Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoGov. Holcomb weighs in on whether income tax should be eliminated ahead of session

Gov. Eric Holcomb talks to State Affairs about the upcoming legislative session. (Credit: Kaitlin Lange)

As Gov. Eric Holcomb prepares to release his final two-year budget, he’s not saying much about his political future or whether he’ll jump into a Senate race as he gets term-limited out of office.

State Affairs recently sat down for a one-on-one interview with Holcomb to discuss how he wants to spend taxpayers’ money in the upcoming session, his thoughts on a Democratic lawmaker’s plan to nix unconstitutional language in Indiana law that bans same-sex marriage and if the state should eventually nix the personal income tax.

The conversation is edited for clarity, brevity and length.

The upcoming budget

Q. The state’s revenue forecast showed about $600 million additional per year, over the next two years. Sen. Ryan Mishler said there’s already $700 million worth of agency requests, and capital projects are already over budget. Do you think fully funding the public health commission’s $243 million financial request makes sense and is doable even in the second year of the two-year budget? If so, how will you balance the different requests for money, READI grant money and any K-12 budget increases?

A. I think it’s important to keep in context that we’re operating off of a budget in the $18 billion range, and now we’re looking at [2024 revenues] in the $20 billion range, and $21 billion in fiscal year 25, so we’re operating off a budget that was much lower than [the revenues] that we have.

The quick answer is yes, we can implement our public health recommendations financially. That’s $120 [million] in the first year and $240 [million], as you alluded to, in the second year and ongoing. But we also have to keep in mind the impact inflation has had on certain projects that we contemplated.

The April forecast will be even more important than this one. But, my budget team was thinking [the revenues were] going to be even lower than the revenue forecasters presented. So, we’re pleased with where we are, and we think that we can meet our priorities. Those centrally revolve around economic development and education and workforce development and both public and personal health and wellbeing.

This comes from a compassionate origin or source, but also a competitive source, and we just don’t have the luxury as a state of Indiana — not very many people do — of leaving anyone on the sidelines. We have to get smarter and healthier if we want to compete and meet these high-wage, high-demand jobs that are wanting to come to the state of Indiana.

But we want to make sure we’re growing 10 years from now, and that means we’ve got to double down and triple down on literacy, so we’ll be pushing for increases in public education as well, not just to throw more money at it.

I am encouraged that leaders and members of the General Assembly are wanting to see the information that [the public health commission compiled]. We got representation on this commission that did a really deep dive, and said we’d been doing it one way for 100 plus years. How should we be doing it today? The state of Indiana has at its disposal certain expertise and resources that local communities just don’t have. So how do we partner? How do we do that smartly? How are we transparent about it? How do we measure it?

And I think those [questions] will answer legislative concerns that are rightly placed, quite frankly. I agree with them that we’re not trying to write a $240 million check and go, ‘There, our work is done. We lead the horse to the water. Now it will drink.’ But we do know there are gaps. And we do know there are hurdles and barriers, that if we do a better job, we will not just out-cooperate but we’ll out-compete some of the competition, and it’s fierce.

Q. You signed a bill that eliminated the utility receipt tax earlier this year. A Democrat pointed out that that money could have almost paid for the implementation of the public health recommendations. Do you still think that tax elimination, as well as the income tax cuts, were a smart move now that revenues are plateauing and capital project expenses are increasing?

A. I think it was the right move, not just at the time but going forward. We’re cutting personal income taxes as we sit right now as well, and it is a real strength to be a low-cost state to, not just live, but to do business. In times of global inflationary pressure, where we can reduce costs makes us even more attractive.

There’s a reason why we’ve been able to grow our economy, from a GDP perspective, and just an ongoing revenue perspective in terms of how we then fund public health and education. We’ve added over $3 billion to public education since I was sworn in. We don’t get to do that unless we grow the pie, grow the revenue.

Part of the reason businesses are coming here is because we’re a low-cost state, [both] tax and regulatory, because we offer great sites and because we offer access to high talent. It’s not an either, or. You could say that all day long about, ‘Well if we wouldn’t have done this, then we could have.’ But low cost is very attractive to people who are wanting to grow.

Potential income tax elimination

Q. Republicans in the Senate say that they want to look at potentially eliminating the personal income tax in Indiana, years down the road. Is this something that you think the state should pursue?

A. Cautiously. I think it’s something that states should discuss. I’ve heard about this conversation for years now. When I sat on the other side of this desk and worked for someone, I heard this being bantered around.

One of the advantages that Indiana has is a regulatory and tax structure that is very consistent, certain and helps you weather the tough times maybe better than some other structures. So, I have always asked, ‘If you eliminate that tax, what do you replace it with or what do you live without?’ That’s the part that really needs to be digested and discussed.

If you want to say we want to compete with states who don’t have personal income tax, well don’t compare Indiana’s property taxes with Texas, who is one of our fierce competitors, but they have higher taxes in other areas. So do you want to tell the homeowner, ‘Well, we’re gonna triple your property taxes, because we’re gonna get rid [of income taxes?’

Q. Do you have an answer for what would replace that revenue or what you would get rid of?

A. No, because we’re out competing and winning right now in the tax structure that we have. And by the way, we just reduced our corporate taxes and we are reducing right now our income taxes, so long as we continue to grow. And those are very persuasive.

Same-sex marriage

Q. A Democratic lawmaker is filing a bill to remove the unconstitutional language in Indiana code that prohibits same-sex marriages. Do you think that language should remain in state law?

A. The law is invalid. This is a very hypothetical question that’s been resolved at the federal level, at the Supreme Court level. I know there was a justice that commented on it. But I think his issue has been resolved, and no action is needed.

COVID-19

Q. Fellow Republicans criticize you the most for your handling of the pandemic. What is your biggest regret from that time period?

A. I don’t have any regrets, honestly. This was such a new, unprecedented experience for almost anyone living to have gone through, unless you were around in 1918. There’s such a difference between the legislative branch and the executive branch that it was almost inevitable that there would be a collision. There was with Democratic governors and Democrat legislatures and Republican governors with Republican legislatures.

It was almost unavoidable, because it was such a rare, unprecedented occurrence, that there would be some disagreement. We even disagreed on the constitutionality [of whether or not lawmakers could call themselves back for a special session during an emergency], an honest disagreement. Fortunately, that was resolved at the Supreme Court level.

Obviously, the good news is this: We had this discussion with a campaign underway. Now it wasn’t a typical campaign because I just said, ‘I’m gonna let my work speak for itself.’ But citizens expressed their approval or disapproval, and that turned out okay.

When you sail through a storm, it’s at its worst. Sometimes in hindsight, when you look back and there’s not as much emotion feeding off of other emotions, you tend to think, okay, we got through that. We balanced lives and livelihoods, and we emerged out of it better than many, quicker than many [other states]. So I’m proud of our team and I’m proud of the local health departments.

And so any slings and arrows that we might have gotten in the past is in the past.

Holcomb’s political future

Q. Speaking of campaigns, are you considering a Senate run?

A. Not right now. I’m not going to let anything interfere with my focus, and my focus right now is the budget session that’s upon us.

Q. Does that mean you’ve ruled it out?

A. I haven’t ruled anything out or in. I’ve told multiple people from different walks that have expressed an interest or asked me to think about something, I’ve literally told 100% of them the same thing so that if one talks to the other they will get the same response. If you need an answer now, I’m not your guy. And that’s what I’ll continue to tell people, and I mean it.

What Holcomb is listening to

Q. Do you have Spotify or Apple Music? Do you know what your top song on Apple Replay is?

A. Well that’s a good one. Can I give you the top three?

Q. Sure.

A. That’s funny. That’s the first time I’ve ever gotten this.

It’s Pearl Jam’s “Alive.” “Right Now” Van Halen, two. “Feeling stronger Everyday” by Chicago.

Contact Kaitlin Lange on Twitter @kaitlin_lange or email her at [email protected].

Twitter @stateaffairsin

Facebook @stateaffairsin

Instagram @stateaffairsin

LinkedIn @stateaffairs

4 things to know about Braun’s property tax proposal

Sen. Mike Braun, the Republican candidate for Indiana’s governor, released a plan for overhauling property taxes Friday morning that would impact millions of Hoosiers, Indiana schools and local governments. “Nothing is more important than ensuring Hoosiers can afford to live in their homes without being overburdened by rising property taxes driven by rapid inflation in …

Bureau of Motor Vehicles looks to add new rules to Indiana’s driving test

The Bureau of Motor Vehicles wants to amend Indiana’s driving skills test, putting “existing practice” into administrative rule. Indiana already fails drivers who speed, disobey traffic signals and don’t wear a seatbelt, among other violations. Yet the BMV is looking to make the state’s driving skills test more stringent. A proposed rule amendment looks to …

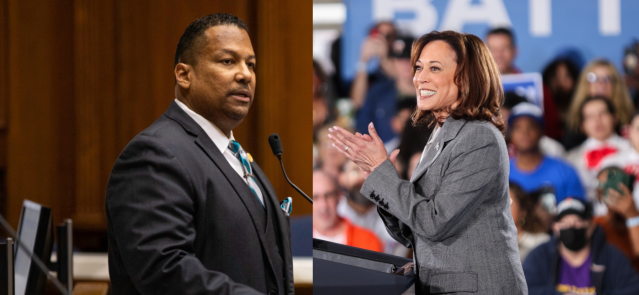

In Indianapolis, Harris says she’s fighting for America’s future

Vice President Kamala Harris, the presumptive Democratic presidential nominee, told a gathering of women of color in Indianapolis on Wednesday that she is fighting for America’s future. She contrasted her vision with another — one she said is “focused on the past.” “Across our nation, we are witnessing a full-on assault on hard-fought, hard-won freedoms …

Indiana Black Legislative Caucus endorses Harris, pledges future support

The Indiana Black Legislative Caucus unanimously voted Wednesday to endorse Vice President Kamala Harris’ presidential run and will look at ways to assist her candidacy, the caucus chair, state Rep. Earl Harris Jr., D-East Chicago, told State Affairs. The caucus is made up of 14 members of the Indiana General Assembly, all of whom are …