Stay ahead of the curve as a political insider with deep policy analysis, daily briefings and policy-shaping tools.

Request a DemoOur 12 questions as Indiana lawmakers race to the 2023 legislative session end

In the last week of the legislative session, Indiana lawmakers are still answering several big questions. (Credit: Kaitlin Lange)

Indiana lawmakers will wrap up the 2023 legislative session sometime this week, likely passing dozens of bills in the final days. That includes the $43 billion budget, which will dictate how tax dollars are spent over the next two years.

It’s typically a rapid, chaotic and confusing end to session as lawmakers throw out some rules, insert language from dead bills into others and convene at seemingly random times throughout the day. State Affairs has a live blog on the proceedings as Sine Die draws near.

Here are some of the questions we’ll be watching in the final hours.

1. What will lawmakers do with a surprise $1.5 billion?

Lawmakers drafted their biennial budget plans based on a December budget forecast. But during the updated April budget forecast last week, legislators found out the state would be generating an additional unexpected $1.5 billion worth of revenue over the next couple of years. In some ways, that makes lawmakers’ jobs more complicated as they decide how to spend the money when finalizing the two-year state budget.

2. How much will mental health be funded?

Senate Republicans’ landmark bill would reform the delivery of mental health services in Indiana. Since January, though, everyone has questioned how to pay for services that could cost as much as $130.6 million per year. Some wanted an increased tax on cigarettes and other tobacco products; others suggested an additional surcharge on cell phone bills. Well, when $1.5 billion lands in your lap, maybe you don’t need either. The question remains, though: Will lawmakers fully fund mental health?

3. Will lawmakers make any big changes to lower health care costs?

Republican leaders in both chambers made reducing health care costs a priority at the start of the legislative session. But so far, none of the priority health care cost-cutting bills have crossed the finish line. Lawmakers appear to be in agreement when it comes to limiting physician noncompetes, but other questions remain. For example, will lawmakers fine hospitals that charge higher amounts?

4. Is the budgeted amount for public health going to change?

The House and Senate are on the same page when it comes to funding public health — almost. Both set aside $225 million in their respective budgets. That means Gov. Eric Holcomb likely won’t get the full dollar amount he requested for public health and trauma care improvements.

The House also included an additional $9 million for trauma care system improvements, which was missing from the Senate proposal. Will it be added back into the final version?

5. Will Hoosiers receive any property tax relief?

We’re all but certain there won’t be any property tax relief coming from the state for the bills you’re paying this year, despite unprecedented increases. But lawmakers in both chambers seem open to providing some kind of relief in future years.

It’s unclear what that would look like. The House voted to temporarily lower property tax caps under House Bill 1499, while the Senate chose to instead temporarily increase deductions for homeowners. Both would result in property tax relief for homeowners, but the House’s plan would impact local government revenues, while the Senate’s plan would shift the burden to other taxpayers.

6. How quickly can Hoosiers expect more income tax cuts?

One key difference between the House and Senate budget plans centered on how quickly to cut Hoosiers’ income taxes. Last legislative session, lawmakers enacted a series of tax cuts that would take effect every year through 2029, lowering the tax rate from 3.23% to 2.9% over time. The Senate voted to keep that plan intact. House Republicans, however, still want to speed up that timeline.

7. Will lawmakers expand the school choice voucher program?

One of the major remaining sticking points between the House and Senate budget proposals is whether to expand school choice vouchers. House Republicans’ budget plan expanded the program to families making 400% of the income required to qualify for free or reduced-price lunches, while the Senate passed a budget that maintained the status quo.

8. Will teachers be required to notify parents about their children’s pronouns?

Both chambers passed a version of House Bill 1608, which prohibits schools from teaching human sexuality to those in pre-K to third grade. It also requires teachers to tell parents if their child wants to use a different name or pronoun. The House author has yet to formally decide whether to sign off with some changes made to the bill in the Senate, which means the bill is currently in limbo.

UPDATE April 25, 2023: House Bill 1608 passed the House 63-28 on Tuesday and is headed to Holcomb’s desk.

9. Who will pay for free textbooks and curriculum materials?

Months ago, Holcomb said it was time to offer free textbooks and curriculum materials to K-12 students. Both the House and Senate budgets followed through on the promise. But while the Senate proposed using state money to pay for the materials, the House sought to place that burden on local schools.

10. Will language banning “harmful material” make it across the finish line after years of failed attempts by the Senate?

The Senate barely met a deadline this year to pass a bill restricting schools from offering books in the library that may contain “harmful” materials. Opponents view it as a book-banning bill that will further limit the teaching of race and gender identity. The House did not vote on the bill, which killed it this year. But the last week of the legislative session can sometimes breathe new life into dead bills by moving similar language into other legislation being debated by conference committees. House Speaker Todd Huston, R-Fishers, last week did not rule out the possibility of reviving the language.

11. Will traditional public schools have to share property taxes with charter schools?

Public schools could have to divert some of their future property tax dollars to charter schools, depending on what agreement Senate and House Republicans reach regarding charter school funding in the budget. House Republicans chose to increase state funding for such schools in their budget, while the Senate decided to instead require public schools to share future property tax dollars.

12. So, when will the legislative session actually end?

Good question! Some years the session ends late at night because lawmakers remain in deep disagreement on something. This year seems to be going … smoothly? Maybe it’s the surprise $1.5 billion, maybe it’s the spring weather, who knows. Whatever it is, we will be there to cover Sine Die — whether it ends Wednesday, Friday or somewhere in between.

Contact Ryan Martin on Twitter, Facebook, Instagram, LinkedIn, or at [email protected].

Contact Kaitlin Lange on Twitter @kaitlin_lange or at [email protected].

Twitter @stateaffairsin

Facebook @stateaffairsin

Instagram @stateaffairsin

LinkedIn @stateaffairs

Header image: In the last week of the legislative session, Indiana lawmakers are still answering several big questions. (Credit: Kaitlin Lange)

4 things to know about Braun’s property tax proposal

Sen. Mike Braun, the Republican candidate for Indiana’s governor, released a plan for overhauling property taxes Friday morning that would impact millions of Hoosiers, Indiana schools and local governments. “Nothing is more important than ensuring Hoosiers can afford to live in their homes without being overburdened by rising property taxes driven by rapid inflation in …

Bureau of Motor Vehicles looks to add new rules to Indiana’s driving test

The Bureau of Motor Vehicles wants to amend Indiana’s driving skills test, putting “existing practice” into administrative rule. Indiana already fails drivers who speed, disobey traffic signals and don’t wear a seatbelt, among other violations. Yet the BMV is looking to make the state’s driving skills test more stringent. A proposed rule amendment looks to …

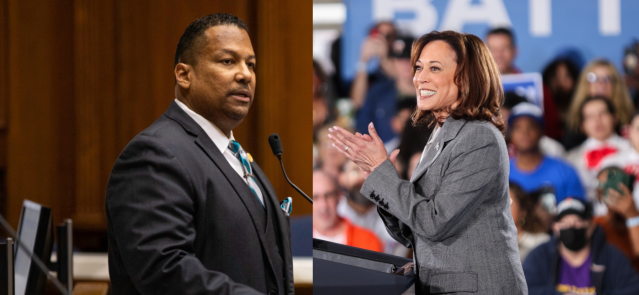

In Indianapolis, Harris says she’s fighting for America’s future

Vice President Kamala Harris, the presumptive Democratic presidential nominee, told a gathering of women of color in Indianapolis on Wednesday that she is fighting for America’s future. She contrasted her vision with another — one she said is “focused on the past.” “Across our nation, we are witnessing a full-on assault on hard-fought, hard-won freedoms …

Indiana Black Legislative Caucus endorses Harris, pledges future support

The Indiana Black Legislative Caucus unanimously voted Wednesday to endorse Vice President Kamala Harris’ presidential run and will look at ways to assist her candidacy, the caucus chair, state Rep. Earl Harris Jr., D-East Chicago, told State Affairs. The caucus is made up of 14 members of the Indiana General Assembly, all of whom are …