Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoHolcomb touts record-breaking capital investment numbers every year. They may not be the whole picture.

Commerce Secretary David Rosenberg, left, and Gov. Eric Holcomb during an Indiana Economic Development Corp. board meeting on Dec. 14, 2023. (Credit: Mark Curry)

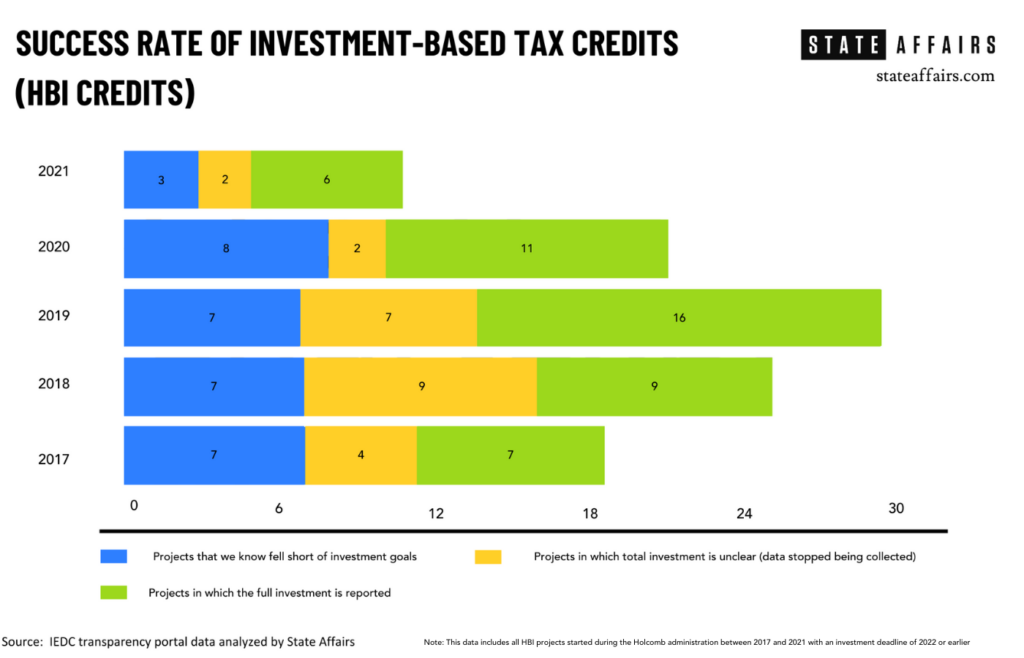

- At least one out of every three projects in which a company committed to making a capital investment in exchange for a Hoosier Business Investment tax credit didn’t meet their investment targets. The number could be closer to 56%.

- Oftentimes, companies received their full tax credit before they met the investment commitment numbers listed in their contracts, due to ambiguous contract language.

- The IEDC’s transparency portal was riddled with errors, from missing contracts to inaccurate investment numbers.

Editor’s note: This article is part of a State Affairs and Fox59/CBS4 series looking at how decisions get made at the Indiana Economic Development Corp. and how it impacts economic development in the state. The IEDC has faced increased scrutiny due to its involvement with Boone County’s LEAP Lebanon Innovation District and because two gubernatorial candidates are former IEDC leaders. Read our first story here.

Update Jan. 16: After State Affairs’ story published, Secretary of Commerce David Rosenberg released the following statement:

“Despite weeks of communication and detailed explanation, this story fails to accurately convey how the HBI tool – or any economic tool for that matter – operates. HBI is typically just one incentive offered to a company committing to locate or grow in Indiana. HBI was only utilized as part of an incentive package in approximately 19% of deals in 2023.

“To be clear, not a single tax credit or dollar goes to a company without the company delivering on a committed investment to earn that tax credit or dollar. Truly the definition of performance-based incentives, as we’ve said many times. The implication there is taxpayer waste is false and intentionally misleading.

“Companies’ plans change regularly based on market conditions and other factors outside of the IEDC’s control. The incentives from the IEDC reflects these changes accordingly. Again, performance-based incentives.”

Original: At the beginning of 2021, Gov. Eric Holcomb did what he does every year: He boasted about a “record-breaking year” for economic development in Indiana, despite COVID-19 throwing the state’s economy for a loop.

In a news release at the time, the Indiana Economic Development Corp. listed off company after company that committed to investing in Indiana, including Thor Industries, an RV manufacturer expected to invest more than $23 million and create 300 jobs.

That never happened. The project was canceled, according to the IEDC, before any tax credits were awarded. This time, though, there would be no press release or information on which companies followed through with their capital investments.

Holcomb and the IEDC routinely share statistics on job commitments and investment promises from companies before the projects begin, using that information to convince the Indiana General Assembly to dedicate a growing amount of tax dollars to economic development.

But the quasi-government agency is far less transparent when it comes to the outcomes of projects, often refusing to disclose companies’ total investment or job creation numbers.

An investigation by State Affairs and Fox59/CBS4 found that one of the IEDC’s economic development programs is falling short of its goals. At least one out of every three projects in which a company committed to making a capital investment in exchange for a Hoosier Business Investment tax credit didn’t meet its investment targets.

But even that statistic is a low estimate.

As many as 56% of the projects could fall into that category. But the public wouldn’t know.

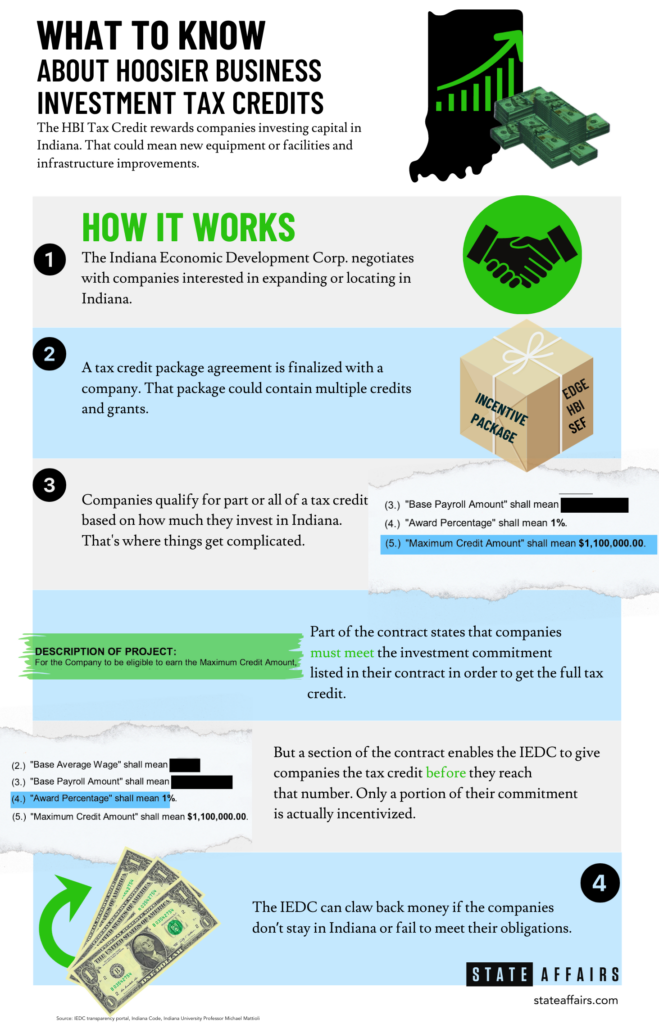

The IEDC routinely stops publicly tracking projects’ qualified investment amounts — money used for things such as new equipment, infrastructure improvements or new facilities in Indiana — before the companies meet their goals. The Hoosier Business Investment credit, or HBI, provides one of the only public glimpses into which companies are meeting their goals.

The investigation by State Affairs and Fox59/CBS4 also found:

- Companies in one out of five HBI contracts were able to receive the full tax credit before they met the investment commitment numbers listed in their contracts, due to ambiguous contract language.

- The IEDC’s public-facing transparency portal contained numerous mistakes, including consistently mislabeled statistics, eight missing contracts and 14 cases of inaccurate investment data— all of which make it challenging for the public to hold the state agency accountable.

- Had the companies we know fell short reached their investment goals, they would have invested an additional $1.2 billion of capital in Indiana. Again, that number could be higher when including the projects in which the IEDC stopped publicly tracking qualified investment.

And if these companies aren’t meeting their investment goals, they could be falling short in other areas, such as job creation.

Greg LeRoy regularly looks at contracts as executive director of Good Jobs First, a nonprofit watchdog organization that tracks subsidies for economic development. He found State Affairs and Fox59/CBS4’s findings concerning.

“Sharing projected investment numbers but not actual outcomes over time makes ‘disclosure’ hollow,” LeRoy said. “Anyone can add up their press releases and spin a happy story.”

Holcomb defended his decision to regularly share investment commitment numbers, rather than true investment numbers.

“Happy to supply you with our batting average and our track record and the businesses that first commit and then build,” Holcomb told reporters on Monday. “It is equally impressive, and I would be proud to tout that as well.”

Following his comments Monday, Holcomb’s office did not provide the dollar amount of actual 2023 capital investment tied to any economic development projects when requested. And the IEDC, whose leadership is appointed by the governor, has also declined to provide any documentation showing the number of jobs created and amount of dollars invested on capital for each active project.

Almost all of that information is hidden by government leaders from Hoosier taxpayers in the name of protecting the business interests and trade secrets of the companies that receive public subsidies. A consequence of that secrecy, though, is that it’s often impossible to confirm how many companies are meeting their obligations. The same people who brag about job creation are the ones tasked with oversight.

The IEDC did not grant State Affairs an interview on the topic despite multiple requests. Instead, Erin Sweitzer, a spokesperson for the agency, answered questions and defended the success of the IEDC through multiple emails.

“It’s all positive for the state since it’s a portion of new taxes generated,” Sweitzer said. “Pulling down, say 80%, of an award is not a bad thing or an indication of the program’s lack of success or utility — it’s tied directly to a company’s success, and as we know, there are a number of factors that could change or slow down a company’s plans, oftentimes outside of their control.”

Even if a company invests only a portion of what they expected, that’s still new investment in the state of Indiana.

Not meeting goals

In Holcomb’s final State of the State speech this week, he boasted that the IEDC had attracted a “jaw-dropping” $28.7 billion worth of committed capital investment from companies.

“That’s called ‘Indiana Momentum’ and we’ve got a lot more coming,” he said in his speech.

In press releases, speeches and meetings, Holcomb and the IEDC always share the investment commitment numbers — sometimes either omitting or not clarifying that the numbers are just that: loose commitments.

Democrats particularly have criticized what they view as a lack of transparency.

“We’re dealing with public dollars going to public companies, and there needs to be a level of accountability and scrutiny of those dollars,” said Rep. Greg Porter, an Indianapolis Democrat who serves on the State Budget Committee. “It is truly troubling that we hear of those commitment numbers, but we don’t see the real results.”

The State Affairs analysis showed that at least 98 of 277 HBI projects fell short of their investment goals. (Again, that number could be higher).

To determine the IEDC’s success rates, State Affairs pulled every HBI tax credit contract from a state transparency portal that started between 2012-2022 with an investment deadline of 2022 or earlier. Reporters then compared the “qualified investment commitment” listed in the contract to the “actual qualified investment” number on the portal itself.

Some companies missed the mark by a little, and others by millions of dollars. Some examples:

- In 2016, Oh Pharmaceutical Co. signed a contract committing to invest $18 million worth of qualified investment in Lake County. IEDC records show the company invested only $66,000 by the deadline.

- Toray Resin Company signed a 2020 contract promising nearly $8 million worth of qualified capital investment in Shelbyville. The company invested less than $500,000.

- In 2016, Nello Inc. committed to investing $12 million in South Bend. The company spent less than two thirds of that.

- Nice-Pak products signed a 2021 contract to invest $155 million-worth of qualified investment in Morgan County. The company spent 1/14th of that commitment.

None of those companies received their full tax credit because they didn’t reach their goals. Sweitzer said the state doesn’t view the rate of projects that don’t meet their goals as failures.

“Incentives awarded to companies are essentially the following: The company grows, generating new state sales tax, payroll withholdings taxes, and assessed value at the local level, and the IEDC issues a percentage of that new revenue back to the company,” Sweitzer said. “So that company’s growth creates a path for incentives, and that path only exists after the company performs. “

But other companies did receive the full tax credit before reaching their goals.

Discrepancy in the contract

Lehigh Cement Company located in small town Mitchell was supposed to spend $430 million on qualified investment. According to one part of the contract the state signed, the company shouldn’t have received a $1.1 million tax credit until the company reached that number.

“For the company to be eligible to earn the maximum credit amount … the company will make a qualified investment as defined in Indiana Code § 6-3.1-26-8 (“Qualified Investment”) of at least the Qualified Investment Commitment,” the contract states.

But, the company, now operating as Heidelberg Materials, got the full credit when the company hit near the $260 million mark — north of $160 million dollars less than expected.

So did more than 50 other HBI projects.

That’s because of a discrepancy in the contract, according to Indiana University contract law professor Michael Mattioli. Another part of the contract detailing how many dollars worth of tax credits a company gets per dollar of investment enables a company to get all of its money before it reaches its goals.

Put simply: The state only incentivizes a portion of a company’s investments, which means a company can fall short of its goal and still get the maximum credit.

“That discrepancy seems like it really erodes the incentive for a company to meet the [full] commitment if they know they’re going to get the same amount of money for putting in less,” Mattioli said. “What does it mean to commit to spend $430 million if you’re going to receive the same amount of money in the end, if you spend half of that or less than half?”

LeRoy, likewise, said the contract language was unusual.

“This is supposedly on its face a performance based incentive which is supposed to be clean and easy to enforce. If the company falls short, well it gets a little haircut.” he said. “But the way this is structured with that wiggle language in there, it looks like we get back to the same squishy language problem.”

Once companies receive the maximum tax credit, the IEDC stops tracking the amount of qualified investment each company spends, which is why we may never know if more than 50 companies ever reached their investment goals. Sweitzer said the IEDC still tracks total capital investment, but that’s not the number tied to the tax credit, nor is it a number that’s made public.

She defended the contract language.

“IEDC incentive agreements accurately reflect the mutual understanding of the parties,” Sweitzer said. “It is reasonable that a third party who is not familiar with the intricacies of these programs and their associated agreements could misinterpret the substance and intent.”

(Story continues after graphic)

Transparency concerns

Some lawmakers have filed legislation in the past asking for more transparency from the IEDC. But in a legislature dominated by Republicans, the same party that controls the IEDC, those proposals haven’t moved.

“We just want to be accountable to Hoosiers,” said Porter, the Democrat who serves on the State Budget Committee. “We need to be good trustees, good stewards of taxpayer money.”

The way Democrats see it, there is a silver lining to the HBI credits: There’s some transparency.

In recent years the state legislature has given the IEDC more money with fewer restrictions. Last year, for example, the General Assembly approved a $500 million deal-closing fund that the IEDC can use as a sweetener to entice companies to expand in Indiana.

Unlike the HBI tax credit, there’s no specifications in state law regarding what a company must do to get that money.

Multiple bills concerning the IEDC have been filed this legislative session, including one from Senate Democratic Leader Greg Taylor, D-Indianapolis, requiring the state to disclose all records “related to taxpayer funded economic development incentives.”

But such legislation likely won’t go anywhere. Republican leadership haven’t shared the same concerns as Democrats, pointing to annual IEDC reports showing some statistics, such as the total number of jobs created by companies that contract with the IEDC.

“Happy to entertain information and suggestions around [increasing transparency],” Holcomb told the press, “but IEDC has been extraordinarily successful over the last few years of bringing a ton of great economic activity to Indiana. We don’t want to do anything that doesn’t support that.”

Contact Kaitlin Lange on X @kaitlin_lange or email her at [email protected].

Facebook @stateaffairsin

Instagram @stateaffairsin

LinkedIn @stateaffairs

4 things to know about Braun’s property tax proposal

Sen. Mike Braun, the Republican candidate for Indiana’s governor, released a plan for overhauling property taxes Friday morning that would impact millions of Hoosiers, Indiana schools and local governments. “Nothing is more important than ensuring Hoosiers can afford to live in their homes without being overburdened by rising property taxes driven by rapid inflation in …

Bureau of Motor Vehicles looks to add new rules to Indiana’s driving test

The Bureau of Motor Vehicles wants to amend Indiana’s driving skills test, putting “existing practice” into administrative rule. Indiana already fails drivers who speed, disobey traffic signals and don’t wear a seatbelt, among other violations. Yet the BMV is looking to make the state’s driving skills test more stringent. A proposed rule amendment looks to …

In Indianapolis, Harris says she’s fighting for America’s future

Vice President Kamala Harris, the presumptive Democratic presidential nominee, told a gathering of women of color in Indianapolis on Wednesday that she is fighting for America’s future. She contrasted her vision with another — one she said is “focused on the past.” “Across our nation, we are witnessing a full-on assault on hard-fought, hard-won freedoms …

Indiana Black Legislative Caucus endorses Harris, pledges future support

The Indiana Black Legislative Caucus unanimously voted Wednesday to endorse Vice President Kamala Harris’ presidential run and will look at ways to assist her candidacy, the caucus chair, state Rep. Earl Harris Jr., D-East Chicago, told State Affairs. The caucus is made up of 14 members of the Indiana General Assembly, all of whom are …