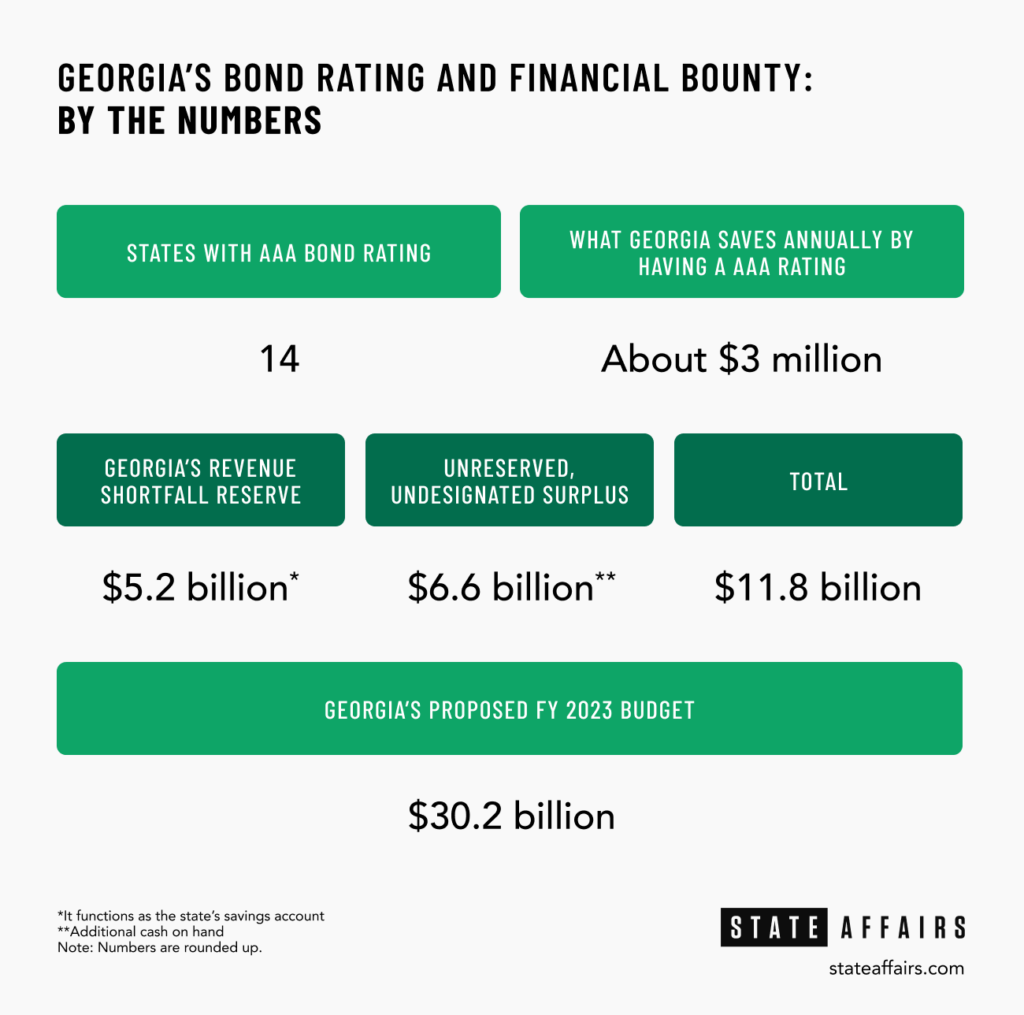

Currently, only 14 states belong to the AAA bond rating club.

“The fact [that] we have maintained these coveted ratings for so long is a testament to our conservative approach to budgeting and governance, our pro-business policies, and especially the hardworking Georgians who make up our robust workforce,” said Gov. Brian Kemp, adding, “Job creators will continue to bring opportunities to the Peach State because they, like the rating agencies, know we are a safe bet.”

That safe bet is buoyed by nearly $12 billion sitting in state coffers — $5.2 billion in the state’s Revenue Shortfall Reserve and another $6.6 billion in unreserved, undesignated surplus.

With the 2023 legislative session set to convene in less than a month and the state’s fiscal year 2023 budget slated for fine-tuning, some say it’s a good time for the state to review how it sets its budget — and how it spends, or doesn’t spend, its money.

What’s Happening

While Georgia’s reveling in its stellar credit-rating and record $12 billion surplus, some state agencies have been operating in recent years with smaller budgets and fewer full-time staff. Education and health care, for instance, bore the brunt of budget cuts in fiscal year 2021 to the combined tune of nearly $1 billion.

“Undeniably, our current level of spending is much lower than what we’re collecting, and what we’re likely to continue to collect in tax revenue,” said Danny Kanso, director of legislative strategy and senior fiscal analyst at The Georgia Budget & Policy Institute.

Kanso, who wrote a report in August analyzing the state’s record surplus, said the state “has considerable room to adjust its revenue estimate upward,” to spend more.

But fiscal conservatives point to the money the state has spent: $1 billion for 10 months worth of gas tax holidays and another $2 billion in income tax rebates and cash assistance to low-income residents who receive Medicaid, PeachCare for Kids, Supplemental Nutrition Assistance Program or the state’s Temporary Assistance for Needy Families.

In addition, Kemp is promising another tax refund in 2023, pending legislative approval.

While the state is flush with cash that state officials insist is necessary to address unforeseen emergencies, Georgians are struggling with the fallout of inflation and are facing a possible recession next year.

The question for some, then, is: Why should I care?

The Frugal Uncle

Think of Georgia as a frugal uncle who’s lived below his means for years even when times didn’t call for it. He pays for that fishing trip or vacation with cash, not credit — much to the chagrin of his family who needle him about his frugalness.

When times get tough, this frugal Georgian keeps trips to the grocery store and utility usage to a minimum, and as such, his austerity has helped him build a healthy savings and a respectable investment portfolio while also socking away money for emergencies. In addition, his carefulness and frugality has enabled him to maintain an impeccable credit score that affords him the best interest rate on the family’s mortgage.

“The state does a good job of not biting off more than it can chew when it comes to spending,” said Kyle Wingfield, president and chief executive of the Atlanta-based conservative think tank Georgia Public Policy Foundation. “The bond rating agencies believe the state is well-managed. It also reflects that we have a very stable fiscal environment.”

State government bond ratings give banks and other lenders a sense of whether a state or municipality can pay its debts. The higher the rating — AAA is the highest — the less chance of default. Georgia has had a AAA bond from the three major rating agencies — Fitch Group, Moody’s Investor Services and Standard and Poor’s — for more than 25 years. In addition to bragging rights, Georgia’s stellar credit rating allows the state to get the best possible rates when it goes to market to sell state bonds.

Tony West, deputy state director for Americans for Prosperity Georgia, agrees. “It’s an enviable position to be in,” West said. “It shows most of the country that we carefully manage the people’s money.”

As Georgia’s fiscal economist, Jeff Dorfman is one of Kemp’s key advisors. The state’s cautious money management is sacrosanct, he says.

“One thing that’s very important, and the governor insists on this, is it [spending the reserves] has to be a one-time thing,” Dorfman said. “We can’t take these extra monies and spend them on an annual recurring thing because then when the money’s gone, now you’re burdening the taxpayers and you’re gonna have to raise taxes to keep paying for that.”

Explains Dorfman, “That’s why we’re looking at water and sewer systems and rural broadband and a lot of things like that where we can pay upfront costs with the money we have now. If we can do infrastructure investments and lower our ongoing expense structure, this is our ultimate goal.”

Why It Matters

In August, the Georgia Budget and Policy Institute (GBPI), a liberal Atlanta-based nonprofit that analyzes tax policies and proposed budgets, released a report on the state’s record surplus.

“The state has prioritized growing surplus accounts over funding for programs, services and workforce,” states the August 2 report, “With Record Surplus, Georgia Stands at a Crossroads Ahead of Pivotal Budget Session,” written by Kanso.

Even though Georgia is expected to see continued revenue growth, it continues to spend less per resident than it did before the Great Recession 14 years ago, Kanso wrote in the report. “Even after accounting for a potential economic recession and the effects of tapering federal spending, it appears that consecutive years of conservative revenue estimates have compounded such that Georgia could raise significantly more than it currently plans to spend in the upcoming year.”

According to the report, in fiscal year 2023, Georgia plans to spend about $1.3 billion less, or about $121 less per resident, than it did before the Great Recession, when Georgia’s budget was upended by spending cuts the state made in response to weakened revenue collections.

The report urged state leaders “to make long-deferred investments and make up ground lost to over a decade of austerity.

“This means that even if state revenue collections come in below the revenue estimate set by the governor, Georgia’s existing reserves are almost certain to be more than sufficient to cover the difference,” the report said.

When asked if Georgia is hoarding money, Kanso replied: “that remains to be seen in how we are going to adjust [the budget] in the upcoming legislative session.”

Former state lawmaker Eric Johnson sees it differently.

“You’ve got to be prepared to have some savings for your emergencies,” Johnson, former president pro tem of the state senate, told State Affairs. “The economy is booming now, but I’ve been through two downturns where we’ve had to cut and that’s a painful process. Look how long it took to get the education funding back up.

“The state’s got the resources now but everybody’s anticipating a recession in the next year or so. You’ve got to be able to live through the downturns without the minimal amount of cuts to programs,” said Johnson.

While Georgia’s large surplus is not usual, this year’s record surplus has emerged from other unexpected circumstances.

Georgia – like the rest of the country – saw unprecedented surpluses last year, thanks to a booming stock market that led to higher-than-expected tax revenues, especially in capital gains taxes, Dorfman said.

“The stock market did tremendously well in 2021. In April 2022 when everybody filed their 2021 taxes, we collected an extra $3 billion in capital gains taxes on stock market profits. And literally, I mean that came in like a week or so right around the filing deadline.

“It happened to every state and to the federal government,” he added. “Everybody got more taxes than they predicted because of the stock market profits.”

Billions in federal pandemic aid also helped grow reserves.

Of the $5.2 trillion the U.S. government committed in response to the pandemic since early 2020, about one-sixth went to state governments for the public health emergency and to boost their economic recovery, according to Pew Trust. The federal government gave more than $800 billion in grants to states through six pieces of COVID-19 legislation. Georgia received more than $17 billion in COVID-related relief.

States saw their collective rainy day funds grow by $37.7 billion, about 50 percent from the previous year, “driving the total held among all states to a record of $114.6 billion,” according to Pew.

What’s Next

While it’s tempting to take the $12 billion surplus and splurge, “We don’t just spend the money because we have the money,” Dorfman said, citing California as a cautionary tale.

Flush with a record $98 billion surplus last year, California now faces a $25 billion deficit next fiscal year. “They gave a ton of it away and they spent a lot of it, including some on continuing expenses, and as our [U.S.] economy slowed down, they got less revenue than they thought and now they’re short,” Dorfman said, adding, “We certainly don’t need to have $12 billion to get the AAA bond rating because we had it when we had $2 billion but we’re much better off with the larger reserves we have now.”

A AAA-rating is so sacred that some states refuse to spend their largesse for fear of losing their impeccable standing.

Research by Pew found that “even in states with the highest rating, policymakers often are unsure about how best to manage their rainy-day funds to earn or keep high credit ratings. As a result, some state officials are reluctant to tap reserves even during recessions for fear of a ratings downgrade.”

Former Baltimore state Sen. Barbara Hoffman said in Pew’s 2017 report, “Rainy Day Funds and State Credit Ratings”: “We never use ours, and that’s one of the reasons we have a triple-A rating in good economic times and bad.”

Maryland is one of the 14 states with a AAA rating. In addition to Georgia and Maryland, the other states are Indiana, Delaware, Iowa, Florida, Tennessee, South Dakota, Virginia, North Carolina, Utah, Texas, Virginia and Missouri.

William Ratchford, former director of the Maryland General Assembly’s fiscal services department, noted in the report that to most legislators, the purpose of the rainy-day fund is to maintain the AAA rating. “If we have future needs, we’ll deal with that. But it’s never been, ‘Well we can always use the rainy day fund.’ It just isn’t how they approach it,” he said.

But Georgia’s not going to keep its $12 billion reserves forever, Dorfman said. “We’ll take our time and spend it wisely and make sure we are very clear-eyed and realistic in our revenue forecasts.”

In Case You Missed It

TEACHERS, BRIDGES, TAX REFUNDS: WHAT GEORGIA’S $5 BILLION SURPLUS CAN BUY

GEORGIA’S RECORD $5B BUDGET SURPLUS SETS UP HIGH STAKES LEGISLATIVE SESSION

Have questions or comments about the state’s AAA bond rating? Contact Tammy Joyner on Twitter @LVJOYNER.

And Subscribe to State Affairs today!

Twitter @STATEAFFAIRSGA

Facebook @STATEAFFAIRSUS

LinkedIn @STATEAFFAIRS

Professionals still face licensing delays amid state’s transition to online system

The Gist Georgia’s professionals and business owners are still struggling to obtain professional licenses in a timely manner. As the Secretary of State’s Office rolls out its new Georgia Online Application Licensing System to expedite the process, the efficiency of this new process is being put to the test. What’s Happening Thursday morning at the …

Controversy over AP African American Studies class grows

Rashad Brown has been teaching Advanced Placement African American Studies at Atlanta’s Maynard Jackson High School for three years. He’ll continue to do so — even though the state’s top education official removed it from the list of state-funded course offerings for the upcoming school year. While Brown prepares to start teaching his class on …

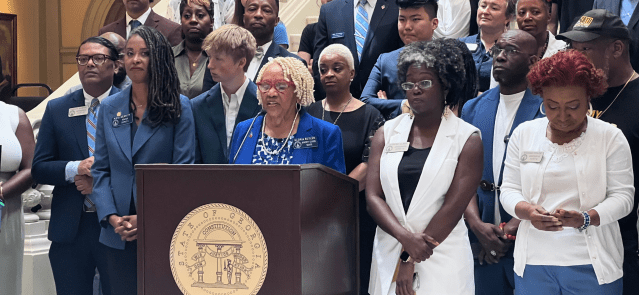

Students, teachers, lawmakers blast decision to end AP African American history classes

ATLANTA — A coalition of lawmakers, civil rights leaders, clergy, educators and students Wednesday called on the state’s education czar to rescind his decision to drop an advanced placement African American studies class from the state’s curriculum for the upcoming school year. “This decision is the latest attack in a long-running GOP assault on Georgia’s …

Kamala Harris’ presidential bid reinvigorates Georgia Democrats

Georgia Democrats have gained new momentum heading into the November election, propelled by President Joe Biden’s decision to bow out of his reelection bid and hand the reins to Vice President Kamala Harris. The historic decision, announced Sunday, is expected to prove pivotal in the national and state political arenas and breathe new life and …