Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoFrom tax perks for new parents to a school voucher expansion: How the passed state budget impacts you

The Indiana Statehouse in April 2023. (Credit: Mark Curry for State Affairs)

Indiana lawmakers finalized the two-year state budget overnight Thursday, just hours after the final version was released.

The biggest headline-grabber of the final day of the legislative session was lawmakers’ chaotic 11th-hour decision to pump more money toward education, leading to hours of confusion and an unexpected new version of the budget at 9 p.m. But the $44 billion budget has several provisions that will impact Hoosiers. Legislators also decided to implement sizable pay raises for state officials.

Gov. Eric Holcomb said he would “gladly sign” the budget but had yet to do so Friday afternoon.

“[It’s] not just your average, ordinary, typical, two-year budget,” he told reporters at a press conference after Sine Die. “It’s a generational impact budget.”

Here’s what the budget, the most significant bill passed on the final day of session, means for you.

More families will qualify for school choice vouchers

Lawmakers passed a controversial major expansion of the state’s school choice voucher program, enabling more Hoosiers to qualify for a voucher to send their child to private school.

Families making 400% of the income required to qualify for free or reduced-price lunches would qualify for a school choice voucher. That means if your family of four makes about $220,000 per year or less, you would qualify for a school choice voucher. That includes parents who have already been sending their child to a private school.

Previously, those making 300% or less of the income required to qualify for free or reduced-price lunch were able to receive a voucher, and only if they met a certain set of other criteria.

Of course, the move also siphons away dollars that otherwise would be going toward the traditional public school system, so whether or not the policy is a win is in the eye of the beholder. While House Republicans boasted about the expansion, it was among the Democrats’ chief concerns about the budget.

As a result of the change, voucher funding will jump 69% in the first year of the budget and an additional 14% in the second. Meanwhile, traditional schools will get a 3.5% bump in total funding in the first year and 1.1% in the second.

You’ll save a little on income taxes

The budget speeds up state income tax cuts lawmakers passed last year, which will mean slightly more money in your pocket.

Last legislative session, lawmakers enacted a series of tax cuts that would take effect every year through 2029, moving the tax rate down incrementally from 3.23% to 2.9% of someone’s income by 2029. This year’s budget sped up that timeline, completely phasing in the tax cuts by 2027.

The savings are minor: Someone making $50,000 per year will save a total of $275 over five years due to this year’s budget.

Low- to moderate-income Hoosiers could also benefit from the recoupling of the state’s Earned Income Tax Credit to the federal credit in this year’s budget. Those families with three or more children, for example, will receive a larger tax credit moving forward.

No more textbook fees for families

Families of students in traditional public and charter schools will no longer be required to pay for textbooks and curriculum fees. On top of the funding provided by the state budget to local schools is a line item to pick up those expenses. The measure has been championed by Democratic lawmakers for years and gained the endorsement of Holcomb this year. It will help the families of more than a million students.

Pre-K and other perks for new parents

There are multiple provisions in the budget that could help parents of young children.

Lawmakers expanded the eligibility requirement of those who qualify for a pre-K voucher from income at 127% of the federal poverty level to 150% of the federal poverty level. That means a family of four making $45,000 per year or less would qualify for a voucher. (Previously, only a family of four making $38,100 or less would qualify unless there was money leftover in the program.)

Lawmakers didn’t add more money to the program; they only expanded eligibility. Democrats were hoping for more.

There’s also some tax perks for new parents. For example, new parents will now receive a $3,000 tax exemption in the first year the child is claimed as a dependent, rather than the standard $1,500 for all other dependents.

The budget also created a tax credit for employers that open an onsite child care center for their employees.

More public and mental health resources

Lawmakers pumped hundreds of millions of dollars into mental and public health in the budget, though neither dollar amount matched the original asks.

Local health departments will receive a majority of the combined $225 million in the budget for public health, which will likely mean more services for those living in communities that decide to take advantage of the funding. That could mean more tobacco cessation programs for those struggling to quit smoking, free immunizations for your children or HIV testing.

And a combined $100 million will fund a continued rollout of a three-part mental health crisis system. A fully developed system is estimated to cost $130.6 million per year, but Republicans landed at slightly less than half that as a starting point.

The budget also funds other mental health initiatives, including a combined $10 million to help incarcerated Hoosiers.

Conservation, parks and trails

The budget adds another $30 million for the state’s Next Level Trails program and another $10 million to help with land conservation.

Those numbers fell short of Holcomb’s initial requests, but the governor still celebrated the funding early Friday. He noted that additional trail funding could come from a separate pool of money appropriated for economic development.

He also highlighted two other significant projects that received funding in the budget. One involves 4,700 acres in Sullivan County, and the other is Origin Park in Jeffersonville, which received $37.5 million in support.

What else?

- More than $1 billion was set aside for economic development programs, including a $500 million infusion into a deal-closing fund run by the Indiana Economic Development Corporation.

- The governor and other statewide officeholders will receive pay raises.

- Starting salaries for Indiana State Police troopers have been bumped to $70,000 per year.

- The state will direct a supplemental $700 million toward paying down the debt associated with the pre-1996 teacher pension fund.

Contact Ryan Martin on Twitter, Facebook, Instagram, LinkedIn, or at [email protected].

Contact Kaitlin Lange on Twitter @kaitlin_lange or at [email protected].

Twitter @stateaffairsin

Facebook @stateaffairsin

Instagram @stateaffairsin

LinkedIn @stateaffairs

Header image: The Indiana State Capitol Building on April 25, 2023. (Credit: Mark Curry for State Affairs)

4 things to know about Braun’s property tax proposal

Sen. Mike Braun, the Republican candidate for Indiana’s governor, released a plan for overhauling property taxes Friday morning that would impact millions of Hoosiers, Indiana schools and local governments. “Nothing is more important than ensuring Hoosiers can afford to live in their homes without being overburdened by rising property taxes driven by rapid inflation in …

Bureau of Motor Vehicles looks to add new rules to Indiana’s driving test

The Bureau of Motor Vehicles wants to amend Indiana’s driving skills test, putting “existing practice” into administrative rule. Indiana already fails drivers who speed, disobey traffic signals and don’t wear a seatbelt, among other violations. Yet the BMV is looking to make the state’s driving skills test more stringent. A proposed rule amendment looks to …

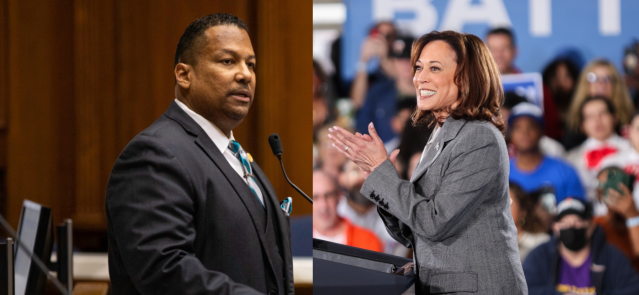

In Indianapolis, Harris says she’s fighting for America’s future

Vice President Kamala Harris, the presumptive Democratic presidential nominee, told a gathering of women of color in Indianapolis on Wednesday that she is fighting for America’s future. She contrasted her vision with another — one she said is “focused on the past.” “Across our nation, we are witnessing a full-on assault on hard-fought, hard-won freedoms …

Indiana Black Legislative Caucus endorses Harris, pledges future support

The Indiana Black Legislative Caucus unanimously voted Wednesday to endorse Vice President Kamala Harris’ presidential run and will look at ways to assist her candidacy, the caucus chair, state Rep. Earl Harris Jr., D-East Chicago, told State Affairs. The caucus is made up of 14 members of the Indiana General Assembly, all of whom are …