Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoPart II: Tax Credits Take Flight

Credit: Beau Evans (State Affairs)

- Hundreds of movies and TV shows filmed in Georgia since 2005 have drummed up more than $24 billion in economic activity.

- Supporters trace the film industry’s local boom to tax credits worth billions of dollars.

- Critics say film out-of-state companies benefit too much by selling tax credits to the tune of $2.9 billion since 2016.

Read this story for free.

Create AccountRead this story for free

By submitting your information, you agree to the Terms of Service and acknowledge our Privacy Policy.

Turnout battle: More Republicans casting ballots in early voting for general primary

The Gist

Whether they’re concerned with a Georgia Supreme Court race or women’s reproductive rights, voters showed up to cast early ballots this week in the Georgia primary election. And Republicans embraced the opportunity more than Democrats, continuing a trend in recent years.

“This isn’t Democratic voters becoming Republicans. This isn’t even a massive turnout of Republicans,” Atlanta political strategist Fred Hicks told State Affairs. “What it is is Democrats are disaffected and they’re staying home in key blocs, particularly African Americans.”

At Chastain Park Recreation Center, Atlanta attorney Stephen Mooney cast his vote with an eye on a Georgia Supreme Court race.

“I felt it was important to cast a vote. We have one candidate who’s putting his personal views over just calling balls and strikes. I want to make my voice known,” Mooney said.

Democratic U.S. Rep. John Barrow, who is running a campaign centered on protecting women’s reproductive rights, is challenging incumbent Justice Andrew Pinson.

Mooney, who identifies as Republican, said he typically votes early in elections. For the upcoming cycle, he said he’s concerned with crime, the economy and world affairs, including the conflict in Gaza.

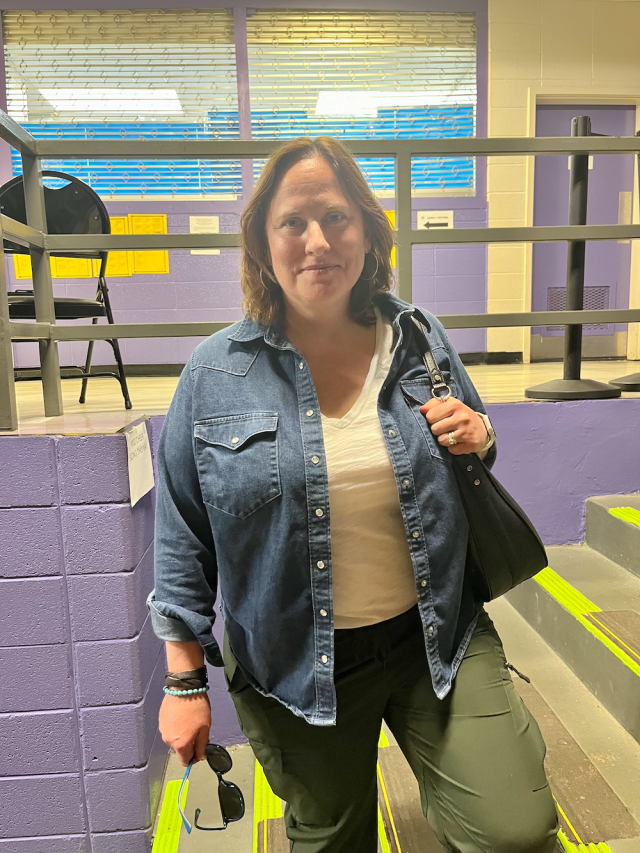

Katherine Hernacki, who mostly votes Democrat, said she tries to cast ballots at every opportunity to make sure her registration didn’t expire and to preserve her vote.

“I would say that right now one of the biggest motivating factors for me is protecting women’s rights to reproductive freedom,” Hernacki, 50, told State Affairs.

She and Mooney both said current Georgia state officials have been doing well, specifically when it comes to the economy.

What’s Happening

As of Friday morning, according to GeorgiaVotes.com, 453,035 Georgians had cast early votes. Republicans outpaced Democrats, 242,140 to 203,305. There were 7,545 nonpartisan ballots cast.

The Secretary of State could not provide the party breakdown of primary election turnout for 2020 and 2022.

The total turnout for the 2024 primary is 36% lower than it was in 2022.

“This will be the fourth straight statewide election where Republicans have outpaced Democrats,” Hicks said.

More Republican voters turned out in the 2022 primary and general election as well as the presidential primary in March and now this one, said Hicks, who has worked on Democratic and Republican campaigns across the country for the past 20 years.

There was a little positive news for Democrats: The Georgia Secretary of State’s office said more Democrats — 15,008 — voted absentee than Republicans. Records show 14,835 Republicans cast mail-in ballots.

Why It Matters

Primaries historically have had low turnout, and this election cycle is no different. As of Friday morning, 6.4% of Georgia’s 7 million registered voters had cast ballots in person or by mail.

Ahead of the general election in November, primaries give voters an idea of who the candidates are. As campaigns continue, citizens get an early opportunity to form their political opinions.

What’s Next?

Friday, May 17, is the last day of early voting in Georgia’s primary election. Polls will reopen Tuesday, May 21, from 7 a.m. to 7 p.m. The general election will happen Nov. 5.

Related stories:

Have questions, comments or tips? Contact Tammy Joyner on X @lvjoyner or at [email protected].

Contact Nava Rawls at [email protected].

New middle Georgia House district up for grabs due to influential incumbent’s departure

The Gist

For the first time in over a decade, voters in parts of middle Georgia’s Bibb and Houston counties will vote for a new state House representative.

House District 143 is a newly redrawn district that now extends from Macon to Warner Robins. That redistricting prompted the departure of longtime incumbent Rep. James Beverly, D-Macon. His term ends in January.

Democrat Anissa Jones and Republican Barbara Boyer are vying for Beverly’s seat. Both are uncontested in the primary.

The two appear on the May 21 primary ballots, but the primary is, in effect, a dress rehearsal for the Nov. 5 general election because neither has a primary opponent.

Jones is a chiropractor who has held numerous seats on civic and local government boards. Boyer is a retired attorney who now runs an antique shop. Georgia is an open primary state, meaning voters can choose the party ballot they wish to vote for.

What’s Happening

House Minority Leader Beverly announced in March he would not seek re-election, in part, because his district had been redrawn. A federal judge ordered state lawmakers to redo their electoral maps because they diluted Black voting power.

Before the remapping, House District 143 was largely Democrat, majority Black and consisted primarily of Macon County. The redrawn district now includes parts of Macon and extends 20 miles south to Warner Robins and remains majority Black.

Boyer, a political newcomer, said Republicans asked her to run because of her legal background. She sees the redistricting as good for middle Georgia.

“Macon and Warner Robins have always sort of been merged together in a lot of ways, and I just don’t see there’s a problem with it.”

The new House district, for example, now includes parts of nearby Houston County, which has “a pretty good school system,” Boyer said.

“I’m interested in how they run their school system compared to how Bibb County runs theirs,” she added. “Our [Macon-Bibb] district really needs a lot of help with their school system.”

If elected, Boyer said she would work to improve education, curb crime and bring more businesses to middle Georgia.

“I think I cross party lines pretty good,” she said. “I have a lot of Democratic friends and a very diverse group of friends. So I think I have a better chance of getting some Democrat and independent votes.”

Jones is a Macon native. She is the former vice chair of the Macon Water Authority Board, an alum of Leadership Macon and a past president of the Main Street Macon Board.

Jones did not return calls from State Affairs for comment.. Her top issues include public safety, economic development and more investment in infrastructure, according to her website.

Why It Matters

The winner of House District 143 will fill a vital seat that Beverly has held since 2011. He often advocated for legislation addressing health inequities, including a last-minute proposal by state Democratic leaders to expand Medicaid.

The Peach Care Plus Act would have let the state get a federal waiver to buy private health insurance for people who make around $20,000 a year. The measure failed. Beverly, a Macon optometrist, also pushed for legislation that would reduce maternal mortality among Black women.

He also led the Democrats’ effort to pass the Safe at Home Act, a bipartisan bill to protect tenants’ rights. The bipartisan bill requires rental properties to be “fit for human habitation.” Landlords must give three days’ notice and can’t shut off cooling before an eviction. Gov. Brian Kemp signed the bill into law in April.

Beverly said his decision to leave was also based on the likelihood that Democrats will not win a majority in the 180-member House.

In addition to Beverly’s departure as House minority leader, the Senate also will lose its minority leader, Sen. Gloria Butler, D-Stone Mountain. She has served since 1999. The two are among 16 legislators who are retiring. Most of the 236-member Georgia General Assembly will be running for office, many unopposed.

What’s Next?

Early voters casting ballots in person have until Friday at 5 p.m. Poll officials, however, have the discretion to keep the polls open until 7 p.m., a Georgia Secretary of State official said. Polls will reopen Tuesday, primary election day, from 7 a.m. to 7 p.m.

Residents voting in Tuesday’s primary can check their precinct location here.

Boyer and Jones will face each other in the Nov. 5 general election. The winner will succeed Beverly, who will leave office in January.

Meet the House District 143 primary candidates

Barbara Boyer

Age: 68

Residence: Macon

Occupation: Retired attorney who now owns an antique store in Macon. “I love to stay busy.”

Party affiliation: Republican

Top issues: Improving education, attracting more businesses and addressing public safety, especially encroaching crime.

Campaign cash on hand: $600 as of May 7

Family: She and husband Wesley, a bankruptcy attorney, have a daughter and granddaughter

Dr. Anissa Jones

Residence: Macon

Occupation: Chiropractor

Party affiliation: Democrat

Top issues: Public safety, economic development, more investment infrastructure.

Campaign cash on hand: $30,679.92 as of May 6

Have questions, comments or tips? Contact Tammy Joyner on X @lvjoyner or at [email protected].

All you need to know heading into the May 21 primary

Gist

Georgia’s primary is only days away, and there’s a lot to unpack.

The May 21 primary will be the first time some Georgians will be voting in new districts for state and congressional candidates. They’ll also be voting in local races for sheriff, judges, school board or county commission members. Primary winners who have challengers will go on to compete in the Nov. 5 general election. Georgia is an open primary state, meaning voters can choose the party ballot they wish to vote for.

This year, Georgians who voted by absentee ballot in the primary could face challenges due to mail delivery delays.

What’s Happening

North Georgia and metro Atlanta are seeing significant mail delivery delays. The holdup, according to media reports, appears to be at the United States Postal Services’ new Regional Processing and Distribution Center in Palmetto. The problem has led to dangerous situations in which people are not getting critical medication.

Georgia’s U.S. Sen. Jon Ossoff recently grilled USPS Postmaster General Louis DeJoy on the delays. Ossoff told DeJoy during an April 16 hearing that on-time delivery rates were abysmal. He said 66% of outbound first-class mail had been delivered on time while 36% of inbound mail had been delivered on time in the past three months.

DeJoy blamed the problem on the difficulty in condensing operations at the facility.

With the approaching primary, state lawmakers are concerned mail delays could disrupt the election process.

Mike Hassinger, a spokesman for the Secretary of State, told State Affairs that Georgia voters are ready.

“Georgia voters are already registered,” he said. “They know how they like to vote. More than half of them vote early. About 5% vote absentee by mail, just in general, and then the rest are voting on election day. So we’ve been able to set up systems that are familiar with Georgia voters so that the percentage who might be worried about their absentee-by-mail ballots are relatively small.”

Why It Matters

Georgia emerged as one of the country’s most important political battleground states during the 2020 election. The Peach State will once again play a key role in deciding who wins the 2024 presidential election in November.

In the May 21 primary, Georgia voters will whittle down their choices for whom they’ll send to Congress and to the state capitol next year.

Under a federal court-approved redistricting process last year, Georgia now has new congressional and state district electoral maps. Those maps created one majority Black seat in the U.S. House of Representatives, five new majority-Black districts in the state House and two in the state Senate.

The redistricting resulted in new seats, intriguing matchups and former politicians returning to the fray. You can see the newly drawn maps here.

What’s Next?

Here’s what you need to know to ensure a smooth voting process:

To vote early.

Early voting is April 29 to May 17. Find your polling place here.

To vote absentee.

Here’s what you can do to avoid problems if you vote absentee:

- Get your absentee ballot application done early. You can request an absentee ballot here. (The registration deadline for the May 21 primary was April 22.)

- Track your application through Georgia BallotTrax. You must have a valid absentee request on file with your county board of elections to see your absentee ballot status in Georgia BallottTrax.

- If you’ve been having mail delays, place your completed absentee ballot in an official drop box during advanced voting instead of using the United States Postal Service. Check your county voter registration and election office for drop box locations. And, yes, your absentee ballot counts. It is counted in the final tally, not just close races.

- If you change your mind about voting absentee and decide to vote in person, take your absentee ballot to your local election office, where workers will void it.

- If you need to contact your county election office, find that information here.

Update: This story has been updated with the mail-in ballot registration deadline for the May 21 primary.

Have questions, comments or tips? Contact Tammy Joyner on X @lvjoyner or at [email protected].

And subscribe to State Affairs so you do not miss any news you need to know.

Education activist Beth Majeroni challenges state Sen. Ben Watson in GOP primary

The Gist In a rare primary challenge, incumbent Republican Sen. Ben Watson faces conservative education activist Beth Majeroni in the state Senate District 1 race in the Savannah area. Watson has run unopposed or handily defeated Democratic challengers in seven previous general elections and hasn’t faced a Republican challenger since 2010, when he won 65% …