Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoGov. Holcomb signs property tax relief bill, but don’t get excited — yet

Gov. Eric Holcomb signed a complex 50-page bill Thursday that would provide some property tax relief for homeowners amid rapidly rising tax bills — but largely not until 2024.

House Bill 1499 could save homeowners across Indiana more than $100 million in 2024, according to a fiscal analysis performed by the Legislative Services Agency. But some Democrats critiqued Republicans for not providing more relief sooner. The new law won’t impact property taxes that are due this month.

Still it passed both chambers, receiving only one no vote.

“We know right now from data that we’re going to see more than likely a repeat again in 2024,” said bill author Rep. Jeff Thompson, R-Lizton, “and this is the time to take care of homeowners in the following year.”

What the new law does

The final bill does the following:

- It limits how much local governments’ budgets can grow in 2024 and 2025, which curbs how much total costs get passed onto taxpayers.

- The legislation temporarily increases the supplemental homestead deduction for property taxes due in 2024 and 2025, which means Hoosiers will pay less in property taxes on their primary home.

- The bill allows counties to provide additional property tax relief if the county’s fiscal body chooses to as early as this fall.

- It enables more Hoosiers 65 years and older to qualify for a deduction from the assessed value of their home, which is used to calculate how much they owe in property taxes. Under the bill, there will be a cost of living increase each year to the income ceiling for determining who qualifies for the deduction.

- More Hoosiers 65 years and older would also qualify for an additional tax credit.

- The legislation clarifies the property tax appeals process.

- The bill also limits the amount by which a school corporation’s existing operating referendum tax levy can increase in 2024.

Some of the tax burden would be shifted onto other property taxpayers in the short term. In 2024, for example, the total tax collection on business equipment is expected to increase by $39 million in 2024 due to the property tax changes in the bill. But by 2025, all property classes will start to see the benefit.

Local governments would lose out on a combined $93 million in 2024 and 2025 due to the changes and more in future years, with school corporations experiencing the brunt of the impact.

Why it matters

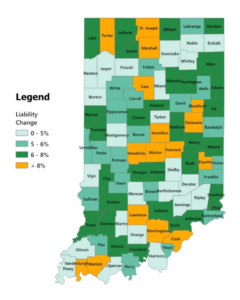

Residential property tax liability was expected to increase by more than 18% on average across the state this year, according to an analysis by the Association of Indiana Counties and Policy Analytics.

That’s due in large part to rising assessed values of properties, but there are other factors as well.

How much your bill jumped depends on where you live. In terms of total tax liability, 16 counties were expected to have totals that increase by more than 8% year over year, including Marion, Vanderburgh, Hamilton, Delaware and St. Joseph. That includes all property types, so homeowners in those counties likely experienced even larger increases.

It’s probable that likely property taxes will continue to increase next year.

Does it go far enough?

Republican legislative leaders were hesitant to dramatically impact property taxes, because property taxes go entirely to local governments, not the state.

Democrats were hoping for more. The state, for example, could have provided relief to homeowners and backfilled local governments’ budgets with money from the state’s coffers. The state opted not to do that when crafting the state budget.

An initial version of HB 1499 also included a provision that would have lowered the property tax caps for homeowners, resulting in more savings. That was stripped from the final bill.

“Homeowners really need some help,” said Cherrish Pryor, D-Indianapolis. “I wish we had done a little bit more for them, but the one thing I just really don’t want people to do and that is to lose their home because they cannot afford their home or they can’t pay their property taxes.”

Contact Kaitlin Lange on Twitter @kaitlin_lange or at [email protected].

Twitter @stateaffairsin

Facebook @stateaffairsin

Instagram @stateaffairsin

LinkedIn @stateaffairs

Header image: Property tax bills have increased across the state. (Credit: Brittney Phan)

4 things to know about Braun’s property tax proposal

Sen. Mike Braun, the Republican candidate for Indiana’s governor, released a plan for overhauling property taxes Friday morning that would impact millions of Hoosiers, Indiana schools and local governments. “Nothing is more important than ensuring Hoosiers can afford to live in their homes without being overburdened by rising property taxes driven by rapid inflation in …

Bureau of Motor Vehicles looks to add new rules to Indiana’s driving test

The Bureau of Motor Vehicles wants to amend Indiana’s driving skills test, putting “existing practice” into administrative rule. Indiana already fails drivers who speed, disobey traffic signals and don’t wear a seatbelt, among other violations. Yet the BMV is looking to make the state’s driving skills test more stringent. A proposed rule amendment looks to …

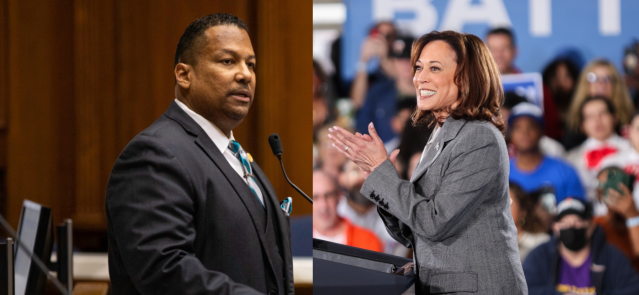

In Indianapolis, Harris says she’s fighting for America’s future

Vice President Kamala Harris, the presumptive Democratic presidential nominee, told a gathering of women of color in Indianapolis on Wednesday that she is fighting for America’s future. She contrasted her vision with another — one she said is “focused on the past.” “Across our nation, we are witnessing a full-on assault on hard-fought, hard-won freedoms …

Indiana Black Legislative Caucus endorses Harris, pledges future support

The Indiana Black Legislative Caucus unanimously voted Wednesday to endorse Vice President Kamala Harris’ presidential run and will look at ways to assist her candidacy, the caucus chair, state Rep. Earl Harris Jr., D-East Chicago, told State Affairs. The caucus is made up of 14 members of the Indiana General Assembly, all of whom are …